Is Yendo Credit Card a Scam? Addressing Your Concerns in 2025

Are you wondering, is Yendo legit? If you’re researching the Yendo Credit Card in 2025, you might have concerns about its legitimacy. After all, a credit card secured by your vehicle title sounds unconventional, and skepticism is natural. Yendo reviews often highlight its benefits. But some users worry: Is Yendo Credit Card legit, or is it a scam?

In this FAQ-style guide, I’ll address your top concerns. Such as “What happens if I miss a payment?”. And “How does Yendo protect my car title?”. By the end, you’ll have a clear picture of whether Yendo is a trustworthy option for your financial needs in 2025.

Disclosure: This post contains affiliate links, and I may earn a commission. If you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

What Is the Yendo Credit Card?

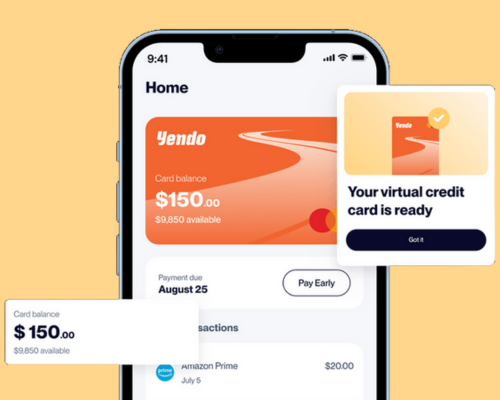

First, let’s clarify what Yendo is. The Yendo Credit Card, issued by Cross River Bank, who is a member of the FDIC (Federal Deposit Insurance Corporation). It is a secured credit card that uses your vehicle title as collateral instead of a cash deposit. This means you can access credit limits from $450 to $10,000 based on your car’s value, without a credit check. For example, if your vehicle is worth $10,000, you might qualify for a higher credit limit than with traditional secured cards. However, this unique approach raises questions about its legitimacy, which I’ll address below.

Is Yendo Legit or a Scam? Examining the Evidence

Let’s tackle the big question: Is Yendo legit? The short answer is yes, Yendo is a legitimate fintech company. Founded in 2022 in Dallas, Texas, Yendo has a B+ rating from the Better Business Bureau (BBB). This indicates a solid track record for a company of its age. Additionally, Yendo has raised $165 million in funding. This includes $150 million in debt financing from i80 Group and $15 million in equity from strategic investors. As reported by Fintech Futures.com in May of 2024. This significant investment signals confidence from financial institutions in Yendo’s business model.

With this strong financial backing, Yendo proves it’s a legitimate option for those seeking a secured credit card. Ready to explore Yendo for yourself? Apply now.

Moreover, Yendo is partnered with Mastercard. It offers a real credit card that reports to all three major credit bureaus—Experian, Equifax, and TransUnion. This helps users build credit, a feature not typically associated with scams. However, some negative reviews on platforms like Trustpilot (average 3.2 stars) mention issues like application glitches or low credit limit. This can fuel skepticism. For instance, one user complained about a $450 credit limit despite a $10,000 vehicle value. However others praise Yendo’s quick approval process. These mixed experiences are common for new fintechs and don’t indicate a scam.

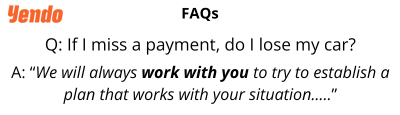

What Happens If I Miss a Payment with Yendo?

A common concern is, What happens if I miss a payment? Since Yendo uses your vehicle as collateral, the stakes feel high. If you miss a payment, Yendo may charge a late fee (up to $40, per their terms), and your account could be flagged as delinquent. After several missed payments—typically three months, according to some user reports on Reddit—Yendo may initiate repossession of your vehicle as a last resort to recover the outstanding balance. However, Yendo emphasizes that repossession is not their goal, as they lose money on each repossession, and they work with users to create payment plans to avoid this outcome.

For example, a Trustpilot reviewer noted that Yendo threatened repossession over a $50 past-due balance, but this was after multiple missed payments and lack of communication. To avoid this, make at least the minimum payment (1% of your balance or $50, whichever is greater) within 25 days of your statement. Additionally, Yendo’s app allows you to track payments and set reminders, helping you stay on top of your obligations.

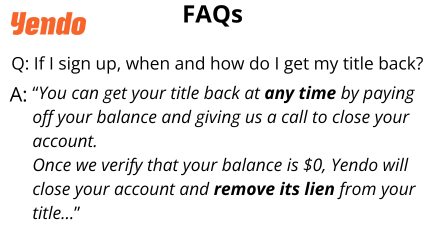

How Does Yendo Protect My Car Title? Is Yendo Legit?

Another frequent question is, How does Yendo protect my car title? When you’re approved, you send your vehicle title to Yendo via FedEx (at their expense). Until the title is received, you get access to 40% of your credit limit (up to $1,500) via a virtual card. Once Yendo receives the title, they become a lienholder, but you retain ownership and can still use your car. Yendo stores your title securely, and their app includes fraud protection features like virtual card numbers for online purchases, reducing the risk of unauthorized use.

If you pay off your balance and close your account, Yendo returns your title. However, some users on the Yendo App Store page reported delays in account unblocking after sending their title, which caused frustration. For instance, one user waited from April to July 2024 for their account to be unblocked, though Yendo eventually resolved the issue. While these hiccups exist, Yendo’s processes are designed to protect your title, and their customer support team is available to address concerns.

Is Yendo Credit Card Legit for Building Credit?

Yes, the Yendo Credit Card is a legitimate tool for building credit. Because Yendo reports all account activity to the major credit bureaus, on-time payments can improve your credit score over time. For example, a Trustpilot user shared, “I’ve been making on-time payments, and my credit line increased!” This credit-building feature is a key benefit for those with bad credit, especially since Yendo doesn’t require a credit check for pre-approval. However, be mindful of the 29.88% APR and $40 annual fee, which can add up if you carry a balance.

What Are the Risks of Using Yendo?

While Yendo is legit, it’s not risk-free. The biggest risk is repossession if you default on payments, as your car is collateral. Additionally, the high APR (29.88%) and annual fee ($40) make it more expensive than some secured cards that offer rewards or no fees—compare Yendo to other no credit check credit cards in 2025 to explore alternatives. Some users also report application issues, like delays or denials despite Yendo’s claim of no credit check, often due to insufficient credit history or vehicle ineligibility (e.g., cars older than 1996 don’t qualify). Therefore, weigh these risks against the benefits, especially if you’re prone to missing payments.

Want a Deeper Dive into Yendo?

If you’re still curious about Yendo, I’ve got you covered. For a comprehensive review of Yendo, including detailed user experiences and comparisons, check out my Yendo reviews for 2025 blogpost or apply now.

Final Thoughts: Is Yendo Legit and Right for You in 2025?

In conclusion, Yendo is not a scam—it’s a legitimate option for those with bad credit seeking a no credit check credit card. Its $165 million in funding, BBB rating, and partnership with Mastercard provide reassurance, though risks like repossession and high fees require careful consideration.

When I first got it,or when I was first getting it, I kind of didn’t know if it was like real or not… But I’m happy to say I got it. I’m glad I did… I definitely recommend it…Let me be the person to tell you it’s legit. Get it.

Click here to see the full review.

Joseph’s experience confirms Yendo’s legitimacy—ready to take the next step?

Convinced Yendo is legit? Apply for the Yendo Credit Card now to start building credit!

Apply for the Yendo Credit Card now to start building credit!

Looking for more credit card options to build your credit? Check out our guide on the best credit cards for young adults with bad credit in 2025 to explore alternatives like OpenSky and Capital One!

By addressing concerns like payment risks and title security, I hope this guide has clarified whether Yendo fits your needs. Have you tried Yendo? Share your experience in the comments below!

Monetize your audience—become an affiliate partner now! https://shorturl.fm/NFyC2

Start earning every time someone clicks—join now! https://shorturl.fm/r9gQ0

Be rewarded for every click—join our affiliate program today! https://shorturl.fm/NF5MF

Earn recurring commissions with each referral—enroll today! https://shorturl.fm/t5lRR

Start sharing, start earning—become our affiliate today! https://shorturl.fm/NY8av

Join our affiliate community and maximize your profits! https://shorturl.fm/JUBwj

Start earning on autopilot—become our affiliate partner! https://shorturl.fm/FwOUa

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/ubVIr

Start earning passive income—become our affiliate partner! https://shorturl.fm/Wl5jo

Unlock exclusive affiliate perks—register now! https://shorturl.fm/EbAL2

Start profiting from your traffic—sign up today! https://shorturl.fm/cJ9nN

Promote, refer, earn—join our affiliate program now! https://shorturl.fm/ejdaK

Join our affiliate program and start earning today—sign up now! https://shorturl.fm/44yDe

Earn recurring commissions with each referral—enroll today! https://shorturl.fm/vZ29k

Partner with us and enjoy recurring commission payouts! https://shorturl.fm/PefZe

Unlock top-tier commissions—become our affiliate partner now! https://shorturl.fm/OhlY6

Monetize your traffic with our affiliate program—sign up now! https://shorturl.fm/XNTFA

Become our affiliate—tap into unlimited earning potential! https://shorturl.fm/eQ29X

Promote our products and earn real money—apply today! https://shorturl.fm/SIbrt

Monetize your audience—become an affiliate partner now! https://shorturl.fm/8vUQa

Tap into unlimited earnings—sign up for our affiliate program! https://shorturl.fm/VUhIW

Start profiting from your traffic—sign up today! https://shorturl.fm/2frCx

Tap into unlimited earning potential—become our affiliate partner! https://shorturl.fm/x1Lil

Earn big by sharing our offers—become an affiliate today! https://shorturl.fm/nX1eK

Be rewarded for every click—join our affiliate program today! https://shorturl.fm/YkrBM

Join our affiliate community and maximize your profits—sign up now! https://shorturl.fm/QvgwE

Be rewarded for every click—join our affiliate program today! https://shorturl.fm/NqSSu

Get paid for every click—join our affiliate network now! https://shorturl.fm/nyXbU

Join our affiliate program today and earn generous commissions! https://shorturl.fm/lRFIO

Start sharing our link and start earning today! https://shorturl.fm/rsAaA

Turn referrals into revenue—sign up for our affiliate program today! https://shorturl.fm/lOuIt

Earn passive income with every click—sign up today! https://shorturl.fm/hjEMC

Unlock exclusive affiliate perks—register now! https://shorturl.fm/2AxVg

https://shorturl.fm/xySr4

https://shorturl.fm/s9eqz

https://shorturl.fm/Syv2r

https://shorturl.fm/y8FLP

https://shorturl.fm/ccQNl

https://shorturl.fm/oMgUy

https://shorturl.fm/8z1AV

https://shorturl.fm/iWRWQ

https://shorturl.fm/rWsEj

https://shorturl.fm/fyff5

https://shorturl.fm/o1sWq

https://shorturl.fm/E9Hvz

https://shorturl.fm/NFryl

https://shorturl.fm/2xsDo

https://shorturl.fm/Dn3C7

https://shorturl.fm/DpOgm

https://shorturl.fm/en63y

https://shorturl.fm/goDYb

https://shorturl.fm/LRU8b

https://shorturl.fm/AwTlw

https://shorturl.fm/1XZaw

https://shorturl.fm/FmnuU

https://shorturl.fm/1CJKZ

https://shorturl.fm/AV2X9

https://shorturl.fm/qpng3

https://shorturl.fm/1YisY

https://shorturl.fm/Izq6x

https://shorturl.fm/wjNkb

https://shorturl.fm/HoHK4

https://shorturl.fm/qLaWu

https://shorturl.fm/Vt0mK

https://shorturl.fm/SIEde

https://shorturl.fm/S1RKQ

https://shorturl.fm/wVheC

https://shorturl.fm/OKvAI

https://shorturl.fm/xZFI7

https://shorturl.fm/JpSF8

https://shorturl.fm/eECU5

https://shorturl.fm/CePwb

https://shorturl.fm/1ouU7

wqtjilfgytmgfytowkjfvzdyziiyqv

https://shorturl.fm/OJkeZ

https://shorturl.fm/0PVf5

I have been browsing online more than three hours today yet I never found any interesting article like yours It is pretty worth enough for me In my view if all website owners and bloggers made good content as you did the internet will be a lot more useful than ever before

https://shorturl.fm/bpJeF

https://shorturl.fm/J7WwJ

https://shorturl.fm/43xIO

I must say this article is extremely well written, insightful, and packed with valuable knowledge that shows the author’s deep expertise on the subject, and I truly appreciate the time and effort that has gone into creating such high-quality content because it is not only helpful but also inspiring for readers like me who are always looking for trustworthy resources online. Keep up the good work and write more. i am a follower. https://webdesignfreelancerfrankfurt.de/

https://shorturl.fm/IqyCI

Great article, thank you for sharing these insights! I’ve tested many methods for building backlinks, and what really worked for me was using AI-powered automation. With us, we can scale link building in a safe and efficient way. It’s amazing to see how much time this saves compared to manual outreach. https://seoexpertebamberg.de/

https://shorturl.fm/cxvJl

Really insightful post — Your article is very clearly written, i enjoyed reading it, can i ask you a question? you can also checkout this newbies in classied. iswap24.com. thank you

Really insightful post — Your article is very clearly written, i enjoyed reading it, can i ask you a question? you can also checkout this newbies in classied. iswap24.com. thank you

https://shorturl.fm/AYm7N