CreditRewardsCards

How to Use a Credit Card Usage Calculator to Boost Your Credit Score

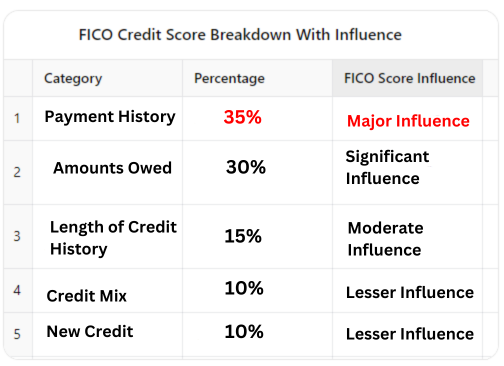

Looking for a credit card usage calculator to improve your credit score in 2025? Credit utilization is a measures how much of your available credit you’re using. Moreover, it’s a key factor in your credit score, making up 30% of your FICO score.

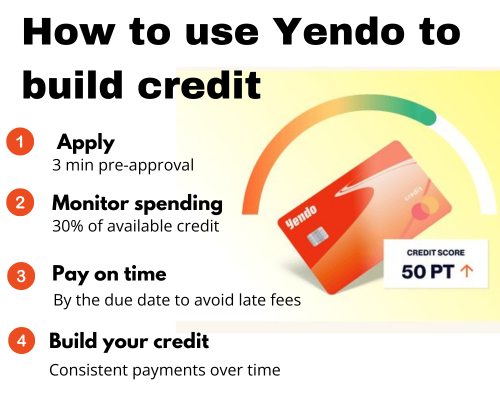

In this guide, I’ll explain what credit utilization is and why keeping it below 30% is ideal. I’ll also provide a step-by-step process to calculate credit utilization effectively and show you how to use our free credit utilization calculator. Additionally, I’ll share how credit cards like the Yendo Credit Card can help lower your utilization with higher credit limits.

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

What Is Credit Utilization and Why Does It Matter?

Credit utilization refers to the percentage of your available credit that you’re currently using. For example, if you have a credit card with a $1,000 limit and a $300 balance, your credit utilization ratio is 30% ($300 ÷ $1,000). As a result, this ratio becomes the major factor in your credit score, second only to payment history.

Why Keep It Below 30% ?

Experts recommend keeping your credit utilization below 30% because:

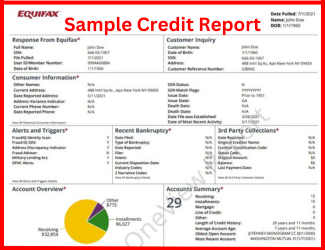

- It Shows Responsible Credit Use: A low ratio indicates you’re not over-relying on credit, which credit bureaus like Experian, Equifax, and TransUnion view positively.

- It Boosts Your Credit Score: Staying below this threshold can improve your FICO score over time, as it demonstrates financial discipline.

- It Prevents Overextension: High utilization can signal to lenders that you’re at risk of missing payments, potentially leading to higher interest rates or denied applications.

For instance, if your total credit limit across all cards is $10,000, you should aim to keep your balances below $3,000 to maintain a healthy ratio. A credit utilization calculator can help you track this easily.

How to Use a Credit Card Usage Calculator: A Step-by-Step Guide

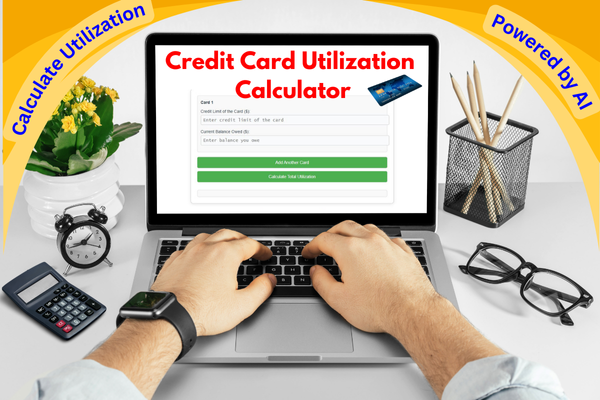

A credit card usage calculator simplifies the process of determining your credit utilization ratio, helping you take actionable steps to improve your credit score. Moreover, it offers a seamless way to track and optimize your credit usage. It’s available right here on CreditRewardsCards.com. Click this link to try our free Credit Card Utilization Calculator now.

So, do you want to see how it works? Watch this quick video to see it in action:

Click on this link to see it on Youtube:

The FREE Credit Card Utilization Calculator That Can Help BOOST Your Credit Score!.

Here’s how you can use it to calculate credit utilization:

Step 1: Enter Your Credit Limit Into The Credit Card Usage Calculator

Add the credit limit for each credit card you own, one by one, into the credit utilization calculator. Simply input the limit for each card as prompted.

Step 2: Enter Your Current Balance

Now, input the outstanding balance on each card in the corresponding field. The calculator allows you to add each card individually, so there’s no need to total your balances manually.

Step 3: Calculate Your Utilization

Click the “Calculate Total Utilization” button to instantly see your overall credit utilization percentage across all your cards

Step 4: Get AI Advice & Recommendations

After calculating, you’ll receive personalized AI-driven insights, tips, and powerful strategies. This will help you lower your utilization and moreover, maximize your credit score.

Step 5: Download Your Personalized Report

With your credit utilization results, you will receive a customized AI report that you can save or print. You get a detailed and personalized AI-powered recommendations report full of great advice and actionable strategies. As a result, you can follow this advice and strategies to maintain or improve your credit health.

If your overall utilization ratio is above 30%, you’ll want to take action to lower it. For example, a 30 percent credit utilization calculator can help you determine the ideal balance to stay below this threshold. If your total credit limit across all cards is $8,000, your balances should be under $2,400 (30% of $8,000) to maintain a healthy ratio.

Strategies to Lower Your Credit Utilization With A Credit Card Usage Calculator

Once you’ve used our credit card usage calculator to calculate credit utilization, here are some strategies to bring your ratio down:

- Pay Down Balances: Focus on paying off high-balance cards to reduce your overall utilization.

- Request a Credit Limit Increase: Contact your card issuer to ask for a higher limit. In truth, this approach can lower your ratio without changing your spending.

- Open a New Credit Card: Adding a new card with a high limit can increase your total available credit, as I’ll discuss in the next section.

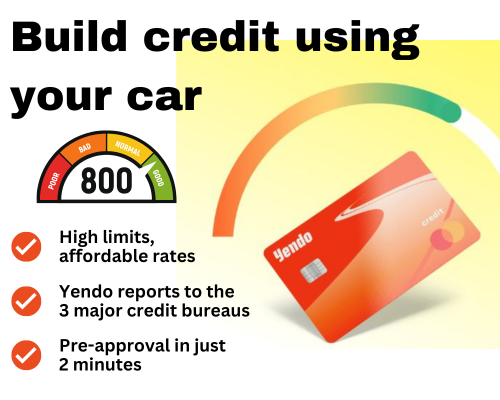

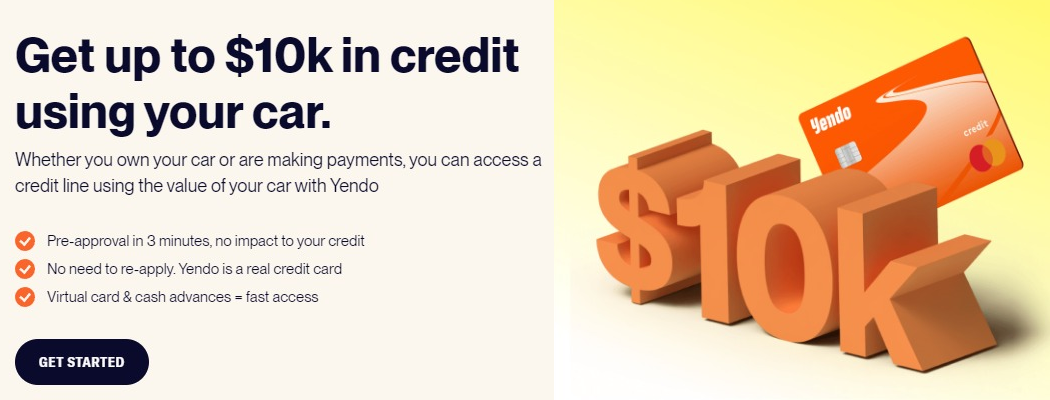

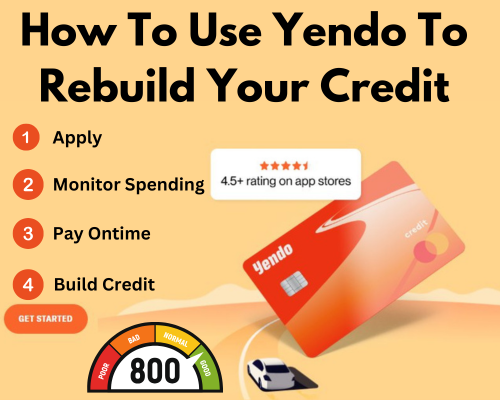

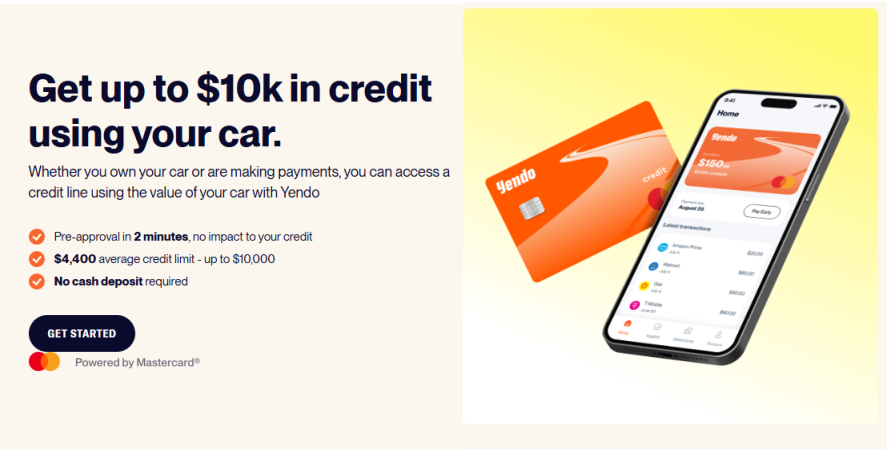

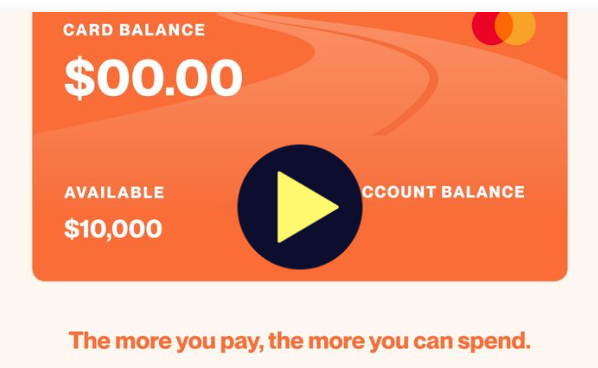

Credit Cards to Lower Your Utilization: How Yendo Can Help

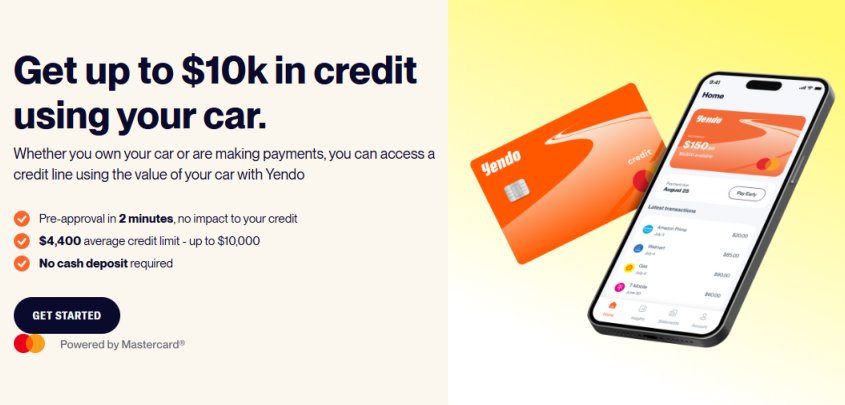

One effective way to lower your credit utilization is by increasing your total available credit. This is where credit cards like the Yendo Credit Card come in. The Yendo Credit Card offers up to $10,000 in credit limits, helping lower your utilization ratio significantly. For example, if your current total credit limit is $5,000 and you add Yendo’s $10,000 limit, your new total limit becomes $15,000, making it easier to stay below the 30% threshold recommended by a 30 percent credit utilization calculator.

In addition, Yendo doesn’t require a credit check, making it ideal for those with bad credit. It also reports to all three major credit bureaus (Experian, Equifax, TransUnion), helping you build credit with on-time payments. So, if you need to learn more, check out my in-depth Yendo reviews for 2025 or apply now at Yendo’s website.

Why Use a Credit Card Usage Calculator to Boost Your Score?

Using a credit card usage calculator offers several benefits:

- Accuracy: It provides a precise calculation of your utilization ratio, saving you from manual errors.

- Goal Setting: It helps you set a target balance to stay below 30%, as shown in the step-by-step guide.

- Personalized Insights: With our free credit utilization calculator, you get AI-driven advice and a downloadable report tailored to your credit situation.

- Motivation: Seeing your ratio and receiving actionable recommendations can motivate you to pay down debt or seek higher credit limits, such as with the Yendo Credit Card.

Additional Tips to Manage Your Credit with a Credit Card Usage Calculator

Beyond using a credit card usage calculator, here are more strategies to improve your credit score:

- Pay Your Balance Multiple Times a Month: This keeps your reported balance low, even if you use your card frequently.

- Monitor Your Utilization Regularly: Check your ratio monthly with our credit utilization calculator to ensure it stays below 30%, especially if you’re aiming for the 30% threshold.

- Avoid Closing Old Credit Cards: Closing accounts reduces your total available credit, which can increase your utilization ratio.

- Consider Secured Cards for Bad Credit: Cards like Yendo or OpenSky can help you build credit while providing higher limits to manage utilization.

Looking for more credit card options? Check out our Best Credit Cards for Young Adults with Bad Credit in 2025. For a broader approach, see our step-by-step guide to improve your bad credit with a credit utilization calculator.

Conclusion: Take Control of Your Credit Utilization With Our Credit Card Usage Calculator

In truth, a credit card usage calculator is a powerful tool that can help you boost your credit score by helping you manage your credit utilization. By keeping your ratio below 30%, using our free credit utilization calculator to track your progress, and leveraging credit cards like Yendo to increase your available credit, you can improve your financial health in 2025.

“Yendo was quick and easy. Simply done from my phone. I hardly had to leave the couch and the interest rate worked great for our budget. So I recommend Yendo to anyone who will listen. I’d say at least try the process. You’d be very happy.” Click here to see the full review.

Inspired by Mela’s experience? Explore how the Yendo Credit Card can help you lower your credit utilization and boost your score.

Ready to boost your credit? Apply for the Yendo Credit Card now!

For more details on Yendo, read my full Yendo reviews for 2025. Concerned about Yendo’s legitimacy? Check out my post addressing whether Yendo is a scam in 2025. Have you tried using our credit card usage calculator to manage your credit? Share your experience in the comments below—I’d love to hear your story!

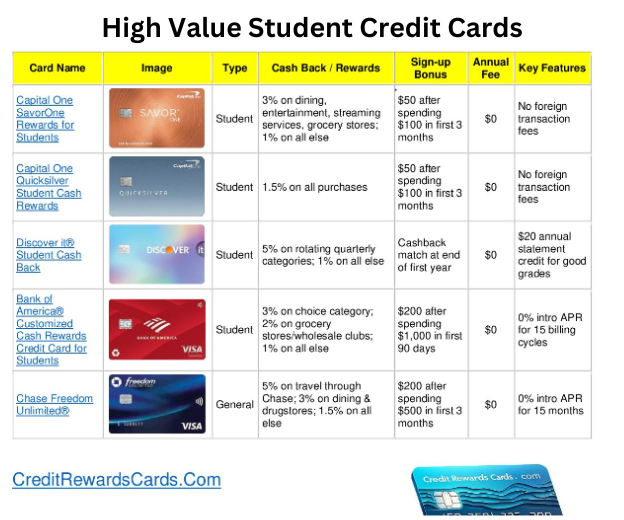

Best Credit Cards for Young Adults with Bad Credit in 2025

Introduction to the Best Credit Cards for Young Adults in 2025

Are you a young adult struggling with bad credit and searching for the best credit cards for young adults in 2025? If so, you’re not alone. Many young adults face challenges building credit due to limited credit history or past financial mistakes, making bad credit credit cards a popular solution.

In fact, certain credit cards for young adults wonderful offer opportunities to rebuild credit without strict requirements. In this guide, I’ll explore the top credit cards for young adults, including options like the Yendo Credit Card, secured cards like OpenSky, and student cards. Moreover, by the end, you’ll know which card best suits your needs to start your credit-building journey. If you’re looking for even more options, check out our comprehensive credit card guide for young adults for a broader overview.

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

1. Yendo Credit Card: Best for No Credit Check and Higher Limits

If you’re looking for the best credit cards for young adults with bad credit, the Yendo Credit Card stands out as a top choice in 2025. Unlike traditional secured cards, Yendo uses your vehicle title as collateral instead of a cash deposit, making it ideal for young adults who may not have extra cash on hand. For example, if your car is worth $10,000, you could qualify for a credit limit between $450 and $10,000—much higher than many secured cards.

If you want to learn more about the Yendo Credit Card, click the link to read our in-depth Yendo Reviews for 2025 blogpost.

Pros of the Yendo Credit Card for Young Adults

- No credit check required, perfect for bad credit.

- Reports to all three major credit bureaus (Experian, Equifax, TransUnion), helping you build credit with on-time payments.

- Higher credit limits based on your vehicle’s value.

Cons of the Yendo Credit Card for Young Adults

- Timely payments are important to avoid any risk of repossession.

- Comes with a 29.88% APR and a $40 annual fee.

In truth, Yendo is particularly appealing for young adults needing a higher credit limit without a cash deposit, offering flexibility to cover expenses like textbooks or emergencies. Additionally, its credit-building potential makes it a solid long-term option.

For a comprehensive review, check out my Yendo reviews for 2025 or apply now.

2. OpenSky Secured Visa: Best Credit Card for Young Adults with Low Fees

Moreover, another excellent option among credit cards for young adults with bad credit is the OpenSky Secured Visa. In truth, this card requires a cash deposit as collateral (starting at $200), which becomes your credit limit. However, it is a great choice for those who don’t want to use a vehicle title as collateral.

Pros of the OpenSky Secured Visa for Credit Building

- No credit check, making it accessible for bad credit.

- Low annual fee of $35.

- Reports to all three credit bureaus, aiding credit building.

Cons of the OpenSky Secured Visa for Credit Building

- Requires a cash deposit, which as a result, can be tough for cash-strapped young adults.

- No rewards program, unlike some student cards.

OpenSky is a safer bet if you’re worried about repossession risks with Yendo. For instance, a $200 deposit gets you a $200 credit limit, offering a controlled way to build credit. Learn more about secured cards at Experian’s guide on secured cards.

3. Discover it® Student Cash Back: Best for Students with Some Credit

While not specifically for bad credit, the Discover it® Student Cash Back card is worth considering among good credit cards for young adults who are students and have at least some credit history. In fact, Discover often accepts applicants with limited credit, making it a viable option for young adults transitioning from bad credit.

Pros of the Discover it® Student Cash Back for Young Adults

- 5% cash back on rotating categories (up to $1,500 per quarter, then 1%) and 1% on other purchases.

- No annual fee, which therefore is budget-friendly for students.

- First-year cashback match, thus doubling your rewards.

Cons of the Discover it® Student Cash Back for Young Adults

- Requires a credit check, which may result in denial for very bad credit.

- Rewards require activation each quarter, which can be inconvenient.

Therefore, this card is best for young adults who are students and can handle a credit check. For example, earning 5% cash back on dining can help with social expenses, while the first-year match adds extra value. However, if your credit is too poor, you might need to start with Yendo or OpenSky first.

4. Capital One Platinum Secured Credit Card: Best for Potential Upgrades

The Capital One Platinum Secured Credit Card is another strong contender for good credit cards for young adults with bad credit, especially those looking for a path to an unsecured card. In fact, like OpenSky, it requires a cash deposit (as low as $49 for a $200 credit limit), but Capital One offers potential upgrades to unsecured cards after responsible use.

Pros of the Capital One Platinum Secured Credit Card for Credit Building in 2025

- Low deposit requirement ($49–$200 for a $200 credit limit).

- No annual fee, which as a result, will save you money.

- Opportunity to upgrade to an unsecured card after 6 months of on-time payments.

Cons of the Capital One Platinum Secured Credit Card for Credit Building in 2025

- No rewards, which might disappoint young adults looking for perks.

- Requires a credit check, though Capital One is lenient with bad credit.

In truth, this card suits young adults who want a path to an unsecured card without annual fees. Additionally, its low deposit makes it accessible if you’re short on cash but still want to build credit responsibly.

Comparing Credit Cards for Young Adults: Which Is Right for You?

So, choosing the best credit cards for young adults depends on your priorities. If you need a card with no credit check and higher limits, Yendo is ideal, especially if you own a vehicle—learn more by comparing Yendo to other no credit check credit cards in 2025. For instance, a $5,000 vehicle might get you a $2,500 credit limit with Yendo, compared to OpenSky’s $200 limit for the same deposit. On the other hand, OpenSky and Capital One are better if you prefer a cash deposit over vehicle collateral, offering lower fees and potential upgrades. Meanwhile, the Discover it® Student Cash Back card suits students with some credit history who want rewards.

Here’s a quick comparison:

- Yendo: Best for no credit check, $450–$10,000 (with vehicle title).

- OpenSky: Best for low fees, no rewards; but requires a deposit.

- Discover it® Student: Best for rewards, students; but requires a credit check.

- Capital One Platinum Secured: Best for upgrades, but low deposit; no rewards.

| Card Name | Credit Check | Annual Fee | Rewards | Credit Limit/Deposit |

|---|---|---|---|---|

| Yendo Credit Card | No | $40 | No | $450–$10,000 (vehicle title) |

| OpenSky Secured Visa | No | $35 | No | $200+ (cash deposit) |

| Discover it® Student Cash Back | Yes | $0 | Yes (5% cash back on rotating categories) | Varies (based on credit) |

| Capital One Platinum Secured | Yes (lenient) | $0 | No | $200+ ($49–$200 deposit) |

Looking for the best credit cards to build your credit in 2025, even with bad credit? Check out this video to learn about options that let you keep your car and boost your credit fast, including the Yendo Credit Card.

Final Thoughts: Start Building Credit Today in 2025

In conclusion, finding the best credit cards for young adults with bad credit in 2025 is easier than ever with options like Yendo, OpenSky, Discover, and Capital One. The Yendo Credit Card stands out as one of the best bad credit credit cards. Its no credit check policy and higher credit limits make it a top pick for young adults needing flexibility.

Hi, my name is Austin and I’ve recently started using Yendo… I fell on some hard times and they were here to help… I truly love it, and they’re there to help you when you need it. They’re willing to work with you if you fall behind on the payments, and that’s great. I encourage everybody to use it. Click here to see the full review.

Inspired by Austin’s experience? Take the first step toward building your credit with Yendo today!

For a comprehensive review of Yendo, click on the link and check out my Yendo reviews for 2025 blogpost.

If you have bad credit and need to improve it, click on this link for a complete step-by-step guide How to Improve Your Bad Credit Score in 2025

However, secured cards like OpenSky and Capital One offer other alternatives if you’re not sure about using your vehicle as collateral. For students with some credit, Discover’s rewards make it a compelling choice.

Moreover, feel free to explore these cards for credit building 2025 goals and start improving your credit today! Have you tried any of these cards? Share your experience in the comments below.

Is Yendo Credit Card a Scam? Addressing Your Concerns in 2025

Are you wondering, is Yendo legit? If you’re researching the Yendo Credit Card in 2025, you might have concerns about its legitimacy. After all, a credit card secured by your vehicle title sounds unconventional, and skepticism is natural. Yendo reviews often highlight its benefits. But some users worry: Is Yendo Credit Card legit, or is it a scam?

In this FAQ-style guide, I’ll address your top concerns. Such as “What happens if I miss a payment?”. And “How does Yendo protect my car title?”. By the end, you’ll have a clear picture of whether Yendo is a trustworthy option for your financial needs in 2025.

Disclosure: This post contains affiliate links, and I may earn a commission. If you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

What Is the Yendo Credit Card?

First, let’s clarify what Yendo is. The Yendo Credit Card, issued by Cross River Bank, who is a member of the FDIC (Federal Deposit Insurance Corporation). It is a secured credit card that uses your vehicle title as collateral instead of a cash deposit. This means you can access credit limits from $450 to $10,000 based on your car’s value, without a credit check. For example, if your vehicle is worth $10,000, you might qualify for a higher credit limit than with traditional secured cards. However, this unique approach raises questions about its legitimacy, which I’ll address below.

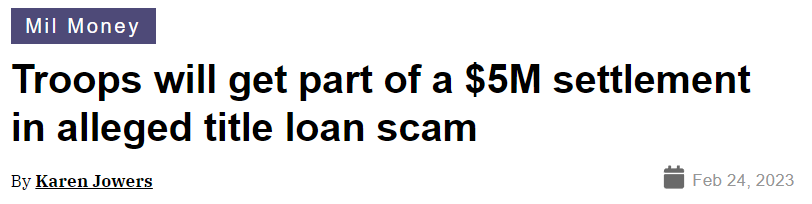

Is Yendo Legit or a Scam? Examining the Evidence

Let’s tackle the big question: Is Yendo legit? The short answer is yes, Yendo is a legitimate fintech company. Founded in 2022 in Dallas, Texas, Yendo has a B+ rating from the Better Business Bureau (BBB). This indicates a solid track record for a company of its age. Additionally, Yendo has raised $165 million in funding. This includes $150 million in debt financing from i80 Group and $15 million in equity from strategic investors. As reported by Fintech Futures.com in May of 2024. This significant investment signals confidence from financial institutions in Yendo’s business model.

With this strong financial backing, Yendo proves it’s a legitimate option for those seeking a secured credit card. Ready to explore Yendo for yourself? Apply now.

Moreover, Yendo is partnered with Mastercard. It offers a real credit card that reports to all three major credit bureaus—Experian, Equifax, and TransUnion. This helps users build credit, a feature not typically associated with scams. However, some negative reviews on platforms like Trustpilot (average 3.2 stars) mention issues like application glitches or low credit limit. This can fuel skepticism. For instance, one user complained about a $450 credit limit despite a $10,000 vehicle value. However others praise Yendo’s quick approval process. These mixed experiences are common for new fintechs and don’t indicate a scam.

What Happens If I Miss a Payment with Yendo?

A common concern is, What happens if I miss a payment? Since Yendo uses your vehicle as collateral, the stakes feel high. If you miss a payment, Yendo may charge a late fee (up to $40, per their terms), and your account could be flagged as delinquent. After several missed payments—typically three months, according to some user reports on Reddit—Yendo may initiate repossession of your vehicle as a last resort to recover the outstanding balance. However, Yendo emphasizes that repossession is not their goal, as they lose money on each repossession, and they work with users to create payment plans to avoid this outcome.

For example, a Trustpilot reviewer noted that Yendo threatened repossession over a $50 past-due balance, but this was after multiple missed payments and lack of communication. To avoid this, make at least the minimum payment (1% of your balance or $50, whichever is greater) within 25 days of your statement. Additionally, Yendo’s app allows you to track payments and set reminders, helping you stay on top of your obligations.

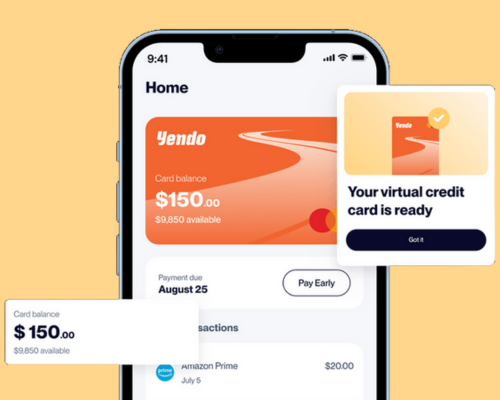

How Does Yendo Protect My Car Title? Is Yendo Legit?

Another frequent question is, How does Yendo protect my car title? When you’re approved, you send your vehicle title to Yendo via FedEx (at their expense). Until the title is received, you get access to 40% of your credit limit (up to $1,500) via a virtual card. Once Yendo receives the title, they become a lienholder, but you retain ownership and can still use your car. Yendo stores your title securely, and their app includes fraud protection features like virtual card numbers for online purchases, reducing the risk of unauthorized use.

If you pay off your balance and close your account, Yendo returns your title. However, some users on the Yendo App Store page reported delays in account unblocking after sending their title, which caused frustration. For instance, one user waited from April to July 2024 for their account to be unblocked, though Yendo eventually resolved the issue. While these hiccups exist, Yendo’s processes are designed to protect your title, and their customer support team is available to address concerns.

Is Yendo Credit Card Legit for Building Credit?

Yes, the Yendo Credit Card is a legitimate tool for building credit. Because Yendo reports all account activity to the major credit bureaus, on-time payments can improve your credit score over time. For example, a Trustpilot user shared, “I’ve been making on-time payments, and my credit line increased!” This credit-building feature is a key benefit for those with bad credit, especially since Yendo doesn’t require a credit check for pre-approval. However, be mindful of the 29.88% APR and $40 annual fee, which can add up if you carry a balance.

What Are the Risks of Using Yendo?

While Yendo is legit, it’s not risk-free. The biggest risk is repossession if you default on payments, as your car is collateral. Additionally, the high APR (29.88%) and annual fee ($40) make it more expensive than some secured cards that offer rewards or no fees—compare Yendo to other no credit check credit cards in 2025 to explore alternatives. Some users also report application issues, like delays or denials despite Yendo’s claim of no credit check, often due to insufficient credit history or vehicle ineligibility (e.g., cars older than 1996 don’t qualify). Therefore, weigh these risks against the benefits, especially if you’re prone to missing payments.

Want a Deeper Dive into Yendo?

If you’re still curious about Yendo, I’ve got you covered. For a comprehensive review of Yendo, including detailed user experiences and comparisons, check out my Yendo reviews for 2025 blogpost or apply now.

Final Thoughts: Is Yendo Legit and Right for You in 2025?

In conclusion, Yendo is not a scam—it’s a legitimate option for those with bad credit seeking a no credit check credit card. Its $165 million in funding, BBB rating, and partnership with Mastercard provide reassurance, though risks like repossession and high fees require careful consideration.

When I first got it,or when I was first getting it, I kind of didn’t know if it was like real or not… But I’m happy to say I got it. I’m glad I did… I definitely recommend it…Let me be the person to tell you it’s legit. Get it.

Click here to see the full review.

Joseph’s experience confirms Yendo’s legitimacy—ready to take the next step?

Convinced Yendo is legit? Apply for the Yendo Credit Card now to start building credit!

Apply for the Yendo Credit Card now to start building credit!

Looking for more credit card options to build your credit? Check out our guide on the best credit cards for young adults with bad credit in 2025 to explore alternatives like OpenSky and Capital One!

By addressing concerns like payment risks and title security, I hope this guide has clarified whether Yendo fits your needs. Have you tried Yendo? Share your experience in the comments below!

Comparing Yendo to Other No Credit Check Credit Cards in 2025

Looking for Yendo Credit Card reviews to decide if it’s the right no credit check option for you? Let’s break down how Yendo compares to other cards in 2025.

Introduction: Why Compare No Credit Check Credit Cards in 2025?

If you’re struggling with bad credit, finding a credit card that doesn’t require a credit check can feel like a lifeline. However, not all no credit check credit cards are created equal. In 2025, Yendo, OpenSky, and subprime cards cater to poor credit users but vary in features, costs, and benefits. For instance, the Yendo Credit Card uses a unique vehicle-secured approach, offering higher credit limits and lower APRs compared to alternatives like title loans. In this guide, we’ll dive into Yendo Credit Card reviews to compare Yendo to other no credit check credit cards, helping you decide which option best suits your needs. Want to understand what the Yendo Credit Card is all about? Let’s dive in.

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

What Is the Yendo Credit Card?

The Yendo Credit Card is a secured credit card designed for individuals with bad credit or no credit history. Unlike traditional secured cards that require a cash deposit, Yendo uses your vehicle as collateral, meaning you don’t need to put down cash upfront. As a result, Yendo offers credit limits ranging from $450 to $10,000, depending on your car’s value, which is significantly higher than many other no credit check cards. Additionally, Yendo reports to all three major credit bureaus (Equifax, Experian, TransUnion), helping you rebuild your credit score with on-time payments. With an APR of 29.88%, it’s also more affordable than predatory alternatives like title loans, which can charge up to 300% APR.

However, Yendo does require you to have a vehicle with a clear title (no outstanding loans) and a minimum value, which may not suit everyone. Nevertheless, its unique approach makes it a standout option for those who need a higher credit limit without a cash deposit.

Learn more about credit reporting at Experian.

Comparing Yendo to Other No Credit Check Credit Cards

To help you make an informed decision, let’s compare the Yendo Credit Card to other popular no credit check credit cards in 2025, such as the OpenSky Secured Visa and typical subprime cards for bad credit users. For example, we’ll look at credit limits, fees, APRs, and credit-building potential.

Comparison Table: Yendo vs. OpenSky vs. Subprime Cards

| Feature | Yendo Credit Card | OpenSky Secured Visa | Typical Subprime Card |

|---|---|---|---|

| Credit Check Required | No | No | No |

| Security Deposit | Vehicle title (no cash deposit) | $200–$3,000 cash deposit | Often none, but high fees |

| Credit Limit | $450–$10,000 (based on vehicle value) | $200–$3,000 (matches deposit) | $300–$1,000 |

| APR | 29.88% | 22.39% (variable) | 30%–36% (or higher) |

| Annual Fee | $0 (but $5.99–$12.99 monthly maintenance) | $35 | $75–$125 (first year, often $45–$99 after) |

| Credit Reporting | Reports to all three bureaus | Reports to all three bureaus | Varies (some don’t report) |

| Best For | Higher credit limits, vehicle owners | Low APR, small deposit | Quick approval, but costly |

Source: Data compiled from official websites and user reviews as of March 31, 2025.

Key Takeaways the Yendo Credit Card Reviews Comparison

- Credit Limits: Yendo shines with its higher credit limits ($450–$10,000), making it ideal for those who need more spending power to manage expenses or improve credit utilization. In contrast, OpenSky’s limit is capped at your deposit ($200–$3,000), and subprime cards often max out at $1,000.

- Costs: Yendo’s APR (29.88%) is competitive compared to subprime cards (30%–36%) and significantly lower than title loans (up to 300%). However, OpenSky offers a lower APR (22.39%), which could save you money if you carry a balance.

- Fees: Yendo has no annual fee but charges a monthly maintenance fee ($5.99–$12.99), which can add up. OpenSky’s $35 annual fee is more predictable, while subprime cards often have high first-year fees ($75–$125).

- Credit Building:Because Yendo and OpenSky report to all three credit bureaus, they’re better for rebuilding credit. Some subprime cards don’t report, limiting their usefulness for credit improvement.

Why Yendo Stands Out: Yendo Credit Card Reviews in 2025

Yendo’s vehicle-secured approach sets it apart from other no credit check credit cards. For instance, if you own a vehicle with a clear title, you can access a credit limit up to $10,000 without a cash deposit—a game-changer for those with bad credit who need more financial flexibility. Moreover, Yendo’s APR of 29.88% is far more affordable than title loans, which can trap users in a cycle of debt with rates as high as 300%. Additionally, Yendo’s credit reporting to all three bureaus helps you build credit over time, provided you make on-time payments.

Based on Yendo Credit Card reviews in 2025, users highlight its benefits for bad credit, appreciating the higher credit limits and the ability to avoid cash deposits, though some note the monthly maintenance fee as a downside. Overall, Yendo is a strong option for vehicle owners looking to rebuild credit without the high costs of subprime cards or title loans.

For a comprehensive review, check out my Yendo reviews for 2025 blogpost or apply now.

Alternatives to Yendo: OpenSky and Subprime Cards

OpenSky Secured Visa

The OpenSky Secured Visa is another no credit check option, requiring a cash deposit ($200–$3,000) that sets your credit limit. Because it has a lower APR (22.39%) and a modest $35 annual fee, it’s a good choice for those who want to minimize interest charges. However, the cash deposit requirement can be a barrier for some, and the credit limit is lower than Yendo’s. For a broader comparison, check out our guide on the best credit cards for young adults with bad credit in 2025.

Subprime Cards for Bad Credit

Subprime cards, like the First Access Visa or Total Visa, often target bad credit users with quick approvals and no credit checks. Unfortunately, they come with high costs—annual fees can be $75–$125 in the first year, and APRs often exceed 30%. Moreover, some don’t report to credit bureaus, limiting their value for credit building. Therefore, they’re best avoided unless you have no other options.

How to Choose the Right No Credit Check Credit Card with Yendo Credit Card Reviews

First, consider your needs. If you own a vehicle and need a higher credit limit, Yendo is a strong contender. On the other hand, if you prefer a lower APR and can afford a cash deposit, OpenSky might be better. Second, evaluate the costs—subprime cards often have hidden fees that can outweigh their benefits. Finally, ensure the card reports to credit bureaus, as this is crucial for rebuilding your credit score over time.

FAQ: Yendo Credit Card Reviews and Comparisons

What is the Yendo Credit Card, and how does it work?

The Yendo Credit Card is a secured card that uses your vehicle as collateral instead of a cash deposit. It offers credit limits from $450 to $10,000 and reports to all three credit bureaus to help you rebuild credit. Learn more.

How does Yendo compare to title loans?

Yendo’s APR (29.88%) is much lower than title loans (up to 300%), making it a more affordable option for bad credit users. It also helps build credit, while title loans typically don’t.

Is Yendo better than other no credit check cards?

It depends on your needs. Yendo offers higher credit limits and no cash deposit, but OpenSky has a lower APR. Subprime cards often have higher fees and fewer benefits.

Conclusion: Is Yendo the Best No Credit Check Credit Card for You?

In 2025, the Yendo Credit Card stands out among no credit check credit cards for its vehicle-secured approach, higher credit limits ($450–$10,000), and lower APR (29.88%) compared to title loans. While OpenSky offers a lower APR and subprime cards provide quick approvals, Yendo’s balance of affordability and credit-building potential makes it a top choice for vehicle owners with bad credit. Still wondering about Yendo’s trustworthiness? Check out our detailed guide on whether Yendo is a scam in 2025 for peace of mind. For a comprehensive review, check out my Yendo reviews for 2025 blogpost.

It’s been a great opportunity for me to build some credit, as well as pay some bills. That were coming up at an untimely event. Yendo was there to be able to give me the funds within 24 hours4. It’s been great ever since. Click here to see the full review.

Inspired by Jason’s success? Take the first step toward rebuilding your credit today!

Ready to rebuild your credit? Apply for the Yendo Credit Card now!

Not sure if Yendo’s vehicle-secured approach is right for you? Explore alternatives like OpenSky and Capital One in our guide on the best credit cards for young adults with bad credit in 2025. For a step-by-step guide to improving your credit, check out how to improve your bad credit score in 2025. Have you tried Yendo or another no credit check card? Share your experience in the comments below!

How to Improve Your Bad Credit Score in 2025: A Step-by-Step Guide

Learn how to improve your bad credit score with practical steps, including using a credit utilization calculator to manage your credit effectively.

Published March 28, 2025

Struggling with a bad credit score and wondering how to improve it in 2025? You’re not alone—many people face the challenge of rebuilding their credit to unlock better financial opportunities, such as lower interest rates, easier loan approvals or even better rental agreements. A bad credit score – typically below 580 on the FICO scale – can feel like a major roadblock, but with the right strategies, like learning how to calculate credit utilization and using a credit utilization calculator to manage your credit, you can finally turn things around and set yourself up for success.

In this step-by-step guide, we’ll walk you through proven methods to improve your bad credit score. Moreover with a special focus on managing your credit utilization—a key factor that makes up 30% of your FICO score. We’ll also explain how to calculate your credit utilization, show you how to use a credit utilization calculator, and recommend tools like the Yendo Credit Card to help you rebuild credit without a hard credit check. Let’s get started on your path to better credit in 2025!

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

Why Your Credit Score Matters in 2025

Your credit score is a three-digit number (ranging from 300 to 850 on the FICO scale) that reflects your creditworthiness. In fact, lenders, landlords, and even employers use it to assess your financial reliability.

Apply now.

A bad credit score can lead to:

- Higher interest rates on loans and credit cards.

- Difficulty getting approved for mortgages or rentals.

- Limited access to financial products.

In truth, improving your credit score opens doors to better financial opportunities. According to Experian, the average FICO score in the U.S. in 2024 was 715, and aiming for at least a “good” score (670–739) can make a big difference. Let’s dive into the steps to get there.

Step 1: Understand Your Credit Score and What Affects It

Before you can improve your credit score, you need to know where you stand and what factors influence it. For instance, the FICO score, the most widely used model, is based on five key components:

- Payment History (35%): Paying bills on time is the biggest factor.

- Credit Utilization (30%): The ratio of your credit card balances to your credit limits.

- Length of Credit History (15%): How long you’ve had credit accounts.

- Credit Mix (10%): A variety of credit types (e.g., credit cards, loans).

- New Credit (10%): Recent applications for credit.

For those with bad credit, focusing on payment history and credit utilization can yield the fastest results. Moreover, in this guide, we’ll zero in on credit utilization, as it’s a major lever you can pull to boost your score quickly.

Action Item: Check your credit score for free through services like Credit Karma or Experian. Review your credit report for errors (e.g., incorrect late payments) and dispute them with the credit bureaus (Equifax, Experian, TransUnion).

Step 2: Calculate Your Credit Utilization Ratio

What Is Credit Utilization?

Credit utilization is the percentage of your available credit that you’re currently using. It’s calculated as:

\[\text{Credit Utilization Ratio} = \left( \frac{\text{Total Credit Card Balances}}{\text{Total Credit Limits}} \right) \times 100\]For example, if you have two credit cards—one with a $500 balance and a $1,000 limit, and another with a $300 balance and a $2,000 limit—your total balance is $800, and your total limit is $3,000. Your credit utilization ratio is:

\[\left( \frac{800}{3000} \right) \times 100 = 26.67\%\]Why It Matters:

Credit utilization accounts for 30% of your FICO score, making it the second-most important factor after payment history. Experts, including those at FICO and Experian, recommend keeping your utilization below 30% to optimize your score. In addition, a high ratio (e.g., 70%) signals to lenders that you’re over-relying on credit, which can hurt your score significantly.

How to Calculate Credit Utilization Manually:

- List all your credit cards, their balances, and their credit limits.

- Add up your total balances (e.g., $800 in the example above).

- Add up your total credit limits (e.g., $3,000).

- Divide your total balances by your total limits and multiply by 100 to get the percentage.

Action Item: Calculate your credit utilization ratio today to see where you stand. If it’s above 30%, reducing it should be a priority.

Step 3: Use a Credit Utilization Calculator to Simplify the Process

First, calculating credit utilization manually can be time-consuming, especially if you have multiple credit cards. A credit utilization calculator makes it easy to determine your ratio and track your progress as you pay down debt.

Try Our Free Credit Utilization Calculator Below:

Use the interactive tool below to input your credit card balances and limits, calculate your overall utilization ratio, and get personalized AI advice on how to improve your credit score. You can also download a PDF report of your results to keep for your records.

| Card Name | Credit Limit ($) | Current Balance ($) | Utilization (%) |

|---|

Boost Your Credit with Yendo

Looking to improve your credit score? The Yendo Credit Card offers a great solution for those with bad credit:

- Up to $10,000 credit limit with no credit check

- Reports to all three credit bureaus to help build credit

- Lower APR (29.88%) compared to title loans (up to 300%)

Example Calculator Input:

- Credit Card 1 Balance: $500 | Limit: $1,000

- Credit Card 2 Balance: $300 | Limit: $2,000

Result: Your credit utilization ratio is 26.67%

How to Use the Calculator:

- Input the balance and credit limit for each of your credit cards.

- Click “Add Another Card” if you have more than one card.

- Click “Calculate Total Utilization” to see your overall ratio and get AI advice.

- Download your results as a PDF for future reference.

Why It Works: Using a credit utilization calculator helps you visualize your credit usage and set clear goals for reducing it, which of course, can directly improve your credit score over time.

Action Item: Use the calculator above to check your credit utilization ratio. Aim to lower it below 30% by paying down balances or increasing your credit limits.

Step 4: Lower Your Credit Utilization to Boost Your Score

Now that you know your credit utilization ratio, let’s explore strategies to reduce it and improve your credit score.

Strategy 1: Pay Down Your Credit Card Balances

The most direct way to lower your credit utilization is to reduce your credit card balances. Therefore, focus on paying off high-utilization cards first. For example, if one card is at 90% utilization ($900 balance on a $1,000 limit), paying it down to $300 will drop its utilization to 30%, significantly impacting your overall ratio.

Tip: Set up automatic payments or reminders to ensure you pay more than the minimum each month. Even small extra payments can make a difference over time.

Strategy 2: Request a Credit Limit Increase

If paying down debt isn’t immediately feasible, ask your credit card issuer for a higher credit limit. For example, if your $1,000-limit card increases to $2,000 and your balance stays at $500, your utilization drops from 50% to 25%. However, be cautious—requesting a limit increase may result in a hard inquiry, which can temporarily lower your score by a few points.

Tip: Only request a limit increase if you’re confident you won’t overspend with the extra credit.

Strategy 3: Use a Credit Card Designed for Bad Credit

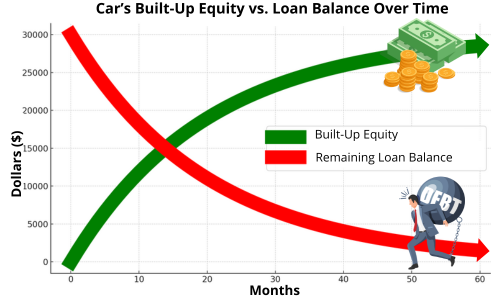

For those with bad credit, getting approved for a credit limit increase or a new card can be challenging. This is where cards like the Yendo Credit Card come in. Yendo offers a vehicle-secured credit card with credit lines from $450 to $10,000, based on your car’s equity, without a hard credit check. By adding a new credit line, you can increase your total available credit, lowering your overall utilization ratio.

For a comprehensive review, check out my Yendo reviews for 2025 blogpost.

Example: If your current total credit limit is $3,000 with a $1,500 balance (50% utilization), adding a $4,000 Yendo credit line increases your total limit to $7,000. If your balance remains $1,500, your utilization drops to 21.4%—a significant improvement.

Action Item: Prioritize paying down high-balance cards, request a credit limit increase if appropriate, or consider a card like Yendo to expand your available credit. Click here to apply for it now. Recalculate your utilization ratio after each step to track progress.

Step 5: Make On-Time Payments to Build a Positive History

While credit utilization is crucial, payment history remains the largest factor in your credit score (35%) because it reflects your reliability to lenders. Moreover, late payments can stay on your credit report for up to 7 years, dragging down your score. To improve your bad credit:

- Set up automatic payments to ensure you never miss a due date.

- If you’ve missed payments in the past, contact creditors to negotiate removing negative marks (a “goodwill adjustment”) if you’re now in good standing.

- Use your credit card for small purchases and pay the balance in full each month to build a positive payment history.

Tip: If you’re using a card like Yendo, which reports to all three credit bureaus, on-time payments can steadily improve your score over time.

Action Item: Review your payment history on your credit report and set up reminders or autopay to ensure future payments are on time.

Step 6: Best Credit Cards for Bad Credit in 2025

Do you need to improve bad credit? Choosing the right credit card can accelerate your credit-building journey, especially if you have bad credit. Look for cards that:

- Don’t require a hard credit check (to avoid dinging your score).

- Report payments to all three credit bureaus (Equifax, Experian, TransUnion).

- Offer reasonable fees and interest rates.

One option to consider is the Yendo Credit Card, which offers up to $10K with no credit check, thus making it ideal for those with bad credit. Unlike traditional secured cards that require a cash deposit, Yendo uses your car’s equity as collateral, making it accessible for those with bad credit. It reports payments to credit bureaus, helping you build a positive history, and its APR of 29.88% is much lower than predatory title loans (which can exceed 300%). Plus, a higher credit line can lower your credit utilization ratio, as discussed earlier.

For a comprehensive review of Yendo, including user experiences and comparisons, check out my Yendo reviews in 2025 blogpost or apply now.

Other Options:

- Open Sky Secured Visa: Requires a cash deposit but has no credit check and a low annual fee ($35).

- Discover it Secured Card: Offers cashback rewards and a potential upgrade to an unsecured card after 7 months of good payment history.

For a deeper comparison of no credit check credit cards, check out our guide on comparing Yendo to other options in 2025.

Action Item: Research credit cards for bad credit and apply for one that fits your needs, like Yendo, to start building a positive credit history.

Step 7: Monitor Your Progress and Stay Consistent

Improving your credit score is a marathon, not a sprint. Therefore, you must monitor your progress regularly to stay motivated and adjust your strategies as needed:

- Check your credit score monthly through free services like Credit Karma or your bank.

- Use a credit utilization calculator to track your ratio as you pay down debt or add new credit lines.

- Review your credit report annually (or more often if you’re actively rebuilding) at AnnualCreditReport.com to ensure accuracy.

Consistency is key—making on-time payments, keeping your credit utilization low, and avoiding new hard inquiries will gradually improve your score. According to FICO, significant improvements can take 3–6 months, but small changes (like lowering utilization) can show up in as little as 30 days.

Action Item: Set a monthly reminder to check your credit score and utilization ratio. Celebrate small wins, like dropping your utilization below 30%, to stay motivated.

Frequently Asked Questions About Improving Your Bad Credit Score

What is a credit utilization calculator, and how does it help?

A credit utilization calculator helps you determine the percentage of your available credit you’re using. Keeping this ratio below 30% can boost your credit score by showing lenders you’re not over-relying on credit.

How do I calculate my credit utilization ratio?

Add up your credit card balances and divide by your total credit limits, then multiply by 100. For example, $1,000 in balances with $5,000 in limits equals a 20% utilization ratio. (Click here to access our Credit Utilization Calculator)

Can a credit card like Yendo really help with bad credit?

Yes! Yendo offers credit lines up to $10,000 with no credit check, reports payments to credit bureaus, and can lower your credit utilization by increasing your available credit. Learn more in my review here.

How long does it take to improve a bad credit score?

It depends on your starting point, but you can see improvements in 1–3 months by lowering credit utilization and making on-time payments. Major improvements may take 6–12 months.

Conclusion: Take Control of Your Credit in 2025

Improving your bad credit score in 2025 is entirely possible with the right strategies. By focusing on your credit utilization—using tools like a credit utilization calculator—and making on-time payments, you can start seeing results in as little as 30 days. Cards like the Yendo Credit Card can accelerate the process by providing accessible credit without a hard credit check, helping you lower your utilization and build a positive payment history.

They make it so easy. They build credit. You get the money instantly and it’s easy to pay. What more could you say? Go ahead, do it. Get it done and see what happens. Great things.

Click here to see the full review.

Inspired by Garret’s great advice? Take the first step toward rebuilding your credit today!

Ready to rebuild your credit? Apply for the Yendo Credit Card now!

So, are you ready to get started? Calculate your credit utilization ratio today, explore credit cards for bad credit, and take the first step toward a better financial future. For more insights on Yendo, check out my detailed Yendo Credit Card review for 2025 or apply now.

Have you tried any of these strategies? Share your experience in the comments below—I’d love to hear your story!

Yendo Reviews 2025: Is the Yendo Credit Card Legit for Bad Credit?

Want to see the Yendo reviews on the credit card that people easily qualify for and depend on despite their bad credit? You’re not alone. In fact, many people face the challenge of finding a legit option that doesn’t require a perfect credit score.

Therefore, in this Yendo reviews guide for 2025, we’ll dive deep into the Yendo Credit Card to clarify whether it’s the right choice for rebuilding your credit. Specifically with a unique vehicle-secured approach, wherein Yendo offers up to $10,000 in credit with no credit check, but is Yendo legit, and can it truly help you?

To address this, we’ll firstly explore what users are saying. Secondly, we’ll break down how does Yendo work. Thirdly, we’ll compare it to other options on the market. In addition, whether you’re curious about its features, legitimacy, or fit for your financial needs, this comprehensive review has you covered.

So, without further ado, let’s get started and see if the Yendo Credit Card can be your path to better credit in 2025!

Want to hear more about Yendo’s legitimacy? Check out our video review below:

After watching, read on to learn how Yendo works or apply now .

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

What Is the Yendo Credit Card?

Undoubtedly, the Yendo Credit Card is a revolutionary financial tool designed to help individuals rebuild their credit, especially those with bad credit. Unlike traditional credit cards, Yendo operates as a vehicle-secured credit card, leveraging the equity in your car to provide access to credit without the usual barriers. Therefore, instead of requiring a cash deposit or a stellar credit score, Yendo uses your vehicle as collateral, allowing you to tap into its value for a credit line ranging from $450 to $10,000, with an average of $4,400..

Moreover, this unique approach embraces a no credit check approval process. In fact, it focuses on the value of your car rather than solely your credit score, which ultimately makes it accessible to those turned away by conventional lenders.

Without a doubt, Yendo is ideal for people struggling with bad credit or those with no credit history who need a way to establish or improve their financial standing. And by reporting payments to major credit bureaus, it subsequently offers a practical path to credit rebuilding without the high fees or risks of title loans.

As a result, you retain full use of your car while benefiting from its equity, a feature that sets Yendo apart from traditional secured cards. So, whether you’re looking to pay off high-interest debt or build a positive credit profile, Yendo provides a flexible, innovative solution tailored to underserved borrowers.

What Is the Yendo Credit Card Game-Changing Approval Approach?

What truly makes Yendo stand out is its game-changing approval approach rooted in the company’s mission to “…offer affordable credit access to everyone”. In contrast to traditional lenders, Yendo doesn’t rely on your credit score to evaluate your application. Instead, it welcomes applicants of all credit backgrounds, as proudly stated on their home page: “All credit scores welcome to apply”. As a result, this inclusive philosophy ensures that more people can access the benefits of a credit card, making Yendo a ground-breaking option for those seeking a fresh start financially.

Moreover, to learn more about Yendo’s features and benefits, read our detailed blogpost titled: Yendo Credit Card: Best Vehicle-Secured Credit Card. This provides deeper insights into the card’s specifics.

Exactly what you’ve been looking for? Want to see the application process? Click on this link to visit Yendo.com and to see what they can do for you.

Curious about how it works or if it’s legit? Stay tuned as we explore further in this guide.

Yendo Credit Card Reviews: What Users Are Saying

Wondering what real users are saying about the Yendo Credit Card in 2025? Yendo credit card reviews in fact, showcase its appeal for those with bad credit, offering a lifeline through its innovative approach.

Yendo Reviews: Teresa

Teresa’s experience notably, stands out:

“I was able to pay off my high-interest credit cards… it really saved my life completely,” Click here to see the full review .

Her testimony highlighting how Yendo provides financial relief and debt management, specifically a game-changer for credit rebuilding. Her stress-free journey with Yendo’s easy process resonates with many users facing similar struggles.

Yendo Reviews: Vincent

In addition, the convenience and speed also shine in Yendo credit card reviews. Vincent noted:

“They approved me within a day, and I got my card within about a week or so… the overall experience has been pleasant, with no issues at all.” Click here to see the full review .

Yendo Reviews: Jose

Likewise, Jose echoed this, saying:

“I applied at 10 o’clock at night… the next morning my virtual card was activated… very quick, very easy,” Click here to see the full review .

In addition, praising the no credit check process that delivers fast funds—ideal for urgent needs like his trucking job.

Yendo Reviews: Melissa

Furthermore, Melissa added:

“The process was super fast, and they gave me part of the money up front… it was just so easy” Click here to see the full review .

Her words thereby reinforcing Yendo’s accessibility for bad credit users needing quick solutions.

To summarize, these glowing reviews position Yendo as a trusted option. But is Yendo legit, and how does it work behind the scenes? We’ll dive into those questions in the next section.

Want to Hear More Experiences and Yendo Reviews From Real Users?

Yes, these glowing reviews position Yendo as a trusted option in 2025. But is Yendo legit, and moreover, how does it work behind the scenes? We’ll dive into those questions next. If you’ve used Yendo, share your story below!

In truth, Yendo has helped countless people improve their financial situation with quick approval, credit-building features, and no cash deposit requirements. Check out more video and text reviews from satisfied Yendo customers to see how this card can benefit you.

Is Yendo Legit? Can You Trust This Credit Card?

With glowing Yendo credit card reviews praising its accessibility, a key question arises: is Yendo legit? For those with bad credit seeking a vehicle-secured credit card, trust is crucial, especially with a no credit check credit card using your car as collateral. For instance, Yendo, a fintech innovator, offers credit lines up to $10,000 via vehicle equity—a unique approach which, in turn, raises some skepticism. In fact, evidence confirms its legitimacy.

Firstly, Yendo is registered with the Better Business Bureau (BBB). Secondly, it recently secured a $165 million investment to fuel growth, as reported by Businesswire.com, signaling strong industry trust in its model. Moreover, user feedback shows initial doubt turning to trust after seamless experiences. For example, Joseph’s review states: “I kind of didn’t know if it was real… but I’m glad I did”—shows initial doubt turning to trust after a seamless experience.

Consequently, Yendo’s transparency about collateral terms and payment reporting to credit bureaus further builds confidence, ultimately helping credit card for bad credit users rebuild scores, unlike predatory title loans. For a deeper dive into addressing concerns about Yendo’s legitimacy, check out our post Is Yendo Credit Card a Scam? Addressing Your Concerns in 2025.

Legitimacy, however, requires responsible use—missing payments risks repossession, a standard secured lending clause. Yendo’s quick approval and support, as reviews note, also affirm reliability. Still, research terms and consult an advisor before applying. So, is Yendo legit? Yes, with diligence of course.

Next, we’ll explore how does Yendo work. Additionally, please share your insights on Yendo’s legitimacy below…

How Does Yendo Work? A Step-by-Step Guide

After exploring Yendo credit card reviews and confirming is Yendo legit, let’s dive into how does Yendo work—a key question for bad credit users. Yendo, a vehicle-secured credit card, offers a no credit check credit card by leveraging your car’s equity, moreover, making it ideal for those denied traditional credit. Here’s the step-by-step process.

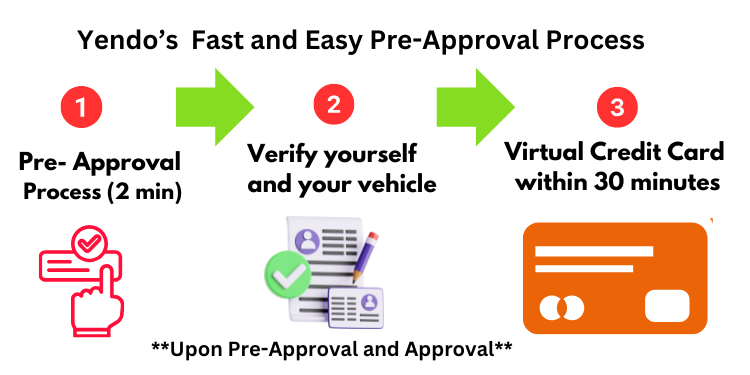

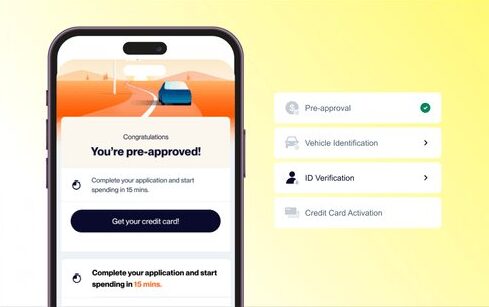

How Does Yendo Work: The Pre-Approval Process

First and foremost, Yendo’s standout feature is its fast and easy pre-approval process that takes just 2 minutes to complete. Consequently, this allows you to be pre-approved without any impact on your credit score. Specifically, this soft inquiry assesses your vehicle and personal details to determine eligibility, thus avoiding the credit hits of traditional applications. Then, once you’re pre-approved, apply online by submitting photos of your car and its title. After that, send your title via a secure service like FedEx, a step that activates your virtual card quickly. As Jose shared, “The next morning my virtual card was activated… very quick, very easy.” In fact, you can access your virtual credit card within 30 minutes, making Yendo a quick solution if you need fast credit.

How Does Yendo Work: The Post-Approval Process

Post-approval, you receive a physical credit card for bad credit with credit lines from $450 to $10,000, while, at the same time, retaining car use. Additionally, Yendo reports payments to credit bureaus, thereby aiding credit rebuilding, and offers a revolving line of credit—specifically, pay it down, and your limit refreshes. Furthermore, Susanna praised the support: “It’s easy to apply… they have the staff to assist you.” Moreover, timely payments are key to avoid collateral risks, typical for no credit check credit card products.

Ready to get started? Apply for the Yendo Credit Card today and see how much credit you can get based on your car’s value.

This streamlined process therefore underscores Yendo’s appeal in 2025. Next, we’ll compare it in Yendo vs. Other Vehicle-Secured Credit Cards. Share your application experience below…

Yendo vs. Other Vehicle-Secured Credit Cards

Wondering how Yendo stacks up against other vehicle-secured credit card options in 2025? For instance, Yendo reviews highlight its edge for bad credit users, but let’s compare it to alternatives like traditional title loans and secured cards to see why it’s a standout credit card for bad credit. Notably, Yendo’s no credit check process sets it apart, offering credit lines up to $10,000 by leveraging your car’s equity without impacting your score—a feature title loans can’t match, as they often involve high interest rates and repossession risks.

In contrast, (and unlike traditional secured cards requiring cash deposits), Yendo uses your vehicle as collateral, freeing up funds while you retain car use. As a result, the table below highlights key differences:

Yendo Comparison:

| Feature | Yendo | Traditional Secured Cards |

|---|---|---|

| Collateral | Your car’s equity | Cash deposit |

| Credit Limit | $450 – $10,000 based on car value | Usually equal to deposit amount |

| Upfront Cost | No cash deposit required | Cash deposit required $200+ |

| Annual Fee | $40 | Varies (some have no annual fee) |

In fact, Yendo also outshines title loans. Moreover, as Wendy noted: “It is so much better than any title loan… the interest rate is reasonable.” Importantly, the table below shows Yendo’s lower APR and flexible terms:

Yendo’s Rate and Terms

| Feature | Yendo Credit Card | Car Title Loans |

|---|---|---|

| Annual Percentage Rate (APR) | 29.88% | Approximately 300% |

| Monthly Interest Rate | 2.49% | Around 25% |

| Typical Loan Fees | Low to none | High origination, service, and processing fees |

| Interest Accumulation | Based only on outstanding balance | High accrual rates, rapid debt growth |

| Repayment Flexibility | Revolving line; carry balance month-to-month | Full repayment often required quickly, risk of repeated borrowing |

| Early Repayment Penalties | None | Some lenders may charge prepayment penalties |

Yendo vs. Title Loans: Cost and Terms Comparison

Yendo, of course, reports payments to credit bureaus, thereby, aiding credit rebuilding, unlike many title loans. Specifically, its 2-minute pre-approval and 30-minute virtual card access (see how does Yendo work) add speed, which is further backed by a $165 million investment (confirming is yendo legit). For a broader comparison with other no credit check credit cards, check out our guide on comparing Yendo to other no credit check credit cards in 2025.

Watch Yendo Compared to Other No-Credit-Check Cards

See how Yendo stacks up against alternatives like OpenSky and Total Visa in this detailed review. Discover why Yendo’s vehicle-secured approach is a top choice for rebuilding credit in 2025 and beyond.

Ready to start rebuilding your credit? Apply for the Yendo Credit Card today or learn more about credit-building strategies in our guide How to Improve Your Bad Credit Score in 2025 .

Now, given these advantages, Yendo undoubtedly stands out as the best choice for bad credit users. To experience these benefits, you need to apply for the Yendo Credit Card today.

Did our videos help you understand Yendo’s benefits? Share your thoughts below!

Next, explore Key Features of the Yendo Credit Card.

Why Choose the Yendo Credit Card in 2025?

After diving into Yendo reviews, confirming is Yendo legit, and understanding how does Yendo work, why should you choose Yendo in 2025? Because, this vehicle-secured credit card offers unmatched benefits to people with bad credit. Specifically, its no credit check process, 2-minute pre-approval, and 30-minute virtual card access make it a fast credit card for bad credit, as seen in Yendo credit card reviews. Moreover, credit lines up to $10,000, based on your car’s equity, provide flexibility without cash deposits, while payment reporting helps rebuild your credit. For a step-by-step guide on improving your credit with tools like Yendo, see our post How to Improve Your Bad Credit Score in 2025.

In addition, a standout reason is the cost savings. Yendo’s APR of 29.88% is significantly lower than title loans’ rates, which can exceed 300%. Use the calculator below to see your savings, and learn more about managing credit utilization in our guide How to Use a Credit Card Usage Calculator to Boost Your Credit Score.

Savings Calculator:

See How Much You Can Save With Yendo

Repayment Summary

| Loan Provider | APR (%) | Time Period | Total Repayment ($) |

|---|---|---|---|

| Yendo | 29.88% | ||

| Title Loan | 125.99% | ||

| Title Loan | 165.99% | ||

| Title Loan | 229.99% | ||

| Title Loan | 302.99% |

**Annual Percentage Rates (APR) and terms sourced from the AmericanTitleLoan.com website.**

This interactive tool shows how Yendo’s no credit check credit card saves you money over time, consequently, a key advantage over alternatives (see Yendo vs. Other Vehicle-Secured Credit Cards). For example, Teresa’s story—“I was able to pay off my high-interest credit cards… it really saved my life”—highlights the financial relief Yendo provides. Moreover, its $165 million investment underscores industry trust, making it a reliable choice for 2025.

Furthermore, Yendo’s generous limits make it a strong choice for anyone wanting to maximize their available credit. Therefore, go ahead and give it a try. Click on the link to see how high your credit line can go with Yendo.

In addition, Yendo combines speed, affordability, and credit-building potential, making it a top pick for those needing accessible credit. So, are you ready to apply? Explore Yendo’s website for more details, or alternatively, please share your experience below to join the conversation...

Frequently Asked Questions About The Yendo Credit Card

What are Yendo credit card reviews saying in 2025?

Users praise Yendo for its accessibility and benefits for bad credit, with no credit check approval. Learn more in our Yendo Credit Card Reviews section.

Is Yendo legit for a vehicle-secured credit card?

Yes, Yendo is registered with the BBB and backed by a $165 million investment, confirming its legitimacy. Check details in our Is Yendo Legit? section.

How does Yendo work as a no credit check credit card?

Yendo uses your car’s equity for a fast 2-minute pre-approval and 30-minute virtual card access. Explore the step-by-step guide in our How Does Yendo Work? section.

How does Yendo compare to other vehicle-secured credit cards?

Yendo offers higher limits and no cash deposits compared to traditional secured cards, plus lower APRs than title loans. See the comparison in our Yendo vs. Other Vehicle-Secured Credit Cards section.

Why should I choose the Yendo credit card in 2025?

Yendo provides cost savings, credit-building, and fast approval, making it ideal for bad credit users. Calculate your savings and learn more in our Why Choose the Yendo Credit Card in 2025? section.

What is the Yendo credit card and how can it help?

Yendo is a vehicle-secured credit card offering up to $10K with no credit check, helping bad credit users rebuild credit. Get started in our What Is the Yendo Credit Card? section.

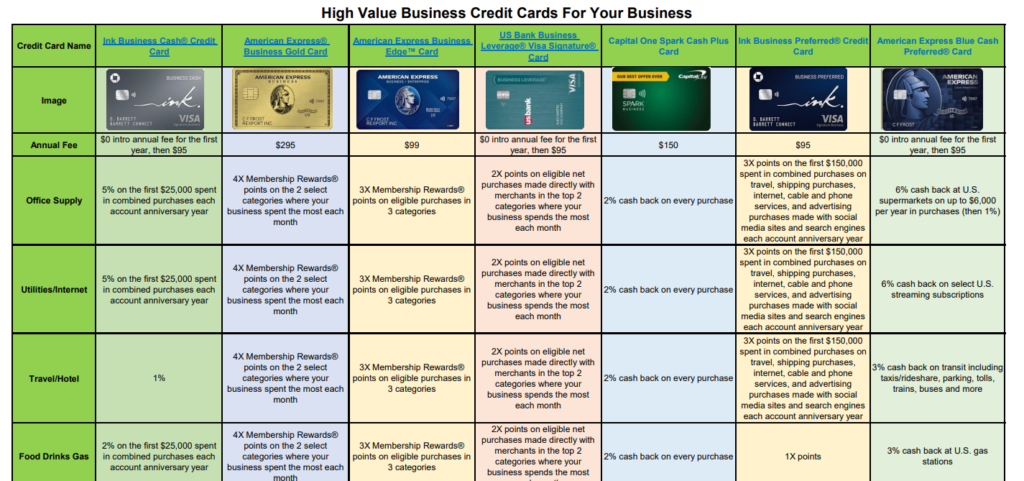

Looking For Other Credit Card Options?

Are you looking for other credit card options? Check out our comprehensive credit card guide for young adults. It provides a detailed guide on selecting the best credit cards for young adults, emphasizing options that help build credit, offer cash back or rewards, and have low fees. For more options tailored to bad credit, see our post Best Credit Cards for Young Adults with Bad Credit in 2025. These resources highlight the best cards, detailing their pros and cons, what to look for in a credit card, budgeting tips, security features, and the impact of credit cards on credit scores to help you make informed financial decisions.

NO CREDIT CHECK! Fast Pre-Approval! See How Thousands Are Using Their Car to get Up To $10K

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

Bad credit? No credit? No problem.

Use your car’s value to unlock a credit line up to $10,000.

No hard credit check required.

Rebuild your credit and get the financial freedom you deserve.

If you’ve been denied for credit cards or loans because of your credit score, you’re not alone. Millions of Americans face the same struggle every day. But what if your car could be the key to unlocking the credit you need – without the stress of rejection or high interest loans? With a Yendo Credit Card, it can. And the best part? It only takes a few minutes to find out how much your car could unlock for you.

Want to learn more about the Yendo Credit Card and what people are saying about it? Read our comprehensive Yendo Reviews 2025: Is the Yendo Credit Card Legit for Bad Credit?

Are you:

Tired of being turned down for credit cards because of your credit score?

Struggling to find a way to rebuild your credit without sky high fees?

Worried about wasting time on applications that lead nowhere?

Do you:

Need emergency funds but don’t want to risk losing your car?

But what if there was a way to turn your car’s value into the credit you need – without the stress of rejection or high-interest loans?

Curious how much your car could be worth? Use our easy tool to estimate your equity and potential credit limit in seconds!

How Much Credit Could Your Car Unlock? Check Now and Get Up To $10K!

Evaluation Result:

Disclaimer: This tool provides an estimated value based on the inputs provided. Actual market value may vary.

Click on this link to go to Yendo, where you can get an exact valuation of your vehicle’s borrowing power and learn about the Yendo Credit Card .

Let Yendo Turn Your Car Into a Financial Lifeline!

The Yendo Credit Card is different.

Instead of relying on your credit score, it uses the equity in your car to secure a credit line up to $10,000.

No hard credit check.

No rejection.

Just fast, affordable access to the funds you need - while keeping your car and rebuilding your credit.

Want to learn more about Yendo before applying? Check out my Yendo reviews for 2025.

Get Your Credit Line in 3 Easy Steps—No Paperwork, No Waiting

“Worried it’ll take weeks or require stacks of documents? With Yendo, it’s faster and easier than you think. Here’s how it works:

✅ No appointments ✅ No credit score required ✅ Keep driving your car

🔍 1. Check Your Car’s Equity

“See how much your car is worth in seconds—no commitment.”

📝 2. Apply Online

“Fill out a quick application with no hard credit check.”

✅ 3. Get Approved

“Receive a credit line up to 80% of your car’s value.”

💳 4. Use Your Card

“Shop, pay bills, or handle emergencies—anywhere Visa® is accepted.”

Ready to get started?

Check your eligibility now - it’s fast, free, and won’t affect your credit score!

Yendo Just Raised $165 Million - Join Thousands Already Securing Their Financial Freedom

Yendo’s innovative approach has attracted $165 million in funding from top investors, fueling its mission to help car owners like you unlock financial freedom. With rapid growth and thousands already benefiting, Yendo is expanding access to even more people.

Don’t miss your chance to be part of this growing movement. Apply today before demand surges and approval criteria tighten!

Click Here To: → Check Your Eligibility Now

Act Now Because Spots Are Limited!

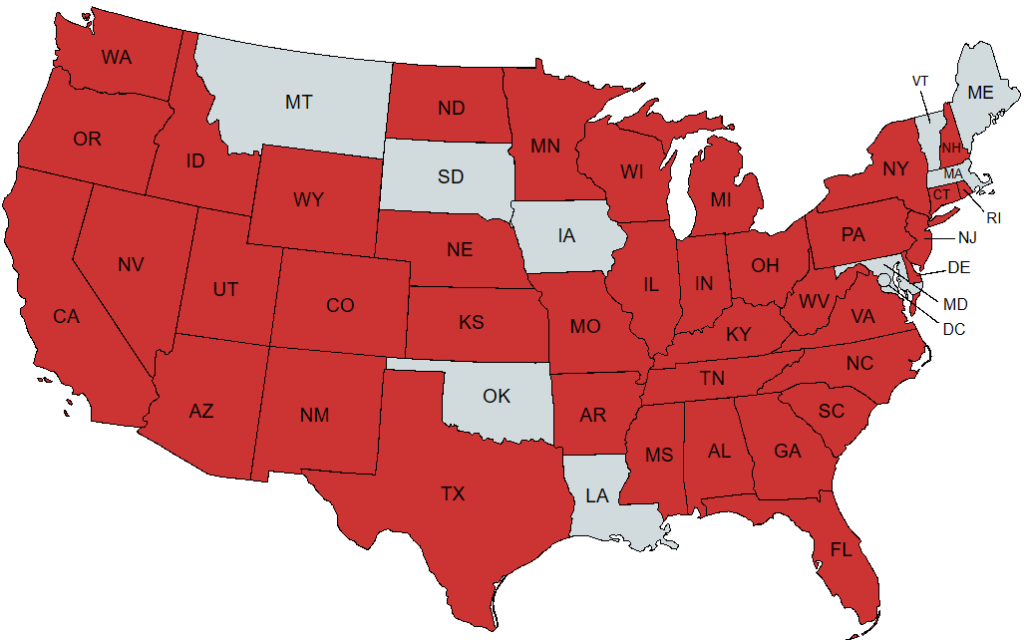

Yendo is currently available in 38 states, and spots are filling up fast. Apply now to secure your place before eligibility changes!

Did you know that early applicants may be more likely to qualify for higher credit limits with the Yendo Credit Card as Yendo grows. Don’t wait—your car’s value could unlock even more opportunities!

Available States:

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, Wisconsin, Wyoming.

Don’t wait—Check Your Eligibility Today!

Join Thousands Who’ve Transformed Their Finances with Yendo

You’re not alone. Thousands of people just like you—facing bad credit, no credit, or financial emergencies—have turned to Yendo to unlock the credit they need. And they’re not just getting approved; they’re rebuilding their credit, paying off debt, and taking control of their financial futures.

Here’s what some of them have to say:

"...it's been a great opportunity for me to build some credit, as well as pay some bills"- Jason

Click here to see the full review.

"I love the fact that I can make payments through Apple Pay. I can make payments through my bank accounts, and it’s very convenient. "- Khary

Click here to see the full review.

"It was super easy, you can do everything online, on the app, on your phone." - Wendy

Click here to see the full review.

The Yendo Credit Card has helped countless people improve their financial situation with quick approval, credit-building features, and no cash deposit requirements. Check out more Yendo reviews from satisfied customers to see how this card can benefit you.

Your Questions, Answered

We know trying something new can feel overwhelming, especially when it comes to your finances. That’s why we’ve included the most common questions about the Yendo Credit Card and Yendo reviews to put your mind at ease. Whether you’re worried about payments, building credit, or keeping your car, we’ve got you covered.

Here’s everything you need to know:

Yendo Credit Card FAQs

Want to learn more about the Yendo Credit Card’s features and benefits? Check out our in-depth review: Yendo Credit Card: Best Vehicle Secured Credit Card.

Ready to Take Control of Your Finances?

Check your eligibility now—it’s fast, free, and won’t affect your credit score! Here’s how easy it is to get started:

[Get Started]: → Check Your Eligibility Now

Early Applicants and the Best Benefits

Did you know? Early applicants may be more likely to qualify for higher credit limits as Yendo grows. By applying now, you’re not just securing a credit line—you’re positioning yourself for future financial flexibility. Don’t wait—your car’s value could unlock even more opportunities!

The types of vehicles allowed to apply include:

- Card

- Light Duty Trucks

- vans

- Sport Utility Vehicles (SUVs)

Click Here To: → Secure Your Position Today

Don’t Let Bad Credit Hold You Back

Use your car’s value to unlock the financial freedom you deserve with the Yendo Credit Card. Apply now—it only takes 2 minutes!

Apply Now & Check Your Eligibility

Use Your Car’s Value to Unlock The Financial Freedom You Deserve.

Remember, pre-approval takes just 2 minutes and won’t affect your credit score. Don’t wait—your car could be the key to a brighter financial future.

Yendo Credit Card: Best Vehicle Secured Credit Card ($4,400 average credit limit – up to $10,000)

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

Looking for a credit card that offers high limits and affordable rates, even if you have bad credit or limited funds? The Yendo Credit Card is the first credit card that uses your vehicle’s equity to secure higher limits at better rates and terms than traditional title loans or secured credit cards. Yendo Credit Cards have credit lines ranging from $450 up to $10,000, with the average being $4,400 in available credit. By far, it’s designed to be the best credit card to rebuild credit with. As one of the top rebuilding credit cards with no deposit, it provides a unique solution for those looking to improve their credit without needing an upfront cash deposit.

To see what real users are saying about their experiences with Yendo, check out our comprehensive Yendo Reviews for 2025.

Title loans and secured credit cards require excessive fees, taking possession of your vehicle, a large upfront security deposit and a good credit score.

Yendo eliminates the need for excessive fees and allows you to keep using your car while leveraging its equity to secure credit.

For those struggling with a bad credit score, Yendo’s innovative approval approach is a a game-changer because it looks at several criteria, instead of your credit score.

This creates a faster, more “accessible-to-all” method for obtaining approval and beginning to build or rebuild credit.

Side Note: According to the NerdWallet article 5 Things to Know About the Yendo Credit Card, “The Yendo card isn’t the only asset-secured credit card on the market, but it may be one of the only ones specifically tailored for automobile owners.“