Best Credit Cards for Young Adults with Bad Credit in 2025

Introduction to the Best Credit Cards for Young Adults in 2025

Are you a young adult struggling with bad credit and searching for the best credit cards for young adults in 2025? If so, you’re not alone. Many young adults face challenges building credit due to limited credit history or past financial mistakes, making bad credit credit cards a popular solution.

In fact, certain credit cards for young adults wonderful offer opportunities to rebuild credit without strict requirements. In this guide, I’ll explore the top credit cards for young adults, including options like the Yendo Credit Card, secured cards like OpenSky, and student cards. Moreover, by the end, you’ll know which card best suits your needs to start your credit-building journey. If you’re looking for even more options, check out our comprehensive credit card guide for young adults for a broader overview.

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

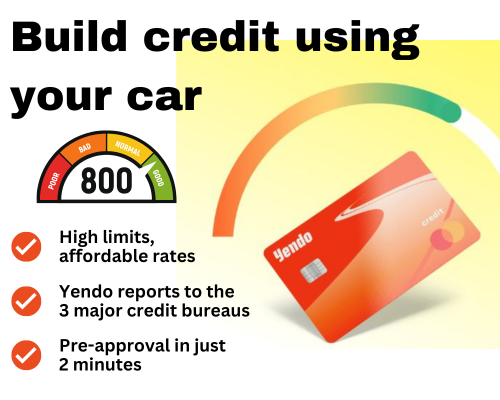

1. Yendo Credit Card: Best for No Credit Check and Higher Limits

If you’re looking for the best credit cards for young adults with bad credit, the Yendo Credit Card stands out as a top choice in 2025. Unlike traditional secured cards, Yendo uses your vehicle title as collateral instead of a cash deposit, making it ideal for young adults who may not have extra cash on hand. For example, if your car is worth $10,000, you could qualify for a credit limit between $450 and $10,000—much higher than many secured cards.

If you want to learn more about the Yendo Credit Card, click the link to read our in-depth Yendo Reviews for 2025 blogpost.

Pros of the Yendo Credit Card for Young Adults

- No credit check required, perfect for bad credit.

- Reports to all three major credit bureaus (Experian, Equifax, TransUnion), helping you build credit with on-time payments.

- Higher credit limits based on your vehicle’s value.

Cons of the Yendo Credit Card for Young Adults

- Timely payments are important to avoid any risk of repossession.

- Comes with a 29.88% APR and a $40 annual fee.

In truth, Yendo is particularly appealing for young adults needing a higher credit limit without a cash deposit, offering flexibility to cover expenses like textbooks or emergencies. Additionally, its credit-building potential makes it a solid long-term option.

For a comprehensive review, check out my Yendo reviews for 2025 or apply now.

2. OpenSky Secured Visa: Best Credit Card for Young Adults with Low Fees

Moreover, another excellent option among credit cards for young adults with bad credit is the OpenSky Secured Visa. In truth, this card requires a cash deposit as collateral (starting at $200), which becomes your credit limit. However, it is a great choice for those who don’t want to use a vehicle title as collateral.

Pros of the OpenSky Secured Visa for Credit Building

- No credit check, making it accessible for bad credit.

- Low annual fee of $35.

- Reports to all three credit bureaus, aiding credit building.

Cons of the OpenSky Secured Visa for Credit Building

- Requires a cash deposit, which as a result, can be tough for cash-strapped young adults.

- No rewards program, unlike some student cards.

OpenSky is a safer bet if you’re worried about repossession risks with Yendo. For instance, a $200 deposit gets you a $200 credit limit, offering a controlled way to build credit. Learn more about secured cards at Experian’s guide on secured cards.

3. Discover it® Student Cash Back: Best for Students with Some Credit

While not specifically for bad credit, the Discover it® Student Cash Back card is worth considering among good credit cards for young adults who are students and have at least some credit history. In fact, Discover often accepts applicants with limited credit, making it a viable option for young adults transitioning from bad credit.

Pros of the Discover it® Student Cash Back for Young Adults

- 5% cash back on rotating categories (up to $1,500 per quarter, then 1%) and 1% on other purchases.

- No annual fee, which therefore is budget-friendly for students.

- First-year cashback match, thus doubling your rewards.

Cons of the Discover it® Student Cash Back for Young Adults

- Requires a credit check, which may result in denial for very bad credit.

- Rewards require activation each quarter, which can be inconvenient.

Therefore, this card is best for young adults who are students and can handle a credit check. For example, earning 5% cash back on dining can help with social expenses, while the first-year match adds extra value. However, if your credit is too poor, you might need to start with Yendo or OpenSky first.

4. Capital One Platinum Secured Credit Card: Best for Potential Upgrades

The Capital One Platinum Secured Credit Card is another strong contender for good credit cards for young adults with bad credit, especially those looking for a path to an unsecured card. In fact, like OpenSky, it requires a cash deposit (as low as $49 for a $200 credit limit), but Capital One offers potential upgrades to unsecured cards after responsible use.

Pros of the Capital One Platinum Secured Credit Card for Credit Building in 2025

- Low deposit requirement ($49–$200 for a $200 credit limit).

- No annual fee, which as a result, will save you money.

- Opportunity to upgrade to an unsecured card after 6 months of on-time payments.

Cons of the Capital One Platinum Secured Credit Card for Credit Building in 2025

- No rewards, which might disappoint young adults looking for perks.

- Requires a credit check, though Capital One is lenient with bad credit.

In truth, this card suits young adults who want a path to an unsecured card without annual fees. Additionally, its low deposit makes it accessible if you’re short on cash but still want to build credit responsibly.

Comparing Credit Cards for Young Adults: Which Is Right for You?

So, choosing the best credit cards for young adults depends on your priorities. If you need a card with no credit check and higher limits, Yendo is ideal, especially if you own a vehicle—learn more by comparing Yendo to other no credit check credit cards in 2025. For instance, a $5,000 vehicle might get you a $2,500 credit limit with Yendo, compared to OpenSky’s $200 limit for the same deposit. On the other hand, OpenSky and Capital One are better if you prefer a cash deposit over vehicle collateral, offering lower fees and potential upgrades. Meanwhile, the Discover it® Student Cash Back card suits students with some credit history who want rewards.

Here’s a quick comparison:

- Yendo: Best for no credit check, $450–$10,000 (with vehicle title).

- OpenSky: Best for low fees, no rewards; but requires a deposit.

- Discover it® Student: Best for rewards, students; but requires a credit check.

- Capital One Platinum Secured: Best for upgrades, but low deposit; no rewards.

| Card Name | Credit Check | Annual Fee | Rewards | Credit Limit/Deposit |

|---|---|---|---|---|

| Yendo Credit Card | No | $40 | No | $450–$10,000 (vehicle title) |

| OpenSky Secured Visa | No | $35 | No | $200+ (cash deposit) |

| Discover it® Student Cash Back | Yes | $0 | Yes (5% cash back on rotating categories) | Varies (based on credit) |

| Capital One Platinum Secured | Yes (lenient) | $0 | No | $200+ ($49–$200 deposit) |

Looking for the best credit cards to build your credit in 2025, even with bad credit? Check out this video to learn about options that let you keep your car and boost your credit fast, including the Yendo Credit Card.

Final Thoughts: Start Building Credit Today in 2025

In conclusion, finding the best credit cards for young adults with bad credit in 2025 is easier than ever with options like Yendo, OpenSky, Discover, and Capital One. The Yendo Credit Card stands out as one of the best bad credit credit cards. Its no credit check policy and higher credit limits make it a top pick for young adults needing flexibility.

Hi, my name is Austin and I’ve recently started using Yendo… I fell on some hard times and they were here to help… I truly love it, and they’re there to help you when you need it. They’re willing to work with you if you fall behind on the payments, and that’s great. I encourage everybody to use it. Click here to see the full review.

Inspired by Austin’s experience? Take the first step toward building your credit with Yendo today!

For a comprehensive review of Yendo, click on the link and check out my Yendo reviews for 2025 blogpost.

If you have bad credit and need to improve it, click on this link for a complete step-by-step guide How to Improve Your Bad Credit Score in 2025

However, secured cards like OpenSky and Capital One offer other alternatives if you’re not sure about using your vehicle as collateral. For students with some credit, Discover’s rewards make it a compelling choice.

Moreover, feel free to explore these cards for credit building 2025 goals and start improving your credit today! Have you tried any of these cards? Share your experience in the comments below.

Refer friends, earn cash—sign up now! https://shorturl.fm/vSgFl

Drive sales, earn commissions—apply now! https://shorturl.fm/8Uj6M

Refer friends, earn cash—sign up now! https://shorturl.fm/vUpME

Tap into unlimited earning potential—become our affiliate partner! https://shorturl.fm/gjTsG

Join our affiliate community and maximize your profits! https://shorturl.fm/JUBwj

Earn passive income with every click—sign up today! https://shorturl.fm/7QSrB

Start earning passive income—become our affiliate partner! https://shorturl.fm/FrINw

Refer friends, collect commissions—sign up now! https://shorturl.fm/rSk9d

Share your unique link and cash in—join now! https://shorturl.fm/8xO22

Be rewarded for every click—join our affiliate program today! https://shorturl.fm/p49uz

Invite your network, boost your income—sign up for our affiliate program now! https://shorturl.fm/5J7pz

Join forces with us and profit from every click! https://shorturl.fm/sO605

Tap into unlimited earnings—sign up for our affiliate program! https://shorturl.fm/ROjUt

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/eSdnY

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/mkHOh

Earn passive income this month—become an affiliate partner and get paid! https://shorturl.fm/T8rWs

Share our products and watch your earnings grow—join our affiliate program! https://shorturl.fm/mY5wy

Promote our brand and get paid—enroll in our affiliate program! https://shorturl.fm/1PurE

Tap into a new revenue stream—become an affiliate partner! https://shorturl.fm/kAZ33

Monetize your audience—become an affiliate partner now! https://shorturl.fm/8eDI1

Promote our brand, reap the rewards—apply to our affiliate program today! https://shorturl.fm/AiQn2

Join our affiliate community and earn more—register now! https://shorturl.fm/XZb0O

Partner with us and earn recurring commissions—join the affiliate program! https://shorturl.fm/bscvc

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/oBHsb

Start earning every time someone clicks—join now! https://shorturl.fm/W7a0W

yrg47a

Join our affiliate community and start earning instantly! https://shorturl.fm/BRJYw

Share our offers and watch your wallet grow—become an affiliate! https://shorturl.fm/jbf1t

Refer and earn up to 50% commission—join now! https://shorturl.fm/woU0p

Become our partner and turn clicks into cash—join the affiliate program today! https://shorturl.fm/feCpe

Refer customers, collect commissions—join our affiliate program! https://shorturl.fm/91I0F

Share our products and watch your earnings grow—join our affiliate program! https://shorturl.fm/J19tk

Sign up and turn your connections into cash—join our affiliate program! https://shorturl.fm/I69jV

Become our affiliate and watch your wallet grow—apply now! https://shorturl.fm/jeK6Q

Share our products and watch your earnings grow—join our affiliate program! https://shorturl.fm/uFs3I

Maximize your earnings with top-tier offers—apply now! https://shorturl.fm/y26wn

https://shorturl.fm/WqUy9

https://shorturl.fm/M0wu5

https://shorturl.fm/UTAqE

https://shorturl.fm/xQf89

https://shorturl.fm/6N3KT

https://shorturl.fm/8OW4O

https://shorturl.fm/AV6R5

https://shorturl.fm/oMgUy

https://shorturl.fm/Z9ZBy

https://shorturl.fm/qVYlt

https://shorturl.fm/rcnPX

https://shorturl.fm/Upncc

https://shorturl.fm/tLCif

https://shorturl.fm/Y1J1Y

https://shorturl.fm/arthD

https://shorturl.fm/C0hEZ

https://shorturl.fm/9IZBw

https://shorturl.fm/sOwN4

https://shorturl.fm/yvoYa

https://shorturl.fm/gKJju

https://shorturl.fm/X8iA7

https://shorturl.fm/fKMka

https://shorturl.fm/aiezY

https://shorturl.fm/bN40P

https://shorturl.fm/MPfYk

https://shorturl.fm/myHra

https://shorturl.fm/Xlzqo

https://shorturl.fm/1Riu8

https://shorturl.fm/uDvex

https://shorturl.fm/mISc1

https://shorturl.fm/Pn3gF

https://shorturl.fm/h4x55

https://shorturl.fm/PnImV

https://shorturl.fm/LscNR

https://shorturl.fm/jzEdK

https://shorturl.fm/rr2v0

https://shorturl.fm/x3KYa

https://shorturl.fm/n0rlP

https://shorturl.fm/DMNW3

https://shorturl.fm/qqf35

https://shorturl.fm/Hu66W

https://shorturl.fm/b5ozc

https://shorturl.fm/SaPpL

pgenpojsrqgspwsetpdztqqnfketke

https://shorturl.fm/mAOt2

https://shorturl.fm/1jJgE

https://shorturl.fm/Gg3yo

https://shorturl.fm/nkB37

hpr12d

k1sgmn

https://shorturl.fm/MdiFJ

https://shorturl.fm/oXlpo

https://shorturl.fm/JtdvM

https://shorturl.fm/zK8mh

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but instead of that this is excellent blog A fantastic read Ill certainly be back

Hi my family member I want to say that this post is awesome nice written and come with approximately all significant infos I would like to peer extra posts like this

p9m9k8

https://shorturl.fm/UdELt

https://shorturl.fm/IlSSw

https://shorturl.fm/VcauY

I’ve been following your blog for quite some time now, and I’m continually impressed by the quality of your content. Your ability to blend information with entertainment is truly commendable.

Your writing has a way of resonating with me on a deep level. I appreciate the honesty and authenticity you bring to every post. Thank you for sharing your journey with us.

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my trouble You are amazing Thanks

Great article, thank you for sharing these insights! I’ve tested many methods for building backlinks, and what really worked for me was using AI-powered automation. With us, we can scale link building in a safe and efficient way. It’s amazing to see how much time this saves compared to manual outreach. https://seoexpertebamberg.de/

https://shorturl.fm/hHjOn

n0222p

https://shorturl.fm/OjlQY

https://shorturl.fm/Z4Lcw

Great article! I really appreciate the clear insights you shared – it shows true expertise. As someone working in this field, I see the importance of strong web presence every day. That’s exactly what I do at https://webdesignfreelancerhamburg.de/ where I help businesses in Hamburg with modern, conversion-focused web design. Thanks for the valuable content!

https://shorturl.fm/RitT9

https://shorturl.fm/UPa2U

https://shorturl.fm/jfGP1

https://shorturl.fm/k2hCl

https://shorturl.fm/gCmlY

I do trust all the ideas youve presented in your post They are really convincing and will definitely work Nonetheless the posts are too short for newbies May just you please lengthen them a bit from next time Thank you for the post

https://shorturl.fm/CuO5P

https://shorturl.fm/EIOHu

https://shorturl.fm/b3z26

https://shorturl.fm/uTDDQ

Really insightful post — Your article is very clearly written, i enjoyed reading it, can i ask you a question? you can also checkout this newbies in seo. thank you

as a professional seo expert in hamburg, i can tell your article is professionally written, i enjoy reading it, keep up the good work, do you post more often ? i am now a follower, you can take a look at my site as the best seo expert in hamburg https://seoexpertehamburg.de/ Thank you

i really enjoyed your article, keep it like that, google will love it and rank it high, i am now a follower, my site https://topseofreelancerberlin.de/ the best seo freelancer in berlin and germany, check it out

such an indepth and professional article, i enjoy it, you can visit my page, the best webdesign agency in dortmund Germany https://webdesignagenturdortmund.de/ top webdesigners. Thank you

I really enjoy reading this article, such an excellent piece, continue the good work, do you post often? you just got a fun from the eiffel tower paris. we are the best guide for paris eiffel tower. visit our site at https://eiffeltower-ticketparis.com/. thank you hope to hear from you.