Yendo Credit Card: Best Vehicle Secured Credit Card ($4,400 average credit limit – up to $10,000)

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

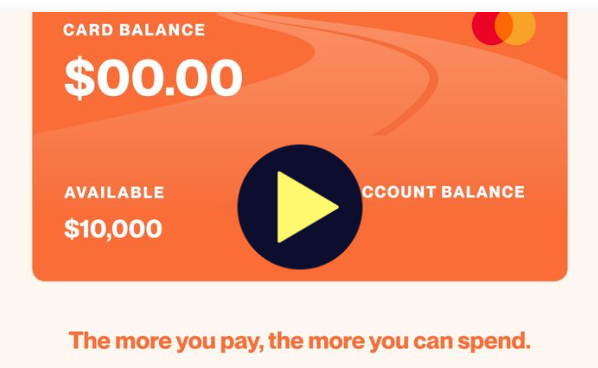

Looking for a credit card that offers high limits and affordable rates, even if you have bad credit or limited funds? The Yendo Credit Card is the first credit card that uses your vehicle’s equity to secure higher limits at better rates and terms than traditional title loans or secured credit cards. Yendo Credit Cards have credit lines ranging from $450 up to $10,000, with the average being $4,400 in available credit. By far, it’s designed to be the best credit card to rebuild credit with. As one of the top rebuilding credit cards with no deposit, it provides a unique solution for those looking to improve their credit without needing an upfront cash deposit.

To see what real users are saying about their experiences with Yendo, check out our comprehensive Yendo Reviews for 2025.

Title loans and secured credit cards require excessive fees, taking possession of your vehicle, a large upfront security deposit and a good credit score.

Yendo eliminates the need for excessive fees and allows you to keep using your car while leveraging its equity to secure credit.

For those struggling with a bad credit score, Yendo’s innovative approval approach is a a game-changer because it looks at several criteria, instead of your credit score.

This creates a faster, more “accessible-to-all” method for obtaining approval and beginning to build or rebuild credit.

Side Note: According to the NerdWallet article 5 Things to Know About the Yendo Credit Card, “The Yendo card isn’t the only asset-secured credit card on the market, but it may be one of the only ones specifically tailored for automobile owners.“

In this post, we’ll explore what Yendo is, how it works, its key features, and why it’s a smarter alternative to high-fee title loans and traditional secured cards for building or rebuilding your credit.

What is a Vehicle Secured Credit Card ?

A vehicle secured credit card is a type of credit line that uses the equity in your car to secure a higher credit limit, offering an alternative to traditional secured credit cards, which usually require a cash deposit. This approach leverages the value of an asset you already own your vehicle allowing you to access a credit line without needing to tie up cash or make an upfront payment.

The Yendo Credit Card is a vehicle secured credit card. It’s unique in this way by using your vehicle as collateral so it can offer higher credit limits and lower fees than typical secured cards. Importantly, you retain full ownership and use of your car while benefiting from its value as financial backing for the card.

With a vehicle secured credit card, you gain the flexibility of a regular credit card along with the opportunity to build or rebuild your credit, as payments are reported to the major credit bureaus. This makes it especially beneficial for those with less-than-perfect credit looking for an accessible way to establish or improve their credit history.

This video sums it up well…

Key Benefits of the Yendo Credit Card

- Your Vehicle’s Built-Up Equity as a Financial Lifeline: Instant access to the value of your car when you need money fast.

- High Credit Limit Credit Card: Ranging from $450 to $10,000, (with an average of $4,400) depending on your car’s value.

- Game-Changing Approval Approach: An approval process based on criteria and not your credit score.

- Fast Pre-Approval Process: Get pre-approved in 2 minutes with no impact on your credit score.

- Instant Access to Credit: Get instant credit access with your virtual credit card within minutes of your approval.

- No Cash Deposit Required: Rebuilding credit cards with no deposit use your car’s value instead of a cash deposit.

- Low Interest Rate: APR of 29.88%, far lower than typical title loan rates, which can reach up to 300%.

- Fast Cash Advance: Offers fast cash advances, allowing you to access funds quickly when needed.

- Customer Vehicle Ownership Mindset: Keep full ownership of your car while leveraging its equity.

- Credit Building: Reports to Experian, Equifax, and TransUnion, helping you build credit.

- Drastically Lower Your Monthly Payments: Pay $306 per month less by refinancing your car loan.

- Multiple Payment Options: Including bank transfers, online payments, and traditional methods like mailing checks and cash payments.

This Yendo customer was so appreciative of how Yendo helped her that she was quoted as saying: “[Yendo]…saved my life literally. I was able to pay off my high interest credit cards. “ Click here to see the full review.

Ready to take advantage of these great key benefits? Click here to start with Yendo today.

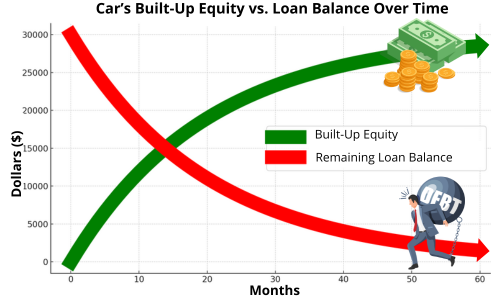

Using Your Built-Up Vehicle Equity as a Financial Lifeline

If you need money right away but don’t have cash on hand or available credit, Yendo allows you to tap into your built-up vehicle equity to immediately access the necessary funds. This is the value of your car that you’ve earned as you pay down your loan and your car retains or increases its worth. This provides a financial lifeline, giving you quick access to cash while keeping your car, allowing you to continue using it as normal. In a nut shell this approach helps you:

1.Leverage your vehicle’s worth for credit

2.Access necessary funds quickly

3.Keep and use your car as normal

4.Avoid the hassle of selling your vehicle

5.Tap into a financial lifeline when traditional options are limited

It’s an efficient and practical solution for people who need access to money quickly and need to keep their car as well.

Information on using your car’s equity, and ownership can be found and verified on Yendo’s how it works page, and FAQ page.

Yendo: The High Credit Limit Credit Card ($450 – $10,000)

The Yendo credit card is considered a high credit limit credit card because it offers credit limits between $450 and $10,000 with an average of $4,400 in credit. This is based on the make, model, mileage, condition of your vehicle, ownership status as well as your ability to make timely repayments. (Many secured credit cards offer only $200-$5000).

The types of vehicles allowed to apply include:

1.Cars

2.Light Duty Trucks

3.Vans

4.Sport Utility Vehicles (SUVs)

The vehicle itself must be 1996 or newer and be in working condition. Each credit line permits one vehicle. You must either own the vehicle outright or have sufficient equity in it. This service is also available to people who are still making payments on their vehicles.

Full details on vehicle eligibility, credit limits, and application criteria can be found and verified on Yendo’s FAQ page.

Vincent, a Yendo customer, was amazed at how high of a credit limit he received. He was quoted as saying: “My experience with them has been really good. I would highly recommend them. The credit limit is high.” Click here to see the full review.

Yendo’s generous limits make it a strong choice for anyone wanting to maximize their available credit. Give it a try. Click on the link to see how high your credit line can go with Yendo.

Game-Changing Approval Approach

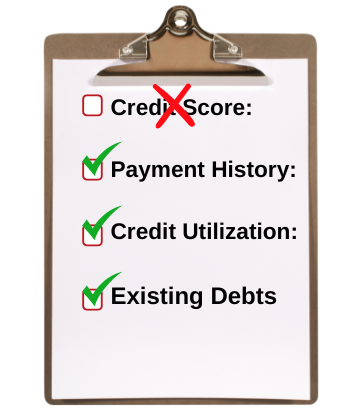

Yendo’s has a adopted game-changing approval approach when it comes to evaluating you as an applicant. The reason behind this is the company’s mission. Yendo’s mission “…is to offer affordable credit access to everyone”. They do not consider your credit score when evaluating your application for a credit card and all the benefits that come with it. It’s even displayed on their home page: “All credit scores welcome to apply”. It’s a more “accessible-to-all” way to get approved. They look at:

Your Vehicle’s:

- Make: Your car’s manufacturer: (Honda, Toyota, Ford, etc).

- Model: You car’s model: (Honda Accord, Toyota Corolla, etc).

- Year: The production year of your car.

- Mileage: The number of miles you have driven your car.

- Condition: The physical condition of your car including any wear and tear or damage.

- Equity: The difference between your car’s market value and any outstanding loans you still owe on it.

- Status of Ownership: If you own your car or have sufficient equity in it. This service also for people who are still making payments on their cars.

Your Credit History

Yendo reviews your credit history, and not your credit score. In your credit history they are looking for patterns of responsible financial behavior. Things like:

- Payment History: If you have been making your credit card payments on time.

- Credit Utilization: What percentage of your available credit you are using.

- Existing Debts: If you have a significant amount of outstanding debt or not.

Yendo typically approve people who have a pattern of being responsible financially, even if their credit score is not the greatest. This allows them to offer credit options to people whom other credit card companies may not consider.

Your Income and Expense Ratio

Yendo looks at your income and expenses to make sure you can handle the new payments without struggling. They want to confirm that your income is enough to cover your current bills and any payments for the Yendo card, so you don’t end up with more debt than you can manage.

Vehicle details, credit history information and income and expense can be found and verified on Yendo’s vehicle ID page, and the how-it-works page.

Candice, a Yendo customer, explains that her application was approved. She was quoted as saying: “…my credit was not the best and nobody else could give me a loan…But [with Yendo] I did get approved for it. “ Click here to see the full review.

Need some financial help, but you have less than perfect credit? Click here to get started with Yendo today!

Fast Pre-Approval Process

The Yendo credit card offers a fast and easy pre-approval process that takes just 2 minutes to complete, allowing you to be pre-approved without any impact on your credit score. This means that Yendo conducts a soft inquiry, which does not affect your credit rating. During pre-approval, Yendo assesses basic details about your vehicle and personal information to determine if you qualify for further steps.

This streamlined process provides users with immediate feedback and allows them to quickly move forward with their application, avoiding the long wait times and potential credit score hits typically associated with traditional credit card applications. Once approved, you can access your virtual credit card within 30 minutes, making Yendo a quick solution if you need fast credit.

Approval time and process details can be found and verified on Yendo’s home page, the how it works page, and the get pre-approved enrollment page.

This Yendo customer was very impressed with the speed of Yendo’s pre-approval and approval process. He was quoted as saying: “…in minutes I had my available credit sent to me…and I don’t even have a card yet…” Click here to see the full review.

Want quick access to your available credit? Click here to get started with Yendo today!

Your Virtual Card Provides Instant Access to Your Credit

Yendo’s virtual credit card offers several key advantages. Here are the ones I’ve found to be the most useful:

Instant Access To Your Money

You’ll gain instant access to a portion of your credit line with a virtual credit card that Yendo will assign to you about an hour after you complete your application and mail in your title. You can use your virtual credit card to access your credit and start making purchases immediately. You can use it online or with Apple Pay, Samsung Pay, or even Google Pay. The company will send your physical credit card to you by mail in about 3-7 days after that.

Extra Layer of Protection

The virtual card adds an extra layer of protection against fraud. It does this by assigning the card a temporary and unique card number instead of your actual credit card number. In this way you wont be sharing your actual credit card number when making purchases, . This is especially useful for online transactions where data breaches can be a concern.

Seamless Mobile Integration

Yendo integrates its virtual card with their mobile app, enabling you to manage your accounts properly, track and better control your spending, and make payments on the go, no matter where you are.

- Manage your account: At any time, you can log in review your account balance. You can see your most recent transactions, and track your overall credit usage in real time. This allows you to better control your finances.

- Track your spending: The Yendo app is set up to track your spending habits. This is a huge help when trying to build or rebuild your credit. If you know where your money is going, you are in a better position to stay on budget.

- Make payments on the go: The mobile app, makes the payment process super simple. As easy as accessing your phone. Whatever the payment, the apps makes the process efficient and effortless. It can be done anytime, anywhere, without the hassle of visiting your bank or having logging in to your computer.

This intergration offers a major benefit for users who require quick, secure and convenient access to their funds at any time and from any location.

Yendo’s vertual credit card key advantages can be found and verified on the Yendo vitual credit card page, the credit building page and the app page.

Melissa, a Yendo customer, was amazed at how quickly she got her money. She was quoted as saying: “The process was super fast, and they gave me part of the money upfront until they got my title, and then I got the rest of the money…” Click here to see the full review.

Want instant access to your credit? Click here to get started with Yendo today!

Rebuilding Credit Cards with No Deposit: Yendo vs. Traditional Secured Credit Cards

How Yendo Works:

Instead of requiring a traditional cash deposit, Yendo is one of the top rebuilding credit cards with no deposit required. It uses the equity in your vehicle as collateral to secure your credit line. This allows you to access a higher credit limit without needing to put down any upfront money, offering financial flexibility even if you don’t have liquid funds readily available.

Yendo prides itself on providing customers with this flexibility, offering a reliable safety net to fall back on when needed. By leveraging your car’s value, Yendo ensures a more accessible and secure solution compared to cash-secured cards, allowing you to retain your savings while still accessing the credit you need.

Traditional Secured Credit Cards:

In contrast, most secured credit cards require a cash deposit that typically becomes your credit limit. For example:

- The deposit amount often ranges from $200 or higher

- Your credit limit usually equals your deposit amount

- The deposit is held as collateral and may be refundable if you close the account in good standing or upgrade to an unsecured card

Key Differences: Yendo VS Traditional Secured Cards

| Feature | Yendo | Traditional Secured Cards |

|---|---|---|

| Collateral | Your car’s equity | Cash deposit |

| Credit Limit | $450 – $10,000 based on car value | Usually equal to deposit amount |

| Upfront Cost | No cash deposit required | Cash deposit required $200 + |

| Annual Fee | $40 | Varies (some have no annual fee) |

Side Note: It’s important to note that the Yendo credit card requires a $40 annual fee. Most traditional secured card do not.

The no cash deposit and vehicle equity key points can be found and verified on the Yendo getting started page. The Traditional Secured Credit Cards key points acan be found and verified in the Credit Karma article titled: How a secured card deposit relates to your credit line.

Low Interest Rate and Flexible Terms Compared to Title Loans

The Yendo Credit Card offers a more sustainable and affordable credit option with a fixed Annual Percentage Rate (APR) of 29.88%. This translates into a manageable monthly interest rate of just 2.49%. Traditional title loans can reach APRs of up to 300%. This can translate into very high monthly interst rates of 25%. Historically, title loans often come with hidden fees like origination or service fees. Yendo doesn’ do that. It provides a clear, straightforward cost structure.

Additionally, Yendo allows flexible repayment without the need for frequent loan renewals and has no prepayment penalties This allows users to pay down their balance faster if they choose. In a nutshell, this makes Yendo an attractive alternative for people looking to access credit using their vehicle’s equity without being subjected to the high costs associated with title loans.

The table below highlights how Yendo’s low interest rate and flexible credit terms stand out against the high costs and restrictive conditions often associated with title loans.

| Feature | Yendo Credit Card | Car Title Loans |

|---|---|---|

| Annual Percentage Rate (APR) | 29.88% | Approximately 300% |

| Monthly Interest Rate | 2.49% | Around 25% |

| Typical Loan Fees | Low to none | High origination, service, and processing fees |

| Interest Accumulation | Based only on outstanding balance | High accrual rates, rapid debt growth |

| Repayment Flexibility | Revolving line; carry balance month-to-month | Full repayment often required quickly, risk of repeated borrowing |

| Early Repayment Penalties | None | Some lenders may charge prepayment penalties |

Note: Title loan APRs and fees vary widely, often leading to debt traps for borrowers due to repeated loan renewals and high-interest rates.

Side Note: According to the AOL article Exclusive: Fintech Yendo has raised $150 million in debt and $15 million in equity, Jordan Miller, the founder of Yendo, was quoted as saying, “…Yendo offers a fixed APR of 29.88%, which is designed to help subprime consumers access credit at a lower, more predictable rate compared to traditional title loans, where rates can soar.”

Mela was very impressed by Yendo’s low interest rate. She was quoted as saying… “.. the interest rate worked great for our budget.” Click here to see the full review.

Looking for a low interest rate? Click here to get started with Yendo today!

Try Our Saving Calculator and Calculate Your Savings With Yendo

If you’re looking for a high credit limit credit card without the need for a deposit, the Yendo Credit Card might be the perfect fit. This vehicle secured credit card provides competitive rates compared to traditional title loans, making it a smart choice for rebuilding credit affordably.

Our Savings Calculator compares Yendo’s competitive 29.98% APR against traditional title loans with rates soaring up to 302.99% APR. You can easily see the total repayment amount and exactly how much money you can save with Yendo.

Simply enter the amount you’d like to borrow and select your loan period to reveal the difference—it’s shocking! Go ahead, try it now and discover why Yendo reviews consistently highlight this card as a top choice for credit building with no deposit required.

Savings Calculator:

See How Much You Can Save With Yendo

Repayment Summary

| Loan Provider | APR (%) | Time Period | Total Repayment ($) |

|---|---|---|---|

| Yendo | 29.98% | ||

| Title Loan | 125.99% | ||

| Title Loan | 165.99% | ||

| Title Loan | 229.99% | ||

| Title Loan | 302.99% |

**Annual Percentage Rates (APR) and terms sourced from the AmericanTitleLoan.com website.**

Like the results? Ready to save with a more affordable credit option? Start your application with Yendo now!

Yendo's interest rate compared to a traditional title loans interest rate can be found and verified on the Yendo home page.

Fast Cash Advance

The Yendo credit card offers fast cash advances as a quick and convenient way to access funds when you need them. You have a daily limit of up to $400 and you can withdraw up to 50% of your total credit limit, Yendo allows cardholders to tap into their available credit for emergency cash. Keep in mind that cash advances incur a 3% fee.

Interest starts accruing immediately at a fixed APR of 29.88%. It's important to repay these advances as soon as possible to avoid accumulating high costs.

Yendo's cash advance details can be found and verified on the Yendo cash advance page.

Yendo's Customer Vehicle Ownership Mindset vs. The Title Loan Mindset

When comparing Yendo’s approach to a vehicle secured credit card with traditional title loans, the priorities and values of each become clear. This contrast highlights a difference in how customer needs and financial stability are viewed. Below, we’ll explore how Yendo and title loans address vehicle ownership and borrower support.

Yendo Prioritizes You

The Yendo's mindset is to support of your as much as possible and to make sure that you remain the owner of your vehicle. They prioritizes you. How do I know this? Because in their FAQ section "If I miss a payment, do I lose my car?" it clearly states:

"No. If you miss a payment or pay late, you will not lose your car. We exist to help people get ahead financially, and we want to support you as much as we can. If you can't make your payments, give us a call so we can work with you".

This is not the case with title loans.

Title Loans Prioritize the Lender

The title loan mindset and structure prioritizes the lender’s ability to recover their money over the borrower’s financial well-being. In this article titled "Car Title Loans: What You Need To Know", the Lending Tree explains that title loans carry high interest rates and fees, with lenders often allowing loans to roll over repeatedly, which traps borrowers in debt cycles. This shows that the system is built to extract as much repayment as possible, even at the borrower’s expense.

To provide further proof please view this article in the MilitaryTimes.com that discusses a significant settlement involving a title loan company that has been accused of engaging in illegal lending practices targeting military families.

The scope of unlawful and overcharging practices of some Title Loan companies can also be found and verified in the same article but posted on the Consumer Financial Protection Bureau's website: CFPB Orders TitleMax to Pay a $10 Million Penalty for Unlawful Title Loans and Overcharging Military Families.

It's important to understand that the key difference between Yendo’s mindset and a traditional title loan lies in the level of risk and purpose of the lien. (Click here to access the article "What is a lien on a car?").

Purpose of the Lien

In a traditional title loan, the lien is placed on your car as collateral specifically for the purpose of securing a loan, and if you default on the payments, the lender can take possession of your vehicle.

With Yendo, the lien is placed to secure a credit line (not a lump-sum loan) based on your vehicle’s equity. The main goal is to help you build credit, rather than simply providing short-term cash like with a title loan.

Risk of Repossession

Traditional title loans are high-risk because if you miss payments, the lender can repossess your car, as they hold the lien to secure their money.

Yendo does not operate in the same way. While they hold a lien on your vehicle, they don’t focus on repossessing the car as the first course of action if payments are missed. Their model is more geared toward improving your credit, offering a secured credit line where you still retain possession of the vehicle, even during the repayment period, as long as you maintain good standing.

As proof of this, Nerdwallet wrote in one of their articles that according to that an email statement from Yendo founder and CEO Jordan Miller, repossession is only considered after all other recovery options have been tried and exhausted. He also clarified that a single missed payment will not trigger repossession as long as customers communicate to Yendo about their financial challenges.

You can view the statement in the article here: 5 Things to Know About the Yendo Credit Card

Ownership

In the FAQ section of the Yendo website, for the question "Will this affect the ownership of my car?" Yendo states:

"No. Even though we become a lienholder on your title, your car remains in your possession, and you will remain listed as the owner.".

In both Yendo’s model and a traditional title loan, the vehicle owner retains legal ownership of the car, but in a title loan, missing payments leads to a higher risk of losing that ownership through repossession.

If flexibility is key for you, Yendo’s model allows you to keep using your vehicle while benefiting from its equity. Start with Yendo here to unlock that hidden value without giving up access to your car.

The Lien Release Process

This is difference between how a title loan company releases the lien on your vehicle and how and Yendo releases the lien:

The Title Loan Lien Release Process

In a traditional title loan, the lien on your car is only released after you repay the entire loan, including any accrued interest and fees. This process can often be costly and challenging, especially because title loans typically come with high-interest rates. If payments aren’t made, the lender has the legal right to repossess the vehicle as soon as there is a default, putting the borrower’s ownership at great risk. (You can read more about it here in this article by Investopedia titled "How to Get the Title After Paying Off a Car Loan".)

The Yendo Lien Release Process

Yendo’s approach is different as it operates more like a credit card than a title loan. With Yendo, once you fully pay off any outstanding balance and close the account, the lien is removed, and your vehicle title is returned. Since Yendo provides a revolving line of credit rather than a one-time loan, it places a lien to secure the credit line rather than setting terms that could lead directly to repossession. Their focus is on credit building, and they emphasize that repossession is a last resort, making it safer in terms of retaining ownership during financial hardships.

Their process was structured this way because their focus is on helping users build credit rather than taking possession of the vehicle. You can verify and read about it here on Yendo's website in the article titled "How to Obtain Your Vehicle Title After Closing Your Yendo Account". That webpage is actually a complete guide on title validation and the title release process.

In Summary

Yendo's mindset is different from a traditional title loan because it places less emphasis on repossession and more on providing an accessible credit line without the immediate threat of losing your vehicle.

A Great Credit Card To Rebuild Credit With

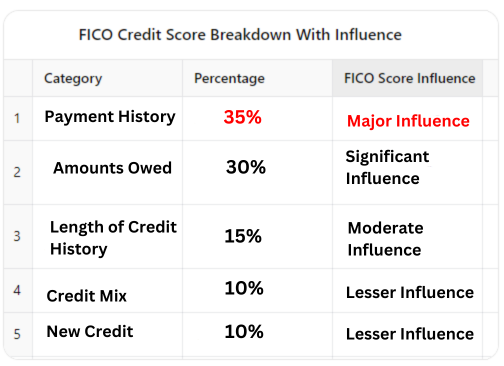

A Yendo credit card is a great credit card to build credit with. It's also a great credit card to rebuild credit with. This is because it reports your payment activity to all three major credit bureaus: Experian, Equifax, and TransUnion. . This means that with responsible usage, such as making on-time payments, over time you can build and improve your credit score. Since payment history accounts for 35% of your FICO® credit score, consistently paying your Yendo credit card balance on time will help establish a positive credit profile. Unlike some secured credit cards that might not report to all bureaus,

Yendo ensures that your credit-building efforts are recognized across all three major reporting agencies, giving you a better chance to improve your credit standing.

Additionally, if you have a title loan, on-time payments usually do not help improve your credit score, as most title lenders do not report to credit bureaus.

Yendo, however, ensures that your responsible financial behavior is properly reflected in your credit report.

Yendo is my recommended tool for building or rebuilding credit without hidden fees. Get started with Yendo here to start building your credit the smart way.

The listing of the three mejor credit bureaus and a breakdown of how the FICO® credit score is calculated can be found and verified on the Yendo build your credit page.

Jason, a Yendo customer, thanked Yendo and said.. "...it's been a great opportunity for me to build some credit, as well as pay some bills" Click here to see the full review.

Looking to rebuild your credit? Click here to get started with Yendo today!

Side Note: The Yendo Credit Card is a valuable option for those looking to establish or rebuild their credit. If you’re a young adult exploring additional credit options, see our guide on Exploring The Best Credit Cards For Young Adults for more recommendations.".

Lower Your Monthly Payments by $306

By getting the Yendo credit card, you can refinance your existing auto loan and dramatically lower your monthly car payments. The average reduction of around $306 per month. This estimate is based on the average savings when comparing previous auto loan payments to the new Yendo loan payments over a 36-month repayment period.

How is this possible? How does Yendo do this?

This is possible because Yendo does one of two things depanding on your specific sutuation. Yendo will either:

- Refinance your current auto loan at a lower interest rate (or)

- Refinance your current auto loan and extend the loan term, spreading your monthly payments over a longer period.

Both approaches result in drastically lowering your monthly payments. Additionally, the refinancing process allows you to access a line of credit of up to $10,000, depending on the value of your vehicle. Yendo is known as a high credit limit credit card. As the loan is paid down, the available credit limit increases, giving you greater flexibility with your finances. This is particularly helpful for people who have subprime or poor credit. It provides them access to credit at more favorable rates compared to other financing options, such as title loans.

Watch this video to see that just by filling out the Yendo application form you can:

- Get instant access to the Yendo credit card

- Lower your monthly payments by $306 a month (or more)

- Have access a line of credit of up to $10,000

- Pay down your auto loan while increasing your credit limit

- Pay back your loan and still be allowed to make purchases via the Yendo app

Lower monthly payment options and details can be found and verified on Yendo's auto-refinancung page, and this fintech finance news blogpost.

Side Note: It’s important to note that while lower monthly payments can be beneficial in the short term, extending a loan term may result in paying more interest over the life of the loan. Consider your overall financial situation when evaluating this option.

Multiple Payment Options

Yendo provides several convenient payment options for flexibility:

- ACH via Bank Account: You can make payments directly from your bank account through ACH transfers.

- Mail a Check: Traditional methods, such as mailing a check, are also available.

- Debit Card, Apple Pay, Google Pay, PayPal: Digital payment options are supported through PayNearMe (with additional fees for these methods).

- Cash Payments: You can make cash payments at select retail locations using PayNearMe.

The multiple payment options can be found and verified on Yendo's credit-card-payments page.

Khary, after having treid Yendo was quoted as saying: "I love the fact that I can make payments through Apple Pay. I can make payments through my bank accounts, and it’s very convenient. " Click here to see the full review.

Ready to experience the convenience of Yendo for yourself? Click here to get started with Yendo today!

Industry Leadership and Financial Backing

Yendo’s innovative approach to vehicle-secured credit recently attracted a massive $165 million investment to support its expansion. This funding is a testament to the growing recognition of Yendo’s unique value proposition in the credit market. According to PYMNTS.com, this backing positions Yendo as a pioneering force in credit innovation, allowing it to provide higher credit limits and better affordability compared to traditional loan products. A similar Businesswire.com article was featured in Yahoo Finance.

This significant funding boost also strengthens the company’s ability to offer services that are more inclusive for individuals with poor or limited credit histories. By using the equity in vehicles as collateral, Yendo provides a safer, lower-cost borrowing alternative, which can help consumers rebuild their credit effectively.

You can read the full article in both PYMNTS and Yahoo-Finance

You can read the full article in both PYMNTS and Yahoo-Finance.

Is the Yendo Credit Card the Right Credit Card For Me ?

The most important point to all this is to know if the Yendo credit card is the right credit card for you. If this vehicle secured credit card is your best option. The most common questions in knowing are:

1. Are you looking for a higher credit limit even if your credit score is low?

2. Do you need immediate access to credit?

3. Would you rather avoid putting up a security deposit altogether?

4. Are you looking to avoid high title loan rates?

5. Are you looking to rebuild your credit?

6. Do you mind borrowing against the equity of your car?

7. Do you mind paying slightly more interest than on a secured credit card?

The best way to know is to compare the Yendo credit card with a title loan and a secured credit card. To list the Pros and Cons of the most impactful features of each and to then decide what's best for you.

Yendo Compared to Title Loans and Secured Credit Cards.

Yendo credit cards have been purposefully built to outperform both title loans and secured credit cards in several key areas that matter most to consumers, such as credit limit, interest rates, and accessibility. They offer unique benefits that appeal to a wide range of users. Depending on individual financial situations, they may not be the best fit for everyone. Ultimately, it's up to the individual to decide what's right for themselves.

Below are the Pros and Cons of Yendo credit cards, helping you decide if it's the right choice for your needs.

Pros of a Yendo Credit Card:

Credit Limit: Yendo offers a higher potential credit limit (up to $10,000) compared to most secured cards, which typically max out around $5,000. This higher limit provides more financial flexibility to users.

Interest Rate: While Yendo's 29.88% APR is higher than some secured cards, it's significantly lower than title loans, which can have astronomical rates up to 300%. This makes Yendo a much more affordable option for borrowing.

Vehicle Possession: Unlike title loans, Yendo doesn't require vehicle possession, allowing cardholders to continue using their car.

Security Deposit: Unlike secured credit cards, Yendo doesn't require a cash depot because it uses your car's built-in equity as collateral. This makes it more accessible to those without savings.

Credit Building: Yendo reports to credit bureaus, helping users build credit history, unlike title loans which typically don't. This feature is on par with secured cards also making it a great credit card to rebuild credit.

Approval Speed: With a virtual card available within 30 minutes of approval, Yendo offers much faster access to credit than traditional secured cards, which can take 1-2 weeks for approval and card delivery.

Overall Advantage: Yendo combines the credit-building benefits of secured cards with the higher limits and quick access of title loans, while offering more reasonable interest rates and terms than title loans. This unique combination positions Yendo as a superior option for many consumers, especially those with limited credit options.

Cons of a Yendo Credit Card:

Annual Fee: Yendo charges a $40 annual fee, while some secured cards might have no annual fee.

Interest Rate: Although lower than title loans, Yendo's APR of 29.88% is higher than some secured cards.

Owning a Vehicle: Approval depends on the vehicle's equity, limiting availability to those who don't own or partially own a vehicle.

Fees for Cash Advances: Cash advances incur a 3% fee, and interest accrues immediately, making it expensive if not repaid quickly.

Risk of Repossession: While you don’t lose your car automatically, abusing the system and failing to meet the card’s payment requirements could lead to the risk of repossession. Yendo only considers this as a last resort action.

Visual Comparison of the Pros and Cons

To simplify the decision, here’s a quick comparison of the Yendo credit card, title loans, and secured credit cards:

Pros and Cons of the Yendo Credit Card

| Features | Yendo Card | Title Loans | Secured Cards |

|---|---|---|---|

| Credit Limit | $450-$10,000 | Based on vehicle value | $200 to $5,000 |

| Interest Rate (APR) | 29.88% | Up to 300% | 15%-30% |

| Requires Vehicle Possession | No | Yes | N/A |

| Builds Credit (Credit Bureaus) | Yes | No | Yes |

| Approval Speed | 30 min (virtual card) | Immediate cash, high risk | 1-2 weeks |

| Annual Fee | $40 | No annual fee, but high initial costs | Varies, some have no fee |

| Owning a Vehicle | Required for approval | Required and used as collateral | Not required |

| Fees for Cash Advances | 3% fee, immediate interest | May incur additional fees | Varies, sometimes fee applies |

| Risk of Repossession | Possible, but always last resort | High, car repossessed on default | Not applicable |

For those looking to avoid the high costs of traditional loans, Yendo offers a balanced alternative. Check out Yendo here to see how it can work for your financial needs.

Side Note: It’s important to note that the Yendo combines the credit-building benefits of secured cards with the higher credit limits and quick access of title loans. It does this while offering more reasonable interest rates and terms than title loans. It may not be the perfect solution for everyone. On the whole, this unique combination positions Yendo as a superior option for many consumers, especially those with limited credit options.

The Yendo Application Process: As Easy As 1-2-3

Applying for the Yendo Credit Card is a breeze, whether your car is fully paid off or you’re still making payments. Yendo simplifies the entire process, ensuring you can unlock your vehicle's equity with minimal hassle. Here’s how it works in just three simple steps:

If Your Car Is Paid Off:

Step 1: Get Pre-Approved

Download the Yendo app and fill out some information about yourself and your car to get pre-approved in just 2 minutes—with no impact to your credit score.

Step 2: Verify Yourself and Your Car

Once pre-approved, verify your information by taking photos of your car and ID. Make sure to keep your phone handy for this quick step.

Download Yendo’s Vehicle ID Verification Process: A Step-by-Step Guide (PDF)

Step 3: Access Your Money

After approval and completing the card activation process, you’ll access part of your credit limit through a virtual card while your physical card is mailed to you. Activate your card once it arrives for full access.

Download Yendo’s Title Validation and Title/Lien Release Process: A Complete Guide (PDF)

If You’re Making Payments on Your Car:

Step 1: Get Pre-Approved

Download the Yendo app and fill out some information about yourself and your car to get pre-approved in just 2 minutes—with no impact to your credit score.

Step 2: Transfer Your Loan

Digitally transfer your existing auto loan to Yendo. The entire application process takes just minutes to complete.

Step 3: Access Your Money

After approval, you’ll get access to part of your credit limit with a virtual card while your physical card is mailed to you. Activate the physical card once it arrives to unlock your full credit limit.

Wendy, a Yendo customer, was quoted as saying: "It was super easy, you can do everything online, on the app, on your phone." Click here to see the full review.

Love to do everything online? Click here to get started with Yendo today!

Real Users Love Yendo: Yendo Reviews

People really love Yendo. Customers are sharing their positive experiences, and it’s clear they appreciate the innovative approach Yendo brings to credit. Many users highlight how easy and user-friendly the application process is, making it simple to access credit when they need it most. They also love the flexibility that comes with using their vehicle's equity, allowing them to get the funds they need without the usual hassle. And let's not forget about the customer support! Users frequently mention how responsive and helpful the team is throughout their journey, making their experience even more enjoyable.

But don't take our word for it, here’s what real users have to say:

Yendo Credit Card Review with William:

In the video review, William shares his positive experience with the Yendo. He refers to the Yendo credit line a being "an awesome, awesome thing that they've done".

What Willian Experienced:

- Quick Approval Process: He praises Yendo’s fast approval, noting that users can receive a virtual card within 30 minutes. This quick access is a major advantage for those needing immediate funds.

- Reliable Credit Building: He mentions how Yendo reports to major credit bureaus, helping users improve their credit scores over time. This feature makes it a reliable option for building or rebuilding credit.

- Ease of Access: He appreciates the card’s accessibility, as it does not require a cash deposit, making it easier for those without significant savings to obtain a credit line.

Ready to experience quick approval and reliable credit building just like William?

Apply for your Yendo credit card today and get started in minutes. Access a virtual card within 30 minutes and start building your credit with ease. Learn More...

(This video review and many others can be found on Yendo's Reviews page.)

Yendo Credit Card Review with Austin:

In this video review, Austin shares his experience and positive views on Yendo, emphasizing How great I think they truly are".

What Austin Experienced:

- Quick Approval and Ease of Use: Austin highlights the easy, hassle-free application process, making Yendo accessible to a broad range of users. The quick approval ensures customers can get immediate access to their funds.

- Affordability and Accessibility: He praises Yendo for not requiring a cash deposit, unlike many secured cards, which opens doors for people without substantial savings to obtain a credit line.

- Great Customer Support: He mentions how supportive and responsive the Yendo team is, making the experience smooth and reassuring for users.

Want a credit card that’s easy to use and backed by great customer support?

Apply for Yendo today and see why Austin found it "great" for affordability and accessibility. With no cash deposit required and a simple application process, you can get quick access to credit when you need it. Learn More...

(This video review and many others can be found on Yendo's Reviews page.)

Yendo Credit Card Review with Susanne:

In this video review, Susanne shares how Yendo has been a crucial financial tool for her, stating, “Yendo is helping me to stay afloat.” She explains how the card provides necessary support during tough financial times, making it easier for her to manage expenses

What Susanne Experienced:

- Financial Stability: Susanne emphasizes how Yendo has been a lifeline, offering a manageable credit solution that helps her cover expenses and stay financially stable without taking on high debt.

- Ease of Accessibility: She appreciates that Yendo doesn’t require a cash deposit, which made it easier for her to get started and gain access to credit quickly.

- Practicality: The flexibility and straightforward terms of Yendo have been beneficial for her, offering an alternative to more expensive or rigid financial products.

Need a credit line to help you manage tough financial times?

Discover how Yendo can be your financial lifeline, just like it was for Susanne. With no cash deposit needed and flexible terms, it’s easier to stay afloat and cover your expenses without high-interest debt. Apply Now

(This video review and many others can be found on Yendo's Reviews page.)

Yendo Credit Card Review with Jose:

In this video review, Jose shares his thoughts on how "Yendo is very effective and very beneficial". He emphasizes the positive impact that the Yendo credit card has had on his financial situation, and how a reliable and useful tool it is.

What Jose Experienced:

Jose highlights the straightforward and efficient way Yendo operates, providing users with immediate access to credit and helping them manage their finances without complications.

- Effectiveness: Jose highlights the straightforward and efficient way Yendo operates, providing users with immediate access to credit and helping them manage their finances without complications.

- Credit Building: He points out how Yendo helps users improve their credit scores by reporting to major credit bureaus, making it a practical tool for those looking to rebuild their credit.

- User-Friendly Experience: The convenience and accessibility of the Yendo card are also mentioned by Jose, who appreciates how easy it is to apply and get approved.

Looking for an effective and reliable credit solution?

See why Jose calls Yendo “very effective and very beneficial.” With its straightforward application, quick credit access, and credit-building features, Yendo can help simplify your financial management. Start building your credit today with a user-friendly card designed to support your needs. Apply Now.

(This video review and many others can be found on Yendo's Reviews page.)

Want to Hear More Experiences and Yendo Reviews From Real Users?

Yendo has helped countless people improve their financial situation with quick approval, credit-building features, and no cash deposit requirements. Check out more video and text reviews from satisfied Yendo customers to see how this card can benefit you. Explore More Yendo Reviews

Final Thoughts on the Yendo Credit

If you’re looking for a practical way to tap into your vehicle’s equity without taking on the risk of a title loan or secured credit card, the Yendo Credit Card is a smart choice. You should seriously consider this vehicle secured credit card. With credit limits that range from $450 to $10,000 (and an average $4,400) , Yendo offers a unique solution that leverages the hidden value of your car for accessible, affordable credit.

Is Yendo Right for You?

Whether you’re building or rebuilding your credit, need a high credit limit credit card, or simply want a card that works with your financial reality, Yendo stands out for its innovative use of vehicle equity. Unlike traditional cards or title loans, Yendo keeps your car in your hands and makes your financial goals a priority.

Ready to unlock the power of your car’s value? Sign up for the Yendo Credit Card today to enjoy high credit limits, reasonable rates, and peace of mind. Don’t miss the chance to use your vehicle as a financial lifeline without the risk of losing it.

Disclosure: This post contains affiliate links, and I may earn a commission if you make a purchase at no extra cost to you. I only recommend products I thoroughly researched and trust.

Turn your network into income—apply to our affiliate program! https://shorturl.fm/dcPoP

Become our affiliate and watch your wallet grow—apply now! https://shorturl.fm/s2OEE

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/dMvoy

Become our affiliate and watch your wallet grow—apply now! https://shorturl.fm/diN7Y

Promote our products—get paid for every sale you generate! https://shorturl.fm/Ruks1

Be rewarded for every click—join our affiliate program today! https://shorturl.fm/atwHP

Join our affiliate program and start earning today—sign up now! https://shorturl.fm/jI62N

Your audience, your profits—become an affiliate today! https://shorturl.fm/fCpJN

Start earning on every sale—become our affiliate partner today! https://shorturl.fm/ExVn7

Drive sales, earn big—enroll in our affiliate program! https://shorturl.fm/w4dRE

Maximize your income with our high-converting offers—join as an affiliate! https://shorturl.fm/57oIL

Share our link, earn real money—signup for our affiliate program! https://shorturl.fm/lyh4C

Join our affiliate program and watch your earnings skyrocket—sign up now! https://shorturl.fm/zh0MP

Start earning passive income—become our affiliate partner! https://shorturl.fm/hXT9u

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/BaeRt

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/tZ5CN

Turn referrals into revenue—sign up for our affiliate program today! https://shorturl.fm/Tj9RM

Sign up and turn your connections into cash—join our affiliate program! https://shorturl.fm/vrrcJ

Join forces with us and profit from every click! https://shorturl.fm/tvLMj

Monetize your traffic with our affiliate program—sign up now! https://shorturl.fm/p0xL3

Share our offers and watch your wallet grow—become an affiliate! https://shorturl.fm/pTwTH

Become our partner and turn referrals into revenue—join now! https://shorturl.fm/NSNUt

Turn referrals into revenue—sign up for our affiliate program today! https://shorturl.fm/f7AM8

Join our affiliate program today and earn generous commissions! https://shorturl.fm/IHZlT

Be rewarded for every click—join our affiliate program today! https://shorturl.fm/DNuNm

Start profiting from your network—sign up today! https://shorturl.fm/DZsqK

Drive sales, collect commissions—join our affiliate team! https://shorturl.fm/EKUXA

Start profiting from your traffic—sign up today! https://shorturl.fm/Ot6gQ

Unlock exclusive rewards with every referral—apply to our affiliate program now! https://shorturl.fm/SudZe

Monetize your influence—become an affiliate today! https://shorturl.fm/bYtbD

Earn passive income on autopilot—become our affiliate! https://shorturl.fm/d7QZH

https://shorturl.fm/YnFw8

https://shorturl.fm/bQqGC

https://shorturl.fm/wCSxF

https://shorturl.fm/LAt8s

https://shorturl.fm/JGGoi

https://shorturl.fm/61A3a

https://shorturl.fm/7DPVt

https://shorturl.fm/QEqbi

https://shorturl.fm/fWmeX

https://shorturl.fm/oJO8x

https://shorturl.fm/rWsEj

https://shorturl.fm/EJ04T

https://shorturl.fm/iYFy2

https://shorturl.fm/3B8f1

https://shorturl.fm/cztET

https://shorturl.fm/WV4ud

https://shorturl.fm/Xuj9T

https://shorturl.fm/gKJju

https://shorturl.fm/GyMYh

https://shorturl.fm/KhnyT

https://shorturl.fm/AwTlw

https://shorturl.fm/weTJg

https://shorturl.fm/Wh7uy

https://shorturl.fm/1CJKZ

https://shorturl.fm/D3jQ8

https://shorturl.fm/5DiUI

https://shorturl.fm/us6pn

https://shorturl.fm/UeqBV

https://shorturl.fm/xtrs4

https://shorturl.fm/uCMzl

https://shorturl.fm/6WJVY

https://shorturl.fm/OUadl

bcte5n

https://shorturl.fm/u53dk

https://shorturl.fm/S1RKQ

https://shorturl.fm/TuAk3

https://shorturl.fm/hAqR9

https://shorturl.fm/dHg9U

https://shorturl.fm/Zn0Kq

https://shorturl.fm/NPvyt

https://shorturl.fm/k2xsp

https://shorturl.fm/Sd0gZ

https://shorturl.fm/3dGPi

https://shorturl.fm/Audff

https://shorturl.fm/cDBZ3

https://shorturl.fm/p0MDl

n8ww03

https://shorturl.fm/m9cJN

https://shorturl.fm/fbJLs

https://shorturl.fm/3llkz

https://shorturl.fm/pcmSN

https://shorturl.fm/2cXqN

https://shorturl.fm/cP6P7

https://shorturl.fm/6FcYI

https://shorturl.fm/91aKU

https://shorturl.fm/Cd3DJ

https://shorturl.fm/XYWVD

https://shorturl.fm/v0zd9

https://shorturl.fm/O4sdK

https://shorturl.fm/8CsbW

https://shorturl.fm/Qu3Ci

https://shorturl.fm/YHtwG

https://shorturl.fm/LpgkJ

https://shorturl.fm/pisbR

https://shorturl.fm/Fs3Em

https://shorturl.fm/2Uy97

https://shorturl.fm/UfXwD

https://shorturl.fm/1ki80

https://shorturl.fm/tyf4M

https://shorturl.fm/oh0Cw

Потрясающе сайт у вас есть здесь.

Посетите также мою страничку Жильё посуточно https://tiktur.store/

Познакомимся с XCARDS — платформу, которая меня заинтересовала.

Буквально на днях услышал о новый бренд XCARDS, который предлагает создавать виртуальные платёжные карты для

рекламы.

Особенности, на которые я

обратил внимание:

Карту можно выпустить за несколько минут.

Сервис позволяет выпустить множество карт для разных целей.

Есть поддержка 24/7 включая живое общение с оператором.

Всеоперации отображаются онлайн — лимиты,

уведомления, отчёты, статистика.

Возможные нюансы:

Юрисдикция: европейская юрисдикция —

лучше проверить, что это соответствует местным

требованиям.

Финансовые условия: в

некоторых случаях встречаются

оплаты за операции, поэтому советую внимательно прочитать условия.

Отзывы пользователей:по комментариям в

Telegram поддержка работает

быстро.

Надёжность системы: все операции подтверждаются уведомлениями, но всегда лучше

активировать 2FA.

Вывод:

На первый взгляд XCARDS — это

отличным помощником для фрилансеров.

Он объединяет удобный интерфейс, разнообразие BIN-ов и простое управление.

А теперь — вопрос к вам

Пользовались ли вы XCARDS?

Поделитесь опытом — будет интересно сравнить.

Виртуальные карты для цифрового маркетинга https://t.me/platipomiru_bot?startapp=4Q3W04TO

https://shorturl.fm/ajEU8

https://shorturl.fm/TIqCP

https://shorturl.fm/4h47v

https://shorturl.fm/4Qqpv

Usually I do not read article on blogs however I would like to say that this writeup very compelled me to take a look at and do so Your writing taste has been amazed me Thanks quite nice post

https://shorturl.fm/Vy62W

https://shorturl.fm/dz5n3

https://shorturl.fm/y17nH

Excellent web site you have here.. It’s difficult to find

quality writing like yours these days. I seriously appreciate individuals like

you! Take care!!