CreditRewardsCards

Exploring Credit Cards for Young Adults: A Comprehensive Guide

Finding the best credit cards for young adults can be a great way to help a young person choose the right credit card that best suits their needs and desires. This blogpost focuses on just that; some of the best credit cards for young adults to ensure a solid financial start. They need a card that offers them cash back or other rewards on their everyday purchases. One that saves them money on the things they want to buy. Since their income is not yet at a higher level, a beginner’s credit card with no annual fee. They especially need a credit card that will help them begin to establish and build their credit.

If you’re a young adult with bad credit, check out our detailed guide on the best credit cards for young adults with bad credit in 2025 for options like the Yendo Credit Card and OpenSky Secured Visa.”

So, finding the best credit cards for young adults of the best credit cards for teens is a positive endeavor. It’s like helping them find the key that unlocks their world of financial possibilities and responsibilities. The downside it that when you’re just starting out, the world of credit cards can be a quite confusing. In truth, a young person may not yet have a clear understanding of how credit cards work, what types of card are available, the benefits and drawbacks of using them, interest rates, fees, late fees, available programs, and how using credit cards can affect one’s credit score. With so many options available, finding best first credit card can feel overwhelming.

But fret not, recent graduates, young professionals and teens as well! As a result, this blogpost will equip you with the knowledge and tools to navigate the credit card landscape and choose a card that perfectly suits your needs.

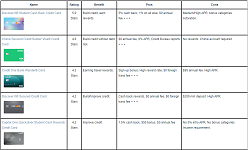

Click the image to show a summary table of the credit cards mentioned below

Click here to hide the table

| Name | Rating | Benefit | Pros | Cons |

|---|---|---|---|---|

Discover It® Student Cash Back Credit Card

|

5.0 Stars | Build credit, earn rewards. | 5% cash back, 1% on all else, $0 annual fee.+ + + | Medium/High APR, bonus categories Activation. |

Chime Secured Credit Builder Visa® Credit Card

|

4.6 Stars | Build credit without debt risk. | $0 annual fee, 0% APR, Credit Bureau reports + + + | No rewards. Chime account required. |

Credit One Bank Wander® Card

|

4.3 Stars | Earning travel rewards. | Sign-up bonus, High reward rate, $0 foreign trans fee + + + | $95 annual fee. High APR. |

Discover It® Secured Credit Card

|

4.2 Stars | Build/Improve credit. | Cash back rewards, $0 annual fee, $0 foreign trans fee + + + | $200 min deposit. High APR. |

Capital One Quicksilver Student Cash Rewards Credit Card

|

4.2 Stars | Improve credit. | 1.5% cash back, $50 bonus, $0 annual fee | No 0% intro APR. No bonus categories. Income requirement. |

1. The Best Credit Cards For Young Adults:

In the quest for the best credit cards for young adults, it’s equally crucial to consider a variety of factors that cater to the unique lifestyle, financial status, and goals of the younger generation. So, let’s explore some standout options that resonate with the aspirations and needs of young adults today.

1.1 The Discover It® Student Cash Back Credit Card

5.0 Star Review according to Forbes Advisor

Why It Stands Out:

The Discover It® Student Cash Back Credit Card is for college students. It’s a strong contender for the best first credit card for young adults because it is designed as a valuable tool to help them build their credit, earn rewards and gain financial knowledge.

The Pros:

- Cash Back Rewards: Students can earn 5% cash back on everyday purchases at different places each quarter (like grocery stores, restaurants, gas stations, and more), up to the quarterly maximum when activating the bonus categories and an additional 1% cash back on all other purchases.

- Annual Fee: $0

- APR: 0% introductory APR (Annual Percentage Rate) on purchases for the first 6 months.

- Foreign Transaction Fee: $0

- Cashback Match™: Discover automatically matches all cash back earned

- Financial Tools: Additionally, Discover provides tools like the FICO credit score tracker to help students understand their credit health.

- Free FICO® Score: Students have access to their FICO® Score.

- Qualification Requirements: No existing credit score required when applying.

The Cons:

- Medium To High APR: After 6 months, APR (Annual Percentage Rate) on purchases climbs to 18.24% – 27.24% Variable

- Bonus Categories: The bonus categories require quarterly activation.

1.2 Chime Secured Credit Builder Visa® Credit Card

4.6 Star Review according to NerdWallet

Why It Stands Out:

The Chime Credit Builder card is designed to help young adults establish and build their credit without the possibility of going into further debt.

The Pros:

- Annual Fee: $0

- APR: 0% APR (Annual Percentage Rate) on purchases.

- Foreign Transaction Fee: $0

- Security Deposit: No minimum security is required.

- Credit Bureau Reports: The cardholder’s activity is reported to all three major credit bureaus (which lays the foundations for establishing and improving one’s credit score).

- Qualification Requirements: Poor to fair credit.

The Cons:

- Rewards: This card offers no rewards.

- Credit Limit Imposed: The card’s credit limit cannot be greater than the security deposit.

- Requirements: Requires a Chime Spending bank account to be linked the the Chime Secured Credit Builder Visa® Credit Card.

1.3 Credit One Bank Wander® Card

4.3 Star Review according to Forbes Advisor

Why It Stands Out:

The Credit One Bank Wander® Card is another one of the recommended credit cards for young adultsfor young adults who want to build or improve their credit all while earning rewards on their travel purchases.

The Pros:

- Signup Bonus: This card offers a signup bonus of 10,000 points if in the first 90 days of the account opening you spend more than $1,000 on eligible purchases.

- Generous Rewards: Moreover, cardholders can earn 10X the points on qualifying hotels and car rentals that are booked via the Credit One Bank travel partner site, additional 5X points on eligible dining, gas and flights and 1x the points on daily purchases.

- Foreign Transaction Fee: $0

- Free Credit Score Access: Cardholders are able to monitor their credit score online for free.

- Qualification Requirements: Fair to good credit.

The Cons:

- Annual Fee: This card comes with an annual fee of $95.

- High APR: This cards comes with a high APR (Annual Percentage Rate) of 29.74% variable on purchases

1.4 The Discover It® Secured Credit Card

4.2 Star Review according to Forbes Advisor

Why It Stands Out:

The Discover It® Secured Credit Card is designed for people who want to build their credit or improve their credit.

The Pros:

- Cash Back Rewards: Cardholders earn 2% cash back at gas stations and restaurants (up to $1,000 in combined purchases each quarter) and unlimited 1% cash back on all other purchases.

- Annual Fee: $0

- Foreign Transaction Fee: $0

- Cashback Match™: Discover automatically matches all cash back earned at the end of the first year.

- Free FICO® Score: Cardholders have access to their FICO® Score.

- Account Review For Unsecured Credit: After 7 months, Discover reviews accounts to determine if users qualify for an unsecured line of credit and can return their deposit.

- Qualification Requirements: Limited or even bad credit

The Cons:

- Security Deposit: To open an account, users must provide a $200 security deposit (minimum) which is refundable.

- High APR: Offers an introductory 10.99% APR (Annual Percentage Rate) on Balance Transfers for 6 months, and then an APR of 28.24% Variable.

- Requirements: Requires a bank account to fund it.

1.5 Capital One Quicksilver Student Cash Rewards Credit Card

4.2 Star Review according to Forbes Advisor

Why It Stands Out:

The Capital One Quicksilver Student Cash Rewards Credit Card is specifically designed for college or university students who have fair to limited credit and wish to improve their credit. It can also be considered one of the best credit cards for teens.

The Pros:

- Cash Back Rewards: Students can earn an unlimited 1.5% cash back on every purchase, and a a one-time $50 cash bonus once they spend $100 or more on purchases within 3 months of opening their account. Additionally they can also receive a 10% cash back on purchases made through Uber & Uber Eats.

- Annual Fee: $0

- Foreign Transaction Fee: $0

- Qualification Requirements: Limited or fair credit

The Cons:

- APR: No introductory 0% APR (Annual Percentage Rate) is offered on purchases.

- Bonus Categories: No bonus categories are offered.

- Income Requirement: Your monthly income needs to be greater than your rent or mortgage by at least $425.

2. What To Look For in a Credit Card

Selecting the best credit card for young adults is a really big decision. This is especially true for those young adults who are just getting started with managing their own finances. In truth, it’s easy to get lost in the terminology options and details.

Here’s straightforward advise on what to look for in a credit card. So let’s go through each important feature one by one to help you choose wisely.

2.1 Low APR (or Interest Rate)

Choose a card that offers you a low APR (or Interest rate). In fact, some cards even offer a 0% introductory APR for the first few months as an incentive.

What it means: The interest rate that a credit card company charges you is called the APR or Annual Percentage Rate. This interest rate is charged on the balance that you owe that is carried past the payment deadline. Therefore, if the APR is low, you pay less interest on the amount you owe on your credit card. Moreover, this interest only applies if you carry a balance and don’t pay your full balance each month.

How to choose the right one: Firstly, compare different credit cards from different companies.

Find a credit card with a low APR, or possibly 0% APR at least for the first few months.

But be aware of the regular APR after the promotion ends. Secondly, read the fine print because the APR can change under different circumstances. Such as if you make late payments.

2.2 Rewards Programs

Choose a Rewards Programs that suit your spending.

What it means: Without a doubt, most credit card rewards programs give you a chance to earn points, cash back, or travel miles every time you make a purchase. Therefore, to really benefit from these programs, choose a card that offers extra rewards for the kinds of things you buy the most, like groceries or gas.

How to choose the right one: At first, look at your recent spending to see where your money goes the most. This will help you figure out which categories you spend on frequently. Then, find credit cards that offer bonuses for buying things in those categories. Moreover, you can use websites that compare different credit cards to help you see which ones align with your spending habits.

2.3 Annual Fees

If you choose a card with an annual fee, make sure rewards and benefits are greater than the annual fee.

What it means: Some credit cards charge an annual fee. This is a fee that you pay once a year in exchange for higher rewards rates or additional benefits. This fee can be worthwhile, but only if the rewards and benefits exceed the cost of the fee.

How to choose the right one: Firstly, calculate the break-even point for any card with an annual fee. This means estimating how much you need to spend on the card to make the rewards value received exceed the fee. Secondly, determine that if you’re unlikely to spend enough to justify the fee, a no-annual-fee card may be more economical.

2.4 Credit Limits

Choose a card that offers a higher credit limit.

What it means: Obviously, your credit limit is the maximum amount you can borrow at one time on your card. Therefore, a higher credit limit can be beneficial for making large purchases and can help improve your credit score by lowering your credit utilization ratio, provided you keep your balances low.

How to choose the right one: To maintain a good utilization ratio, experts generally recommend using less than 30% of your total available credit. You can also request a higher credit limit on your existing accounts if you have a good payment history, though this sometimes results in a hard inquiry on your credit report, which might temporarily lower your score.

2.5 Educational Resources

Choosing the best credit cards for young adults often comes with the benefit of educational resources that can guide them in financial management.

What it means: Financial stability and wellbeing come from better managing our finances. In other words, understand how credit works and how to manage it successfully. Financial knowledge is the key. Moreover, understanding thinks like your credit card score, interest rates, minimum payments and due dates can help you make better financial decisions.

How to choose the right one: Many credit card companies offer resources and tools to help you learn about managing credit. Additionally, there are numerous online platforms and non-profits that provide free educational materials on financial literacy. As a result, engaging with these resources can build your understanding and confidence in using credit wisely.

2.6 High Approval Odds

What it means: Approval odds refer to the likelihood that your application for a specific credit card will be accepted. So, for beginners or those with limited credit history, finding a card with high approval odds is crucial as it can help you start building your credit profile without facing frequent rejections, which could impact your credit score.

How to choose the right one:

- Look for Cards Aimed at Beginners: Credit cards (like those above) designed for students, secured credit cards, and those specifically marketed towards individuals with no or low credit history generally offer higher approval odds.

- Check for Pre-Approval Options: Many credit card issuers provide online pre-approval tools that allow you to see if you’re likely to qualify without affecting your credit score. Because this is a soft inquiry, it gives you a good idea of your chances without any risk.

- Apply for Retail Store Cards: Often, retail store credit cards have more lenient approval criteria. While these cards typically come with higher interest rates, they can be easier to obtain and can help build your credit if used responsibly.

- Use Credit Builder Programs: Some financial institutions offer programs designed to help individuals build or rebuild their credit. Hence, these programs might include a small loan or credit card product with guided financial education.

If you’re looking for a card to rebuild your credit, see how the Yendo Credit Card works in our post Yendo Reviews 2025: Is the Yendo Credit Card Legit for Bad Credit?

- Consult with Financial Institutions Where You Have Accounts: If you already have for example a relationship with a bank or credit union, ask about credit card options they may have for someone with your financial profile. In truth, existing banking relationships can sometimes improve your chances of approval.

2.7 Listed with the Major Credit Bureaus

Specifically, try to choose a card that reports to all three major credit bureaus. They are Experian, Equifax, and TransUnion. These types of credit cards have a greater impact when trying to build credit.

What it means: Credit bureaus undoubtedly collect and maintain individual credit information and use it to create credit reports and scores. Therefore, reporting your account activity to all three major credit bureaus—Experian, Equifax, and TransUnion—ensures that any credit you build is recognized and reflected in your credit report at each agency.

How to choose the right one: Look for credit cards that explicitly state they report to all three major credit bureaus. In truth, this is crucial for building your credit score effectively, as lenders and other financial institutions may check your credit history from different bureaus. So, reporting to all three helps maintain a consistent and accurate credit profile across the board.

By choosing a credit card that reports to Experian, Equifax, and TransUnion, you maximize the potential to build a strong credit score, provided you manage your credit responsibly, such as by making payments on time and maintaining low balances relative to your credit limit. This is particularly important for beginners who are looking to establish a solid credit foundation.

3. Credit Card Terms Every Beginner Should Know

At first, credit card terminology and lingo can be confusing. This is especially true if your new to the credit card world and are totally unfamiliar to these terms. Therefore, if you’re just starting out, it’s very important that you understand what things mean. So, in this section we’ll take the time to explore key terms related to credit cards, financing and borrowing.

3.1 Annual Fee

This fee is what you pay every year to use your credit card. These cards usually offer rewards and services that out weigh the annual fee. Some cards are more limited in terms of rewards and services but don’t charge an annual fee.

3.2 Annual Percentage Rate (APR)

APR is the interest rate charged on any money you don’t pay back each month. Moreover, it shows how much extra you’ll pay if you don’t clear your balance.

3.3 Card Balance

This is how much money you owe on your card. It includes everything you’ve bought, plus any fees or interest.

3.4 Balance Transfer

Moving the debt that you owe from one card to another, usually to get a lower interest rate.

3.5 Billing Cycle

The time between your credit card bills. It’s usually 30 to 31 days. It may be longer due to legal holidays.

3.6 Credit Limit

The maximum amount you can spend on your card before the credit card is considered to be “maxed out”. It’s set based on your creditworthiness.

3.7 Due Date

The day by which you need to pay your credit card bill to avoid late fees.

3.8 Minimum Payment

The smallest amount you can pay on your bill to avoid a penalty. You pay less per month, but it’ll take longer to pay off your card and it will cost you considerably more in terms of interest.

3.9 Overdraft

When you spend more than your credit limit, you are in overdraft. Not all cards have this. This option usually comes with extra fees.

3.10 Statement

Your monthly bill. A complete monthly overview that lists everything you’ve spent and owe on your credit cards. Some statements also include how many points you’re earned. your expenses.

3.11 Credit Score

It’s basically a report of your borrowing and payback habits. According to you history, it tells credit card companies and financial institutions how likely you are to pay back borrowed money on time.

3.12 Foreign Transaction Fee

A fee that is charge to your card for making purchases in a currency other than your own.

3.13 Cashback

A reward where you get money back on what you spend. It’s like saving a bit on each purchase.

3.14 Security Deposit (Secured Credit Cards)

The amount of money you deposit into the credit card that you will be using. It’s secure because you cannot spend more that this amount. You are using your own money but also and more importantly establishing credit and trust with the credit card companies.

3.15 Rewards

Rewards are perks like points and miles you earn from using your card. Points and miles can be applied to for example, getting cheaper (or free) airline tickets, hotel rooms, merchandise, gifts and many more other things a well.

3.16 Credit Utilization Ratio

It’s a way of measuring how much of your credit limit you are using. Additionally, credit bureaus can see a high credit utilization ratio as a sign of overspending or financial difficulty. So, it’s best to keep this metric low (under 30% of your total available credit) to look good to lenders.

To sum up, knowing these simple terms will help you make better choices and use your credit card wisely.

4. How Credit Cards Affect Your Credit Score

4.1 Understanding Credit Scores

Understanding specifically how the best first credit card for young adults affects one’s credit score is very important for maintaining a good financial standing.

Therefore it’s important to mention that credit card companies, banks and financial lenders use your credit score to determine if they can trust you with the money they will lend you. Moreover, to determine to what degree you’re likely to pay it back or not. So think of your credit score is a numerical value that represents and is used to assess your creditworthiness.

Your credit score is influenced by several factors. This includes your payment history. If you pay your bills on time. How much credit you use compared to your credit limits. This is your credit utilization rate. Another important factor is the length of your credit history. A long positive credit track history is a good thing to have. And the types of credit you have, and any new credit. Too much available credit can sometimes work against you.

4.2 Impact of Credit Cards on Your Credit Score

The best credit cards for young adults are designed to positively influence your credit score when used responsibly. This is how:

Payment History: Making your credit card payments on time is crucial. Late payments can significantly hurt your credit score. Credit cards like to get paid on time.

Credit Utilization: Even though you may need it, using up all the available credit on your credit card can negatively impact your credit score because “Maxing it out” looks bad. In truth, tt send a message that you may be are struggling financially. So try to keep your utilization below 30% of your total credit limit.

Credit History Length: Without a doubt, older credit accounts contribute to a longer credit history. As a result, these accounts show more stability and will positively affect your score. However, opening new credit cards frequently can lower the average age of your accounts, potentially reducing your score.

Credit Mix and New Credit: Having a mix of credit types can help your credit score. Things line revolving credit cards, installment loans and credit lines. However, every time you apply for a new credit card, a hard inquiry is made, which might temporarily lower your score.

4.3 Tips for Maintaining a Good Credit Score

Pay Your Bills on Time: Of course, make sure you always pay your bills on time. This cannot be overstated. To put it another way, even one small late payment can hurt your credit and stay in credit file for a long, long time. Consider setting up automatic payments. This will help you avoid any missed deadlines

Don’t Max Out Your Credit Limit: Try not to max anything out. Keep your balances low and manage your credit limits wisely. Keep your utilization amount below 30% of your total credit.

Don’t Apply for Too Many Credit Cards at The Same Time: Too many credit inquiries done in a short period can hurt and even lower your score. Also, only apply for new credit when necessary. Having too many credit cards can hurt your chances of being approved for bigger loan or mortgage that you really want.

Monitor Your Credit Regularly: Regularly monitor your credit report to ensure accuracy and spot potential fraud. If you find errors, make sure to dispute them promptly.

4.4 Credit Score Chart

Here’s a quick rundown of what credit scores mean. This credit score chart will help you understand the different ranges of credit scores and how they rate. It’s based on the on the FICO® Score Scale, which is one of the most commonly used and accepted credit scoring models. To check your credit score for FREE visit: AnnualCreditReport.com.

| Credit Score Range | Quality |

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very Good |

| 800 – 850 | Excellent |

5. Budgeting Tips For The Best Credit Cards For Young Adults

Now that you have one of the best credit cards for young adults, it’s time to learn a few budgeting tips. In truth, for young inexperienced adults, credit cards can be a double-edged sword. When used wisely, they can be a great budgeting tool. They can also be a stepping stone to building great credit. Here are some strategies to help you manage your finances effectively with a credit card:

5.1 Effective Budgeting is Key When Managing the Best Credit Cards For Young Adults

Set a Budget and Stick to It: Without a doubt, you should know what your spending habits are. Ijn fact, to do this you need to track you expenses and your income. So, create a budget where you determine how money you need for things like savings, food, rent and entertainment. Then, only use your credit card for purchases that you know that you can completely pay off by the due date.

Pay Your Balance in Full Each Month: Additionally, make sure you pay off your entire credit card statement balance each month by the due date. As a result you will avoid interest charges because a zero balance has no interest charged to it.

.Beware of Impulse Purchases: When shopping, always avoid impulse purchases because they frequently lead to overspending and debt. In fact, make it a rule to never buy anything on impulse. That is, if you really want something, research it because may be available elsewhere at a cheaper price. Purchase it when you can work it into your budget.

Track Your Spending: Many credit card companies offer budgeting tools on their website or in the form of apps. Some even have spending trackers. Use these features to control your spending.

Avoid Cash Advances: Never take a cash advance. A credit card cash advance come with very high interest rates and fees. Considerably high than those of a regular purchase. If you consider them for emergencies, be prepared to repay them quickly.

By incorporating these budgeting strategies with your credit card use, you can develop healthy financial habits and avoid the pitfalls of credit card debt.

6. How to Protect Yourself from Credit Card Fraud

6.1 Key Credit Card Security Features: Credit Card Fraud Detection

Due to the fact that credit card fraud is a huge problem in today’s digitally connect world, the best credit cards for young adults now come equipped with advanced security features to safeguard against fraud. Specifically,features that help keep your financial information safe and are geared for credit card fraud detection.

Chip Technology: To clarify, nearly all credit cards today come with a chip that’s embedded into the body of tyhe card. Moreover, this chip creates a unique code for each and every transaction you make. As a result, this makes it much more difficult for thieves to copy your card’s information and commit fraud.

Zero Liability Protection: Many credit card companies now guarantee that you won’t be held responsible for unauthorized charges made with your card. You must however report these unauthorized charges as soon as you detect them.

Virtual Card Numbers: These are temporary card numbers that can be used for online shopping. They link to your account but keep your real card number hidden, adding an extra layer of security. Click on this link to find out more about “Understanding Credit Card Tokenization: A New Era of Secure Transactions“.

Credit Card Security Code: A credit card security code is a numbered code on the back (sometimes the front) of your card. It’s also know as CVV number (Card Verification Value). It’s required for most online purchases, proving you have the actual card with you.

6.2 Tips to Keep Your Card Safe

Here’s what you can do to keep your card and money secure. Start putting these safety features into practice.

Protect Your Card Information: Once outside of a transaction, never share your credit card number, PIN, or CVV number with anyone. Also always remember to keep these things confidential. When not in use, keep your credit card out of sight.

Review Your Statements: Of course, you should always check your card statements regularly. In fact, make it a point to look for any charges you don’t recognize or anything suspicious at all. As a result, if you find something and it looks wrong, contact your card company immediately.

Secure Your Online Transactions: Due to the growing sophistication of hackers and fraudsters, make sure to use strong passwords on websites where your credit card information is stored. Obviously, the more complicated the password, the better. Equally important, never save a password on a public computer.

Set Transaction Alerts: Once you’ve downloaded the credit card company’s app, using it to set up alerts that will send you a message every time a transaction is made. This is without a doubt a great way to catch fraud right away.

6.3 Extra Precautions You Can Take

Use a Secure Network: Despite its mass availabilty, always try to avoid shopping or banking over public Wi-Fi. Make sure you’re on a secure internet connection before entering your card information online.

Consider Credit Monitoring: Also, consider enrollong in a credit monitoring service because this service will alert you of any changes to your credit report. When sudden changes occur, they can be a sign of unauthorized or fraudulent actions. This is indeed a great way to keep an eye on things.

In summary, by understanding these security features and practicing vigilant behaviors, you can help protect your credit card from fraud and keep your financial life secure.

How to Transfer a Credit Card Balance: A Step-by-Step Guide

- How to Transfer a Credit Card Balance: A Step-by-Step Guide

- Step 1: Understand Your Current Situation

- Step 2: Find the Right Balance Transfer Card

- Step 3: Check Your Eligibility and Apply

- Step 4: Contacting the New Credit Card Company

- Step 5: While Waiting for the Transfer …

- Step 6: Verify the Transfer and Understand Your New Terms

- Wrapping Up: Navigate Your Balance Transfer Like a Pro

How to Transfer a Credit Card Balance: A Step-by-Step Guide

How to transfer a credit card balance is fairly simple to do. Why would what to do this? Because moving your credit card balance to another card with a better interest rate can really help you manage your debt more effectively. In fact it can help you cut down on how much interest you pay. It could save you a lot of money. It’s like getting a better deal on a loan you already have. This can make a big difference in how quickly you can pay off your debt, since less of your money goes to interest.

In this guide, I’ll break down the process of exactly how to transfer a credit card balance into simple, easy-to-follow step-by-step instructions. Firstly, we’ll look at how to figure out if transferring your balance is the right move for you. Secondly we’ll learn how to pick the best new card for your balance. Thirdly, we’ll discover what you should do after you’ve made the transfer. This way, you can make a smart choice that helps you reduce your debt faster and save money on interest, giving you more control over your finances.

This checklist is a concise summary of all the important steps you must take when learning How to Transfer a Credit Card Balance. Download it and keep it handy. Use it to transfer your credit card balance without missing a step.

Step 1: Understand Your Current Situation

Starting with a balance transfer requires a solid grasp of your present credit card situation. It’s important to not only know the total debt you’re carrying across all your cards but also to know the interest rates being applied to each. Different cards might have different rates, and these rates directly influence how quickly your debt can grow over time.

Additionally, take note of any annual fees you’re currently paying. These fees can accumulate and add to your debt. Understanding the details. This is the groundwork for getting out of debt.

This step is about more than just numbers; it’s about understanding the nature of your debt. Are these high-interest debts that are growing quickly? Are there specific cards that are costing you more due to higher rates or fees? This information is crucial because it allows you to identify whether transferring your balance to a card with a lower interest rate or a promotional 0% APR offer could provide significant financial relief.

Moreover, simply understand that in this game, credit score is king. In fact, your creditworthiness will directly affect your eligibility for the most competitive balance transfer offers. The best deals are often reserved for those with good to excellent credit. You can verify your credit rating in step 3.

So take the time to fully understand your current credit card debt, interest rates, annual fees, and credit score. This is the knowledge you need to make an informed decision. You can then accurately assess the potential benefits of a balance transfer, ensuring that any move you make is genuinely in your best financial interest.

Step 2: Find the Right Balance Transfer Card

Not all balance transfer cards are equal. In fact, aim for cards with minimal balance transfer fees (ideally 0%), lengthy 0% APR introductory periods (think 12-18 months), and no annual fees. Read the fine print – especially the post-introductory APR. Finding these gems is easy! Reputable finance websites like NerdWallet: https://www.nerdwallet.com/ or Bankrate: https://www.bankrate.com/ offer comparison tools to find the perfect card for your debt.

If you’re looking to find business balance transfer cards, I’ve created a blog post just on this topic alone. Click on the link to see “The Best Cards For A Business Credit Card Balance Transfer“.

Step 3: Check Your Eligibility and Apply

3.1 Check Your Credit Score

The first thing to do is to check you credit score. This will show you if you’re eligible for a balance transfer. This is a crucial step. As stated earlier, most credit card companies require that you have a good to excellent credit score. If you do, you have a very high probability of being accepted for their balance transfer card and the best deals they offer.

There are several way to check your credit score for free:

- AnnualCreditReport.com: The only source for free credit reports authorized by federal law. Visit (http://www.annualcreditreport.com).

- Credit Card Issuers: Many offer free credit score access to their customers.

- Major Credit Bureaus: These companies offer credit score access, sometimes for a fee. The three major ones are: Experian (https://www.experian.com/), Equifax (https://www.equifax.com/), and TransUnion (https://www.transunion.com/)

- Third Party Websites: Websites like Credit Karma (https://www.creditkarma.com/) or Credit Sesame (https://www.creditsesame.com/) provide free credit scores and credit monitoring.

3.2 The Financial Information You Should Have On Hand

The online application for a balance transfer credit card will require some basic financial information to process your request. Moreover, having this information readily available will help streamline the application process and avoid delays. These are the specific financial details you’ll want to gather to ensure a smooth application experience.

- Personal Identification Information (name, address, Social Security number)

- Employment Status and Income Details

- Monthly Housing Costs (rent or mortgage)

- Total Transfer Amount: The total amount of credit card debt you wish to transfer.

Step 4: Contacting the New Credit Card Company

The approval process may take anywhere from a few days to a week. Once you’ve been approved for a new balance transfer credit card you’ll need to initiate the transfer process with your new card issuer. This typically involves contacting their customer service department by phone or secure online message. Now we’ll outline the information you’ll want to have on hand and what questions you should ask in order to ensure a smooth transfer process.

4.1 Additional Information You Will Need To Provide

When you contact the new credit card company to initiate the transfer, be prepared to provide:

- Your new credit card account information

- Contact information for both yourself and the old credit card issuer

- The payment address of the old credit card if it’s different from the customer service address

4.2 Questions to Have On Hand

Initiating the balance transfer with your new credit card issuer is exciting! Before you get started, there are a few key details to confirm to ensure a seamless and cost-effective transfer. By asking the following questions, you’ll gain valuable insights that can help you:

Q1: What is the deadline for completing a balance transfer to take advantage of any introductory offers?

- Many balance transfer cards offer a 0% introductory APR on transferred balances for a limited time (often 12-18 months). This is a major perk that can save you significant interest charges. But, missing this deadline could mean you’ll be charged the card’s regular APR on the transferred amount, negating some of the benefit.

Q2: How long will the balance transfer process take?

- This helps you manage your existing credit card balance. Knowing the timeframe allows you to avoid making additional payments to the old card while the transfer is in progress. You might also need to adjust upcoming payments to prevent late fees on either card.

Q3: Are there any balance transfer fees, and how are they calculated?

- Not all balance transfer cards have fees, but some do. Understanding these fees is crucial. They can be a flat fee or a percentage of the transferred amount. Therefore knowing how they’re calculated, can help you factor in the total cost of the transfer and compare different card offers effectively.

Q4: What happens if the transfer amount exceeds my new credit limit?

- In truth, some credit card companies may not approve a balance transfer exceeding your new credit limit. Knowing their policy beforehand helps you avoid application delays and potential disappointment. Some issuers might approve a partial transfer for the amount that fits within your limit.

Step 5: While Waiting for the Transfer …

The balance transfer process typically takes between a few days and several weeks to complete. While you wait for your debt-free future to arrive, there are proactive steps you can take to stay ahead of the game. Let’s explore some ways to make the most of this time:

5.1 ProAction Steps To Take

- Continue making payments on your old card to avoid late fees until you confirm the balance has been successfully transferred.

- Begin planning your repayment strategy for the new card, taking into account the introductory period’s duration.

- Monitor both your old and new credit card accounts regularly to catch the transfer as soon as it happens.

Step 6: Verify the Transfer and Understand Your New Terms

Congratulations on completing your balance transfer! Before you reap the benefits of a lower interest rate, one final step remains: verifying the transfer and understanding your new credit card’s terms. This ensures you receive the full amount requested, avoid unexpected fees, and maximize the introductory offer.

6.1 What to Verify

- Complete Transfer: Confirm the entire balance you requested has been moved to your new card.

- No Surprise Charges: Scrutinize the transfer details for any unexpected fees.

- The Starting Date: Know the exact starting date of your introductory rate period, so you will be able to calculate when it ends.

6.2 Understanding the Terms:

Familiarize yourself with these key terms to effectively utilize the balance transfer and avoid unnecessary costs:

- Interest Rate: This is the rate applied to your transferred balance after the introductory period ends. A lower rate translates to less interest paid.

- Introductory Period: This is a limited timeframe (often 0% interest) to pay down your transferred balance without accruing interest charges. Understanding the start date is crucial for calculating when this period concludes.

- Balance Transfer Fee: This is a common fee, typically a percentage of the transferred amount, charged for processing the transfer.

- Annual Fee: Some cards have a yearly charge for card usage. Factor this into your decision.

- Late Payment Fees: These are penalties imposed for late payments on your balance. Be aware of the fee to avoid additional charges.

- Credit Limit: This is the maximum amount you can borrow on your new card. Be mindful not to exceed this limit while paying off the transferred balance.

This checklist is a concise summary of all the important steps you must take when learning How to Transfer a Credit Card Balance. Download it and keep it handy. Use it to transfer your credit card balance without missing a step.

Wrapping Up: Navigate Your Balance Transfer Like a Pro

Embarking on a balance transfer can be a transformative step towards smart financial management and interest savings. Our comprehensive “How to Transfer a Credit Card Balance: A Step-by-Step Guide” has armed you with the essential know-how to proceed with confidence. This process, when done correctly, not only offers a pathway to reduce your interest rates but also simplifies your debt under a more manageable umbrella.

Key takeaways include the importance of firstly choosing a suitable card, secondly closely examining the terms, and thirdly crafting a repayment plan that aligns with your financial goals. Therefore, once you’re armed with the knowledge from our guide, you’re poised to tackle your credit card debt more effectively, potentially saving you a significant amount in interest charges.

As you move forward with your balance transfer, remember the significance of the steps outlined in our guide. Sharing this knowledge could also empower friends or family looking to optimize their financial strategies. Keep following us for more insights into making your finances work harder for you. Your journey towards a more financially savvy future is just beginning.

The Best Cards For A Business Credit Card Balance Transfer

A business credit card balance transfer can be a powerful tool that can transform a company’s financial health and operational efficiency. In fact, this strategic technique can help a business reduce costs, consolidate debt and increase cash flow.

In this blog post we will take a look at the 5 best credit cards for business balance transfers on the market. We will clearly explain what a balance transfer is, what it entails and the substantial advantages it holds for businesses. By understanding the full scope of benefits and how to effectively employ this strategy, businesses can unlock a powerful tool for enhancing their financial operations and overall growth.

So let’s spotlight the 5 best business balance transfer cards

Five Best Business Balance Transfer Cards

1. PNC Visa® Business Credit Card

0% Intro APR: For 13 billing cycles on balances transferred within 90 days.

Balance Transfer Fee: 3% or $5, whichever is greater.

Unique Benefit: Offers a longer 90 day window for balance transfers, providing flexibility for debt payoff strategies. No annual fee but lacks rewards.

Advantage: Suited for businesses focusing on paying off existing debt without distractions.

2. U.S. Bank Business Platinum Card

0% Intro APR: For 18 billing cycles.

Balance Transfer Fee: Applicable during the 0% introductory period.

Unique Benefit: Offers tools like Visa Spend Clarity for tracking expenses and the option to divide eligible purchases into monthly payments without interest via the ExtendPay® Plan.

Advantage: Ideal for transferring significant balances and benefiting from a long interest free payment period with no annual fee.

3. U.S. Bank Business Triple Cash Rewards World Elite Mastercard®

0% Intro APR: On purchases and balance transfers for 15 billing cycles.

Balance Transfer Fee: Charged during the introductory period.

Unique Benefit: Earn up to 5% cash back on eligible business expenses and an annual $100 statement credit for recurring software subscriptions. Offers cash back rewards alongside the balance transfer feature.

Advantage: A great option for businesses looking to earn rewards on their spending while also taking advantage of the balance transfer offer.

4. Edward Jones Business Plus Mastercard®

0% Intro APR: On balance transfers for the first 12 billing cycles for transfers made in the first 60 days.

Balance Transfer Fee: 0% intro fee for transfers in the first 60 days, then 3%.

Unique Benefit: Offers Loyalty Points® on purchases, with increased points for spending over $40,000 annually. Designed for Edward Jones clients to maximize rewards alongside managing debt.

Advantage: Best suited for Edward Jones clients looking to combine rewards earning with a balance transfer option.

5. M&T Bank Business Rewards Credit Card

0% Intro APR: For 12 months on balance transfers.

Balance Transfer Fee: 4% or $10, whichever is higher.

Unique Benefit: Offers rewards on purchases, including gas stations, office supply stores, cell phone service providers, and restaurants.

Advantage: A solid choice for businesses in the mid-Atlantic states looking to earn rewards while also consolidating debt.

Now with these cards in mind, let’s delve into what makes a business credit card balance transfer such a strategic financial move

What is a Business Credit Card Balance Transfer?

When a company decides to transfer the amount owed on one business credit card to another, it’s engaging in what’s known as a business credit card balance transfer. In truth, this isn’t just moving debt around; it’s a calculated decision often made to take advantage of lower interest rates or better terms that the new card offers. In fact, this strategy goes beyond merely managing debt and can strategically position the business for better financial health. From lowering costs to improving the flow of cash within the company, the benefits of executing a well-thought-out balance transfer are vast and valuable.

The Process of a Business Credit Card Balance Transfer

Kicking off a balance transfer for your business credit card is a bit like finding your way through a financial puzzle. The idea is to get a handle on your debt and maybe even improve your cash flow situation. Think of it as following a map with several key stops along the way, each one getting you closer to a place where your business’s money matters are in better shape. As we walk through what these steps are, I’ll share some straightforward tips and insights, the kind you’d get from a friend who’s been through it before. Let’s tackle this step by step, focusing on making things better for your business’s bank account.

1. Look Closely at Your Business Finances:

- Evaluate Your Debt: Start by totaling up the debt on all your business credit cards. It’s just like taking inventory but of what you owe.

- Review Your Cash Flow: Check your monthly cash flow—how much money comes in and goes out. This will help you figure out how much you can realistically pay towards the debt each month.

- Check Your Credit Score :Your credit score matters here. A higher score usually opens the door to better balance transfer deals.

- Consider Other Debts: Don’t forget about any other loans or money your business owes. It’s all part of the big picture.

2. Find the Best Balance Transfer Card for Your Business:

- Finding the Ideal Card: Start your search by looking into credit cards that are made for balance transfers. You want to find ones that give you a 0% APR for a good stretch of time on both new purchases and any balances you move over. This period where you’re not being charged extra interest is golden because it lets you chip away at your debt without it growing.

- Weighing Your Options: When you’re comparing cards, focus on these details

- Length of the 0% APR Period: In fact, the longer, the better. More time without interest means more opportunity to reduce your debt.

- Balance Transfer Fees: Firstly, check if the card charges a fee to move your balance over. This is typically a percentage of the amount you’re transferring. Secondly, aim for cards that keep this fee as low as possible or don’t have one at all.

- Extra Benefits: Look into any other perks the card might offer, like points, cashback, or travel rewards. These can be nice bonuses once you’ve got your debt under control.

3. Apply for the New Credit Card:

- Creditworthiness: Before applying, assess your creditworthiness. Generally, you’ll need good to excellent credit to qualify for a balance transfer card.

- Application Process: Apply for the chosen credit card. Once approved, you’ll receive your new card along with instructions on how to proceed.

4. Arranging the Balance Transfer:

- Reach Out to Your New Card Company: Let them know you’re ready to move a balance over. In fact, you’ll need to give them the specifics like which account it’s coming from, that account’s number, who the issuer is, and how much you’re transferring.

- Kick Off the Transfer: After you’ve given them all the details, the credit card company takes over. They’ll get in touch with your old credit card’s bank to transfer the amount you specified to your new card.

- Check That Everything’s Settled: Once they tell you the transfer is done, take a look at your new card’s statement to make sure the transferred balance shows up correctly.

5. Pay Down Your Debt on the New Card:

“How long does a balance transfer take from one credit card to another…” is a question people always ask when transferring balances from one credit card to another. Generally speaking, the transfer takes between five to seven business days. Once that is done, you can them…

- Zero Out the Old Card: Make sure the old balances are fully paid off and your old cards now show a zero balance.

- Focus on the New Card: Now, focus on paying off the new card. The aim is to clear all the transferred debt before the 0% APR period ends to avoid any interest.

Approaching business balance transfer cards in this way—methodically and with a good understanding of your financial situation—can be a strategic move to lower your business’s debt load. Keep your eyes on the prize: eliminating that debt during the no-interest window.

Key Benefits of a Business Credit Card Balance Transfer

1. Save on Interest Costs

Because, businesses always want to explore ways to reduce the interest they pay on existing credit card balances they naturally gravitate to a balance transfer credit card which allows them to transfer their outstanding balance from a high-interest credit card to one with a lower introductory rate. By doing so, they aim to minimize the portion of their payments that goes toward interest and allocate more funds toward paying down the principal balance. The end result is that businesses can significantly reduce the amount of interest paid, leading to considerable cost savings.

2. Consolidate and Managing Debt

Business owners may have multiple credit cards with varying balances and interest rates. Therefore, by transferring balances to a single card, they can consolidate their credit card debt and simplify their financial management. Moreover, this consolidation can help them keep track of payments and potentially save money on interest.

In short, by opting for a business credit card balance transfer, businesses can manage their debt more effectively.

3. Improve Your Cash Flow

So, the honest truth is that the majority of businesses, if not all, need cash flow to operate on a daily, weekly and monthly basis. A business credit card balance transfer allows a business to secure a lower interest rate in the process. The lower interest rate can free up a lot of cash and increase the business’ cash flow. Then this allows the business to invest in growth opportunities, replenish inventory, or cover operational expenses. Things that may have been impossible to do or limited before the switch.

Done correctly, a transfer balance can give a business the flexibility to free funds, channel then into other essential areas and enhance their overall financial maneuverability.

4. Taking Advantage of Offers

The allure of balance transfer promotions lies in their ability to slash or even erase interest costs for a set period. Offers, such as zero or low-interest are a golden opportunity. They are a strategic window that allow businesses to aggressively tackle debt without the burden of growing interest. By taking advantage of these offers, businesses can not only ease their financial load but also speed up the process of becoming debt-free.

The outcome of these offers is a more efficient path to debt reduction, significant savings, and an overall enhancement of the business’s financial leverage.

5. Streamlining Finances

A balance transfer (and the consolidation of debts) can simplify financial oversight by reducing the number of accounts to monitor. Because of this it can be easier for the business to track expenses, manage payments, and maintain a clearer overview of the business’s financial health.

6. Better Financial Management

The process of consolidating multiple credit card balances into one through a balance transfer doesn’t just reduce clutter. In truth, it brings about better financial management. Moreover, this consolidation makes it simpler to track expenses, manage payments, and maintain a clearer overview of the business’s financial health. It eliminates the confusion of juggling multiple accounts.

So the end result of a business credit card balance transfer and the consolidation of debt brings about a more organized and manageable financial environment for businesses.

7. Avoid Penalty Fees

In financial management, late fees and penalty rates are missteps that can throw off your rhythm. In contrast, a timely balance transfer acts as a corrective step, moving your balance to a card with a payment plan and terms that better suit your payment capabilities. This is especially true for a business struggling to keep up with multiple due dates. This proactive approach not only avoids unnecessary fees but also shields your credit score from potential harm, ensuring the business remains on solid financial footing.

In summary, with the strategic use of balance transfers, businesses can effectively dodge the pitfalls of late fees and high-interest rates. So the outcome is a more stable financial position, safeguarding the business’s budget and credit health.

Conclusion

The strategic use of a business credit card balance transfer can offer a lifeline to businesses aiming to navigate the complexities of debt management and financial optimization. By carefully selecting the right credit card, as detailed at the outset of this exploration, businesses can harness these transfers not only as a tool for managing existing debt but as a strategic asset for financial planning and growth.

As with any financial strategy, the key to maximizing the benefits of a business credit card balance transfer lies in thorough research, careful planning, and a clear understanding of the terms and conditions involved. With the right approach, businesses can leverage balance transfers to not only alleviate financial burdens but also to pave the way for sustained financial health and operational success.

Side Note:

Firstly, does your business accepts online payments? Secondly, are you concerned about the security of online transactions and safeguarding the privacy of cardholders’ information? If so, then please click on the following blogpost link. The blogpost is titled “Understanding Credit Card Tokenization: A New Era of Secure Transactions“. It will help you understand how credit card tokenization technology can help you secure online payments and customer information. Moreover, it will help give you insight on how to move forward in terms of online security which is paramount in today’s business digital word.

What Are The Best Credit Cards For Travel Points

- 1. Understanding Your Travel Aspirations

- 2. Exploring The Many Travel Credit Card Options

- 3. Comparing Reward Programs: Making Informed Choices

- 4. Top Credit Cards Tailored for Your Travel Style

- 5. Maximizing Your Credit Card Travel Rewards

- 6. Before You Apply: A Crucial Step

- 7. Final Thoughts: Choosing the “Perfect” Card

- 8. Disclaimer

The quest for the best credit cards for travel points begins with a simple proposition: imagine transforming your routine purchases into the ticket to your next grand adventure. Picture the possibility of minimizing travel expenses while savoring the joy of exploring new destinations, tasting diverse foods, and collecting unforgettable experiences. This is the essence of leveraging travel points credit cards. Above all, a strategic approach to earn rewards that make travel more accessible and enjoyable.

This guide takes you through the intricate landscape of travel points credit cards, highlighting their advantages, evaluating various choices, and guiding you towards selecting the ideal card that aligns with your personal travel dreams. So, prepare yourself for an enlightening voyage as we navigate through the options available, including those that offer the luxury of best credit cards for travel with no annual fee. Or the best travel credit card with lounge access, ensuring your travel is not just memorable, but also remarkably rewarding.

1. Understanding Your Travel Aspirations

1.1 Decoding Travel Rewards: Aligning Benefits with Your Goals

Before diving into the specific cards, we need to demystify how travel rewards programs work. So, the way it works, is that these programs reward you with points or miles for every dollar you spend using your card. These accumulated points can then be redeemed for a variety of travel experiences. Things like flights, hotels, rental cars, and more.

On the other hand, maximizing the value of your credit card travel rewards goes beyond simply earning points. In fact, it’s important to decode travel rewards by considering your preferred airlines, travel frequency, and the perks that matter most to you.

Do you dream of luxurious airport lounge access to unwind before long flights? Do you want comprehensive travel insurance for peace of mind during your adventures? Aligning the card’s benefits with your travel aspirations is key to maximizing its value.

- Preferred Airlines: If you have a favorite airline, look for cards with them or their co-branded partners to maximize rewards on flights and other purchases with that airline.

- Travel Frequency: Do you travel frequently or occasionally? Frequent flyers may benefit more from premium cards with airport lounge access and higher rewards rates, while occasional travelers might prefer cards with no annual fee.

- Desired Perks: Consider what perks matter most to you, such as airport lounge access, travel insurance, statement credits, or bonus points in specific spending categories.

2. Exploring The Many Travel Credit Card Options

Travel credit cards offers a diverse amount of options, each catering to specific needs and preferences. So, let’s explore the main categories:

2.1 Airline-Specific Cards

These cards usually partner up with a specific airline. As a result, they can offer generous rewards and perks which are well tailored to the loyal customers of that particular airline.

Chase Sapphire Preferred® Card:

Earn points and then transfer those points at a 1:1 value to leading frequent travel programs.

Airline Travel Partners

- British Airways Executive Club

- Emirates Skywards®

- Flying Blue AIR FRANCE KLM

- Iberia Plus

- JetBlue TrueBlue

- etc

Hotel Travel Partners

- IHG® Rewards Club

- Marriott Bonvoy®

- World of Hyatt®

Southwest Rapid Rewards® Priority Credit Card:

Earn points on Southwest purchases and enjoy annual travel credit, upgraded boarding, and 25% back on inflight purchases.

Specific Airline

- Southwest Airlines customers

4 Upgraded Boardings Every Year When Available

- Best A1-A15 boarding position available

- First access to seats and overhead bins

- Available to buy via the Southwest app, opens overlaySouthwest.com®, or at the departure gate or ticket counter on day of travel.

2.2 General Travel Reward Cards

If you crave flexibility, these cards offer broader redemption options. Additionally, you can redeem points through various travel portals or transfer them to different airlines and hotel loyalty programs. This flexibility allows you to choose the best options for your specific travel needs.

Capital One Venture X Rewards Credit Card:

Earn miles redeemable for travel with no blackout dates and enjoy Anniversary Bonuses and Annual Travel Credits.

Anniversary Bonus

“Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary.”

$300 Annual Travel Credit

Chase Sapphire Reserve® Card:

Earn points transferable to various travel partners and enjoy premium travel benefits like luxury hotel and resorts and travel insurance.

Point Transfer

“Transfer your points to leading airline and hotel loyalty programs at 1 to 1 value. That means 1,000 Chase Ultimate Rewards points equal 1,000 partner miles/points.“

The Luxury Hotel & Resort CollectionSM

“Take advantage of cardmember perks such as a room upgrade and daily breakfast at over 1,000 properties when you book with The Luxury Hotel & Resort Collection.“

2.3 Co-Branded Cards

Additionally, these cards forge partnerships with hotels, rental car companies, or other travel service providers. They often come with exclusive perks such as free upgrades or priority access. Moreover, cardholders can earn points or miles that can be redeemed for future travel expenses.

Marriott Bonvoy Boundless® Credit Card:

Earn Marriott Bonvoy points for hotel stays and enjoy perks like elite status and free night certificates.

Up to 17X total points at Marriott

“Earn 6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card.“

Elevate Your Status

“Earn 1 Elite Night Credit towards Elite Status for every $5,000 you spend.“

Hilton Honors American Express Surpass® Card:

Earn Hilton Honors points for hotel stays and enjoy benefits like automatic Hilton Honors Gold Status and airport lounge access through Priority Pass Select membership.

Hilton Honors Gold Status

“Complimentary Gold Status: Gives you great perks like the 5th night free on standard room stays of 5+ nights booked with 100% Points and an 80% Bonus on all Base Points so you can earn free nights faster.“

Priority Pass™ Select

“...enjoy access to over 1,000 lounges in over 120 countries when you enroll in your complimentary Priority Pass™ Select membership… “

3. Comparing Reward Programs: Making Informed Choices

Understanding the different types of cards is only half the battle. When comparing options, it’s crucial to delve deeper into the specifics of their reward programs.

3.1 Travel Points Credit Card vs. Miles Credit Card

Miles and points are the currencies that fuel travel rewards programs. Additionally, they have distinct characteristics. For example, miles are usually tied to specific airline loyalty programs. Moreover, their redemption value often fluctuates depending on the airline and the chosen flight route. On the other hand, a travel points credit card offers more flexibility. Specifically, you can redeem your points through travel portals, transfer them to various airline and hotel partners, or even use them for statement credits to offset travel expenses.

3.2 Valuable Perks that Enhance Your Travel Experience

Travel credit cards offer a plethora of perks that go beyond the basic points and miles. Let’s take a look at…

3.2.1 Airport Lounges

In truth, airport lounges are very convenient and extremely comfortable. As a result, you can use them to relax and escape the hustle and bustle of the busy airport terminal. In fact, they offer things like comfortable seating, complimentary refreshments, and Wi-Fi access. So, we will now look at some of the best travel credit cards with lounge access. This can be extremely helpful to you if you travel frequently and appreciate a relaxing pre-flight experience.

3.2.2 Travel Insurance Protection Benefits

Consider selecting credit cards that offer robust travel insurance protection plans. These benefits are crucial for covering you in case of unexpected travel disruptions, such as trip cancellations, medical emergencies while abroad, or issues with luggage. Moreover, having this kind of support can be reassuring, reducing worries and potential financial burdens if plans don’t go as expected.

3.2.3 Statement Credits

Additionally, look into credit cards that offer statement credits, thereby effectively reducing the cost of the card’s annual fee or being applied to travel-related expenditures. In this way, you could save money on travel by using this feature, such as airline charges or hotel room upgrades.

3.3 Earning Rates

Credit cards have diverse approaches to rewarding spending habits. For example, certain cards may provide enhanced points or miles for every dollar spent on categories such as travel, dining, and fuel. You might encounter a card that rewards you with double miles for spending on airlines, while offering triple points for expenditures on dining and entertainment venues. Understanding the intricacies of these reward rates is crucial for getting the biggest benefits from routine expenses. Therefore, understanding these rates is crucial to ensure that the card you select resonates well with your purchasing patterns, enabling you to optimize the rewards you accumulate.

3.4 Redemption Options

The real worth of loyalty points or miles is determined by how flexibly you can use them. Moreover, some of the best credit cards for travel points offer flexible redemption options that can enhance your travel experience. Furthermore, certain credit cards provide the option to exchange your rewards for airline tickets, hotel stays, car hire services, or even credit back on your statement for travel costs.

In addition, these top-tier cards present a variety of redemption possibilities, guaranteeing that you can utilize your points or miles to align with your travel ambitions, be it securing a seat in business class or reserving a stay at a high-end hotel

3.5 Annual Fees

A number of travel-focused credit cards include membership costs, known as annual fees. These fees vary widely, starting at less than $100 and can escalate to a few hundred dollars, depending on the card. However, the advantages provided, such as access to exclusive airport lounges, comprehensive travel protection plans, and opportunities to earn additional points, often surpass the expense for those who travel regularly. Evaluating the value of these perks against the fee is crucial, especially when you take into account your specific travel frequency and expenditure habits.

4. Top Credit Cards Tailored for Your Travel Style

4.1 Best Credit Cards For Travel No Annual Fee

For those prioritizing minimizing fees while maximizing travel rewards, consider cards offering a compelling travel points credit card experience without an annual fee. These cards are ideal for occasional travelers or those wanting to explore the world of travel rewards before committing to cards with higher annual fees.

However, it’s important to note that cards with no annual fees might offer lower rewards rates or fewer perks compared to cards with annual fees. Here are some of the best credit cards for travel with no annual fee:

Capital One VentureOne Rewards Credit Card:

Earn miles redeemable for travel with no blackout dates and enjoy purchase protection and travel assistance. This card is offered with no annual fee.

Annual Fee

$0 Annual Fee

Unlimited Rewards

“Earn unlimited 1.25 miles per dollar on every purchase.

Earn unlimited 5 miles per dollar on hotels and rental cars booked through Capital One Travel“

Citi® Double Cash Card:

Earn cash back on all purchases, which can be used towards travel expenses or anything else. This card does not have an annual fee.

Annual Fee

$0 Annual Fee

2%Cash Back

“Unlimited 1% cash back when you buy, plus an additional 1% as you pay, on every purchase.“

4.2 Best Travel Credit Card With Lounge Access

In truth, for those who spend their lives soaring through the skies, the allure of the best travel credit card with lounge access is undeniable. Moreover, these cards cater to frequent flyers by offering premium travel experiences, including access to airport lounges, priority boarding, free checked bags, and generous rewards on airline purchases.

In fact, many even offer annual travel credits that can be used to offset travel expenses or upgrade your flight experience to a more comfortable journey. However, cards with these premium perks often come with higher annual fees, so ensure you travel frequently enough to justify the cost. Consider cards like:

United℠ Explorer Card:

Earn bonus miles on United purchases and enjoy features like free checked bags, priority boarding, and access to United Clubs℠ lounges when flying domestically.

Earn 60,000 Bonus Miles

” after you spend $3,000 on purchases in the first 3 months your account is open.“

United Clubs℠ Lounge Access

“Relax in comfort while waiting for your flight with complimentary beverages, snacks, high-speed Wi-Fi in our United Clubs℠ lounges “

The Platinum Card From American Express:

Earn bonus miles, travel reward and a luxurious suite of benefits with the American Express Platinum Card. Earn credit on dining and and enjoy access to 1,400 airport lounges in over 500 airports around the world.

$200 Annual Dining Credit

“Get the room upgrade with the $200 Annual Travel Credit. Use it towards any single travel booking of $200 or more on your Card, made through American Express Travel Online or Platinum® Card Travel Service.”

American Express Global Lounge Collection®

“…access to 1,400 airport lounges in over 500 airports around the world. Whether you’re looking for a place to rest and recharge or somewhere to catch up on work, enjoy our growing network of lounges across 140 countries and counting.“

4.3 Exploring the Globe: Essential Features for Adventurous Spirits

If you seek adventures off the beaten path, you’ll need a card tailored for global adventurers, offering features like:

4.3.1 No Foreign Transaction Fees

This eliminates the additional charges incurred when using your card internationally, which can add up quickly and eat into your travel budget. Look for cards like the:

Capital One Quicksilver Cash Rewards Credit Card:

Earn cash back on your everyday purchases and a low introductory APR with the Capital One Quicksilver Cash Rewards Credit Card. Take advantage of a $200 one-time cash bonus and no foreign tranaction fees.

Earn $200

“…as a one-time cash bonus once you spend $500 within 3 months from account opening.“

No Foreign Transaction Fees

“…no foreign transaction fees on purchases made outside of the United States.“

Charles Schwab Platinum Card®

Available to people who currently have a Schwab account with Schwab One® or Schwab General Brokerage. Use them to earn 5X the Membership Rewards® points when booking hotels through the Amex website, and avoid extra charges on your international purchases.

Earn 5X Points

“…5X Membership Rewards® points on eligible prepaid hotels booked through AmexTravel.com, including The Hotel Collection.“

No Foreign Transaction Fees

“No foreign transaction fees from American Express when using your Card. “

4.3.2 Comprehensive Travel Insurance

As mentioned earlier, travel insurance protects you against unforeseen circumstances that may affect your trip, your person, or your possessions. This ensures you can focus on exploring with peace of mind, knowing you’re covered if things go awry. Consider cards like the

Marriott Bonvoy Brilliant® American Express® Card:

The Marriott Bonvoy Brilliant® Card is an excellent choice for travelers. It offers several compelling benefits and several travel insurance coverages to enhance your peace of mind during your journeys.

Access to Priority Pass™ Select

“…granting unlimited lounge access in over 1,200 lounges across 130 countries, regardless of your airline or class of travel.“

Trip Cancellation And Interruption Insurance

“…provides insurance for trip cancellation and interruption*, as well as coverage for delays over six hours for qualifying reasons. To be eligible for this coverage, your round-trip ticket must be fully purchased with this card.”

Southwest Rapid Rewards® Plus Credit Card

The Southwest Rapid Rewards® Plus Credit Card is designed for travelers who enjoy flying Southwest Airlines. It offers several valuable benefits along with travel insurance coverage such as Purchase, Lost Luggage, and Baggage Delay protection.

Earn 50,000 points

“Earn 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening.”

Travel Insurance Coverage

“Includes many travel coverages such as Trip Cancellation and Interruption Insurance, Trip Delay Insurance, Baggage Delay Insurance, Hotel Burglary Insurance etc…”

4.3.3 Airport Lounge Access, Even When Flying Internationally

Some premium travel cards offer access to exclusive airport seating areas regardless of the airline you fly with. This allows you to relax and recharge in a comfortable environment before your international flight, even if you’re not flying on the partnered airline. Cards like the

United ClubSM Infinite Card

The United ClubSM Infinite Card Credit offers rewards, benefits and unlimited United Club lounge access, offering a blend of luxury and convenience for a superior airport experience. It’s the perfect choice for travelers seeking comfort and exclusivity before their flights.

Earn 80,000 bonus miles

“…after you spend $5,000 on purchases in the first 3 months from account opening.”

Exclusive Access To United Club Lounges Worldwide

“…offer a place to work, relax, and enjoy complimentary beverages and snacks before your flight. The primary Cardmember and eligible travel companions will enjoy access to all United Club locations and participating Star Alliance™ affiliated lounges worldwide.”

Citi® / AAdvantage® Executive World Elite Mastercard®

The Citi® / AAdvantage® Executive World Elite Mastercard® is the ultimate travel companion, offering a suite of benefits including complimentary Admirals Club lounge access. In addition, cardholders enjoy a premium airport experience, enhanced mileage earnings on American Airlines purchases, and a range of travel perks. This card defines luxury travel with its exclusive advantages.

VIP Access

“Enjoy an enhanced airport experience including priority check-in, screening, and boarding when flying with American Airlines.”

Admirals Club®Membership

“Complimentary Admirals Club® membership (a value of up to $850) and partner lounge access for primary cardmember.”

4.3.4 Diverse Reward Earning Opportunities

Many travel cards offer reward multipliers on foreign purchases, allowing you to earn points faster while exploring international destinations. This can significantly boost your travel rewards and help you reach your travel goals quicker. Cards such as the:

American Express® Gold Card:

Renowned for diverse reward earning multipliers significantly enhance the earning potential for cardholders, particularly for those who spend a lot on dining, groceries, and travel. Cardholders can accumulate points much faster, which can then be redeemed for a variety of rewards including travel, gift cards, and shopping with AmEx’s merchant partner

4X POINTS On Groceries

“…at U.S. supermarkets on up to $25,000 in purchases per year.”

3X Membership Rewards® Points

“Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com”

Chase Sapphire Preferred® Card:

Offers a very high signup bonus and multiple times the points on travel and dining at restaurants worldwide. Also includes a broad definition of travel, including everything from taxis to hotels, ensuring every dollar spent abroad helps you travel further.

Earn 60,000 Bonus Points

“…after you spend $4,000 on purchases in the first 3 months from account opening.*Opens offer details overlay That’s $750 toward travel when redeemed through Chase Travel.”

High Rewards Rates

“Up to 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining, select streaming services, and online groceries, and 2x on other travel expenses.”

4.4 Foodies & Entertainment Enthusiasts: Indulge Your Passions and Earn Rewards