Advanced Credit Card Hacks (Part 2): Maximizing Rewards for Business and Student Cards

Credit Card Hack:– “a strategic method or technique used to maximize the benefits of credit cards, such as earning more rewards, reducing interest costs, or enhancing your credit score“.

Discover advanced credit card hacks tailored specifically for business owners and students. Are there any specialized ones that can help entrepreneurs maximize their business expenses or assist students in building credit while earning rewards?

Absolutely!

Join us as we explore a new frontier of financial optimization. In this guide, we’ll uncover sophisticated strategies designed to amplify the benefits of both business and student credit cards. Whether you’re managing company finances or navigating the world of credit as a student, these advanced techniques will help you extract maximum value from every transaction.

We’ll explore strategic method or technique that go beyond the basics, focusing on the unique opportunities presented by business and student cards. Get ready to transform your spending into a powerful tool for financial growth and reward accumulation.

Ready to take your reward game to the next level? Great! Let’s begin our journey into the world of advanced credit card hacks for business and student cards.

If you haven’t done so already, click here here to access Part 1 of this blog post series “Advanced Credit Card Hacks (Part 1): How To Maximize Your Cash Back And Cashback Rewards“. Learn how to make the most of your Cash Back and Cashback rewards.

Maximizing Rewards for Business and Student Cards

Welcome to Advanced Credit Card Hacks (Part 2). Mastering the credit card strategies discussed below is essential for those looking to maximize rewards for their Business or Student credit cards. These strategies are the key to unlocking the full potential of your cards. Whether you’re a small business owner seeking to optimize every business expense or a student aiming to build credit while earning valuable rewards, knowing how to strategically leverage your credit cards can make a significant difference.

Business credit cards offer unique opportunities to maximize rewards on business-related expenses. A student credit card can provide a solid foundation for young adults to build credit responsibly all while earning perks. This section delves into advanced strategies tailored specifically for both business and student credit cards. It offers important insights to help you make the most out of every dollar spent. By mastering these techniques, you’ll be well on your way to maximizing your credit card’s potential, ensuring that every swipe works harder for you.

1. Business Credit Cards

When it comes to maximizing the benefits and rewards from credit cards, business credit cards offer unique advantages tailored specifically to the needs of small businesses and entrepreneurs. These cards are powerful instruments for earning significant rewards, accessing valuable perks, and managing cash flow more effectively. By understanding the foundational aspects of business credit cards, you can strategically position your business to gain the most from every transaction, and ultimately boosting profits.

1.1 Introduction to Business Credit Cards

So what is a Business Credit Card?

As the name implies, it’s a credit card that is designed specifically for business owners and entrepreneurs. With this type of credit card, business owners and entrepreneurs can pay for their business expenses and earn benefits and rewards in the process. Benefits and rewards that are tailored to business needs.

Benefits like:

- Expense tracking

- Employee credit card with customizable spending limits.

- Purchase Protection

- Fraud Protection

- Cash Flow Management

Rewards on:

- Office Supplies

- Travel and Dining

- Telecommunications

- Advertising

By understanding the foundational aspects of business credit cards, you can strategically position your business to gain the most from every transaction, ultimately boosting your bottom line.

1.2 Leveraging Business Credit Cards for Rewards

What you want to do is to take full advantage of the benefits and rewards of the cards you’re using. You want to generate the most rewards from your everyday business expenses. To do this, you must leverage your business cards. This is where their true power lies. It could be cash back, or travel points, or any other perk. Leveraging your business credit card effectively can lead to significant savings and benefits. This type credit card hack can dramatically increase the value you receive back.

So how can you leverage your business cards?

By aligning your spending patterns with your card’s usage. So for example, if your business spends a lot of money on office supplies, or travel, or advertising, then apply for a card that offers high rewards in these categories. This will dramatically increase the value you receive back. You can even study the specific rewards structure of your card and plan your spending according to that. This will further maximize your rewards and benefits.

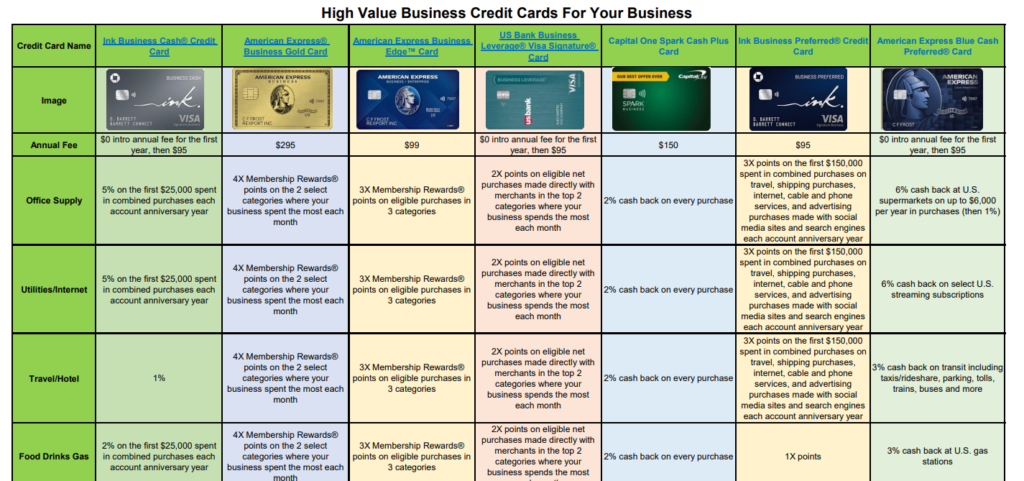

Click the link to download this “High Value Business Credit Cards For Your Business” chart. It list all the business credit cards discussed in this section. It also covers their Cash Back and Rewards, their Sign-up Bonus, Annual Fee and Key Features.

1.3 Choosing the Right Business Credit Card

Choosing the right and best business credit card for your company is more than just selecting the one with the highest reward level. You need to look deeper. This credit card hack involves evaluating several key factors. You need to examine:

Spending habits: In what area or category does your business spends the most amount of money?

Rewards categories: Does the card’s highest rewards and benefits categories align with your spending habits?

Annual fee: Compare the rewards and benefits to the annual fee cost. At first, a card with a higher fee might seem costly. It could be well worth it If it offers valuable perks (such as travel benefits, expense management tools, or rewards) that far exceed the fee in value.

Additional perks: Consider addition perks like travel benefits or an employee credit card with spending limits. Or integration with accounting software or an expense management tool.

The goal is to find a card that not only rewards your everyday spending, but also supports your business operations. By selecting a card that aligns with your business strategy, you set yourself up to maximize rewards and make your business spending work harder for you.

1.4 Maximizing Category Rewards on Business Expenses

So you’ve selected the best business credit card for your business as outlined in the previous section. Great. Now it’s time to maximize your rewards by making the most of the card’s features. This credit card hack involves utilizing category bonuses effectively. Most business cards are designed with specific features that help you get great value out of your spending. Your job is to study these features. To know them very well and to know how to use them effectively.

1.4.1 Utilize Category Bonuses Effectively

You need to find and identify the spending categories where your card offers the most rewards. Is it in dining? What about travel or office supplies? Then you need to align your spending with these categories to earn more points, rewards or cash back. For example:

1.4.1.1 Office Supplies

If you buy a lot of office supplies use a card that offers 5x the points or 5% cash back on office supply purchases. Buy all your office supplies with this card. This is a simple, very well-used credit card hack. Consider a card like the:

Ink Business Cash® Credit Card

Earn 5% cash back

“Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year.“

1.4.1.2 Travel

If travel is a big part of your business, select a card the gives you 3x the points on travel related services. Use the card to pay for the airline tickets, the hotel stays and the car rentals. Maximize your rewards by putting everything travel related on this card. Consider a card like the:

American Express® Business Gold Card

3x the points on travel

“Earn 3x points on airfare purchased directly from airlines and 3x points on hotel stays booked directly through Amex Travel.“

1.4.1.3 Entertainment and Dining

If client entertainment and dining is a major factor of your business, use a card that offers 3x the points or 3% cash back on entertainment and dining expenses. Maximize your rewards by using this card to pay for the business lunches, the dinners, the catered events and the nights out.

American Express Business Edge™ Card

Up to 3X the points on entertainment and dining

“Earn 3X the points on eats & drinks and rides & gas – up to 75,000 Membership Rewards® points and then earn 1X the points on all other purchases.”

1.4.2 Optimize Employee Credit Card Usage

Some business credit cards offer additional cards for the employees of the business. This can be a huge opportunity to maximize your rewards on business expenses. So now your sales representatives, office managers and purchase department can all help increase your rewards.

1.4.2.1 Set Smart Spending Caps For Each Employee

Tailor card limits to each team member’s role and purchasing needs. A sales rep who frequently travels for business may have a spending limit of $5,000 per month for travel-related expenses. This allows them to book flights, hotels, and meals without needing prior approval for each transaction. An office manager might have a limit of $1,000 per month specifically for office supplies, ensuring they can purchase necessary items without exceeding the budget. This approach keeps spending in check while racking up rewards on necessary costs.

US Bank Business Leverage® Visa Signature® Card

No annual fee for employee cards

“… all of the transactions made by each of your employees and make a single payment to your account. “

1.4.2.2 Keep an Eye on the Bottom Line

Most corporate cards offer top-notch expense tracking tools. You can use a platform like Expensify or Concur that integrates with your business credit cards. This allows you to view real-time spending by each employee. It will flag any transactions over their assigned limits or any unusual spending patterns. Things like a sudden spike in restaurant expenses from a particular employee. This bird’s-eye view helps you better manage your bottom line, make savvy decisions about resource allocation and maximize your reward potential.

1.4.2.3 Educate Employees on Rewards Maximization

Teach your staff the importance of using the right card for the right type of purchase. This will help you take full advantage of the potential of employee cards and how quickly they can accumulate rewards and points. For example, have them use the “higher rewards for travel” business card to book and pay for all the travel related expanses. Things like the airfare, the hotel and the car rental. Have them use the “higher rewards for office supplies” business card to pay for the office supplies. The same principle can be applied to entertainment. Your employees should be aware of which card to use to maximize the rewards earned on these transactions.

Employee Credit Card Maximum Rewards Chart

| Credit Card | Employee Cards | Travel | Office Supplies | Dining | Advertising | Transportation | Other Bonuses |

|---|---|---|---|---|---|---|---|

| American Express Business Gold Card | Yes | 4X points on airfare | 4X points on U.S. purchases for office supplies | 4X points at restaurants | 4X points on select U.S. advertising | No specific bonus | 4X points on U.S. gas stations |

| Chase Ink Business Preferred | Yes | 3X points on travel | No specific bonus | No specific bonus | 3X points on advertising purchases with social media sites and search engines | No specific bonus | 3X points on shipping purchases and internet, cable, and phone services |

| Capital One Spark Miles for Business | Yes | 2X miles on all purchases | 2X miles on all purchases | 2X miles on all purchases | 2X miles on all purchases | 2X miles on all purchases | 5X miles on hotel and rental car bookings through Capital One Travel |

| American Express Business Platinum Card | Yes | 5X points on flights and prepaid hotels booked through Amex Travel | No specific bonus | No specific bonus | No specific bonus | No specific bonus | 1.5X points on eligible purchases of $5,000 or more |

| Chase Ink Business Cash | Yes | No specific bonus | 5% cash back on office supply stores | 2% cash back at restaurants | No specific bonus | 2% cash back at gas stations | 5% cash back on internet, cable, and phone services |

| American Express Blue Business Plus | Yes | 2X points on all purchases (up to $50,000 per year) | 2X points on all purchases (up to $50,000 per year) | 2X points on all purchases (up to $50,000 per year) | 2X points on all purchases (up to $50,000 per year) | 2X points on all purchases (up to $50,000 per year) | No additional bonuses |

| U.S. Bank Business Leverage® Visa Signature® Card | Yes | 2% cash back if in top 2 spending categories | 2% cash back if in top 2 spending categories | 2% cash back if in top 2 spending categories | 2% cash back if in top 2 spending categories | 2% cash back if in top 2 spending categories | 2% cash back on top 2 spending categories each month |

1.4.2.4 Centralize Reimbursements

Some businesses have a reimbursement policy for their employees who pay out-of-pocket for specific expenses. Don’t let your employees pay out-of-pocket for anything. Instead, have them use their assigned business credit card to make eligible purchases. This does two things. Firstly, it eliminates or makes the process of getting reimbursed for expenses more efficient. Secondly, it earns the business rewards that may have been otherwise missed.

So as an example, an employee who attends a conference may have to pay for registration, lodging and meals. From now on, these business expenses will be charged to the employee’s assigned business credit card instead of them paying for it. The expenses will be paid by the card and the business will gain the rewards in return.

1.4.2.5 Put Regular Bills on Autopilot

Determine which employee cards will handle your recurring business charges. Things like subscriptions, software fees, or utilities. This set-it-and-forget-it approach keeps the rewards flowing without any extra effort. It’s an inventive way to spread spending across multiple cards and hopefully multiple rewards.

So as an example, you would assign a company card to handle regular recurring expenses. Monthly software subscriptions like Adobe Creative Cloud and Microsoft Office. Or utility bills likle your internet connection ,or electricity. By charging these to a designated employee card, you ensure consistent rewards accumulation. If your team has a card that earns 2% cash back on all purchases, charging a $100 monthly software subscription can earn $2.00 in rewards each month.

Capital One Spark Cash Plus Card

2% cash back on every purchase

“Earn unlimited 2% cash back for your business on every purchase, everywhere, no limits or category restrictions.“

By implementing these examples, you can enhance your spending management strategy, optimize rewards, and streamline your financial processes effectively.

Click here to discover 11 benefits of using employee business cards or Corporate Cards as they are also referred to: “11 Benefits of Corporate Cards for Business“.

1.5 Strategies for Meeting High Minimum Spend Requirements

Snagging that juicy sign-up bonus often means spending a hefty sum in a short time. For small businesses watching their cash flow, this can be tricky. But with some clever planning, you can hit that target without breaking the bank.

1.5.1 Timing Your Application

Try syncing your card application with times when you know you’ll be shelling out more cash than usual. Let’s say you run a small bakery and know you’ll need to replace your industrial mixer soon, costing around $5,000. You could apply for a new business credit card just before making this purchase, using it to meet a large chunk of the minimum spend requirement.

Ink Business Preferred® Credit Card

90,000 bonus points

“Earn 90,000 bonus points after you spend $8,000 on purchases in the first 3 months after account opening.“

1.5.2 Shifting Regular Payments

Got a big inventory restock coming up? Instead of paying your $1,000 monthly inventory bill by check, switch it to your new credit card for 3-4 months. This easily adds $3,000-$4,000 towards your minimum spend.

1.5.3 Prepaying Expenses

Many landlords, utility companies, and insurance providers are cool with you paying a few months ahead. This can give you a quick boost towards that spending goal. So if your business pays $500 monthly for office rent, you could arrange to prepay 6 months ($3,000) on your new card. This helps meet the spend requirement without increasing overall expenses.

1.5.4 Additional

And don’t forget about those big-ticket items you usually pay by check or bank transfer. Vendor services, contracts, even taxes – many of these can go on plastic, turning necessary costs into reward-earning opportunities.

With some savvy planning and a bit of strategy, you can nail those minimum requirements and unlock those sweet bonuses without putting the squeeze on your cash flow.

1.6 Strategic Decision-Making: Business vs. Personal Credit Cards for Maximizing Rewards

1.6.1 Business Card Advantage

Business cards are tailor-made for company needs, dishing out perks for things like office supplies, travel, and ads. Plus, they often come with nifty tools for keeping tabs on business expenses and employee spending. For example, imagine you own a marketing agency. A business card offering 4X the points on advertising spend could be ideal, as you frequently purchase online ads for clients.

American Express® Business Gold Card

Earn 4X Membership Rewards® points

“Earn 4X Membership Rewards® points on the 2 categories where your business spends the most in each billing cycle from 6 categories: Purchases at US media providers for advertising in select media (online, TV, radio)“

1.6.2 Personal Card Benefits

Sometimes a personal card might actually be the better bet for certain spending categories. Maybe it offers killer rewards on groceries or gas, which could be big-ticket items for your business. If you’re dropping serious cash in an area where a personal card shines, it might be worth whipping that one out instead. For example, let’s say you run a small catering business and spend heavily on groceries. A personal card offering 6% cash back at supermarkets might outperform a business card for those specific purchases.

American Express Blue Cash Preferred® Card

6% cash back on groceries

“Earn 6% cash back on groceries Up to $6,000 per year in purchases at U.S. supermarkets.“

1.6.3 Mixing Strategies

Sometimes, depending on the situation you may need to combine or mix the two strategies to achieve the highest rewards possible. The following can be a real life example of a consultant who travels frequently to meet with clients.

Consultant Example: Sarah is a business consultant who frequently travels for client meetings. She has both a business credit card and a personal credit card.

>>Business Credit Card Usage

- Office Supplies: Sarah uses her business credit card, which offers 2x points on office supplies, to purchase items like notebooks, pens, and software subscriptions. For instance, she spends $200 on office supplies in a month, earning 400 points.

- Client Dinners: When meeting clients for dinner, she uses the same business card, which offers 3x points on dining expenses. If she spends $150 on a dinner, she earns 450 points for that transaction.

>>Personal Credit Card Usage

- Flights: For her travel, Sarah has a personal credit card that offers 3x points on airline purchases. When booking a flight for a client meeting costing $600, she uses her personal card, earning 1,800 points.

- Hotels: Similarly, when booking a hotel for a two-night stay at $300 per night, she uses her personal card, earning another 1,800 points (3x points on hotel stays).

That said, business cards often bring more to the table. We’re talking higher spending limits, detailed expense tracking, and the ability to hand out cards to your team. And let’s not forget – keeping business and personal spending separate is crucial for staying organized and keeping the taxman happy.

The secret sauce? Take a good, hard look at the rewards and perks of each card type, and match them up with how your business actually spends money. This way, you can strategically pick the plastic that’ll give you the biggest bang for your buck, making sure every swipe is working overtime for your bottom line..

2. Student Credit Cards

When it comes to building credit history and managing finances while in school, student credit cards offer unique advantages tailored specifically to the needs of college and university students. These cards are valuable tools for establishing credit, earning rewards on everyday purchases, and learning financial responsibility. By understanding the key features of student credit cards, you can make informed decisions about your finances and set yourself up for financial success after graduation.

2.1 Introduction to a Student Credit Card

So what is a Student Credit Card?

As the name implies, it’s a credit card that is designed specifically for college and university students. With this type of credit card, students can make purchases, build credit history, and earn benefits and rewards in the process. These cards often come with features and perks tailored to student life and financial situations.

Benefits like:

- Lower credit limits to help manage spending

- Easier approval process for those with limited credit history

- Educational resources on credit management

- Lower or no annual fees

Rewards on:

- Groceries and dining

- Textbooks and school supplies

- Transportation and gas

- Entertainment and streaming services

By understanding the basics of a student credit card, young adults can start building their credit responsibly while enjoying benefits that align with their student lifestyle. This foundation can set them up for financial success as they transition into their post-graduation careers.

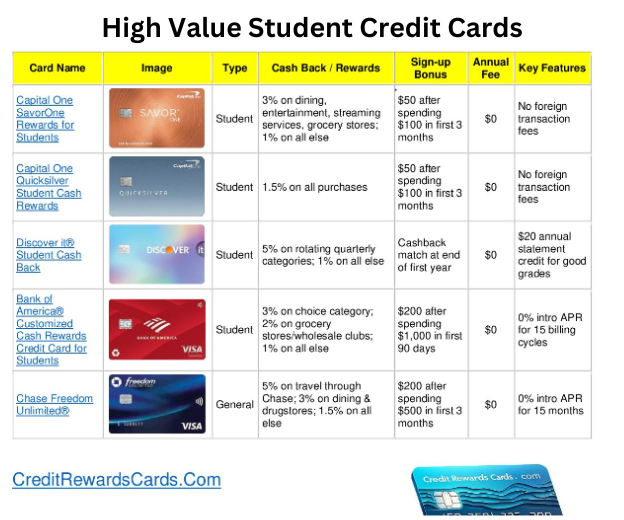

Click the link to download this “High Value Student Credit Cards” chart. It list all the student credit cards discussed in this section. It also covers their Cash Back and Rewards, their Sign-up Bonus, Annual Fee and Key Features.

2.2 Maximizing Rewards While Building Credit Early

Building credit is essential, but why not earn valuable rewards simultaneously? Here’s how to optimize your approach:

2.2.1 Pay in Full and On Time

This is the golden rule of credit card use. Paying your balance in full each month avoids interest charges and demonstrates responsible borrowing to lenders. For example, if you charge $300 in textbooks and groceries, make sure to pay off the full $300 by the due date. This habit will set you up for success when applying for premium cards with lucrative sign-up bonuses in the future.

2.2.2 Start with a Rewards Card

Don’t settle for a basic card. Choose one that aligns with your spending patterns. For instance, if you frequently order takeout or study at coffee shops, look for a card that offers extra points or cash back on dining and cafes. You can earn unlimited 3% cash back on dining, entertainment, and grocery store purchases, making it an excellent choice for students looking to maximize their rewards while managing their budgets.

Capital One SavorOne Rewards for Students Card

Unlimited 3% cash

“Earn unlimited 3% cash back on dining, entertainment, popular streaming services & at grocery stores. $0 annual fee. Plus, earn a $50 cash bonus.“

2.2.3 Keep Your Credit Utilization Low

Aim to use less than 30% of your credit limit to maintain a healthy credit score. If your limit is $1,000, try to keep your balance under $300. This doesn’t mean you can’t spend more than $300 per month – just pay off your balance multiple times throughout the month to keep the reported utilization low. This strategy allows you to earn more rewards while protecting your credit score.

2.2.4 Leverage Small, Frequent Purchases

Use your card for everyday expenses like groceries, transportation, or school supplies. This approach helps build a consistent credit history and accumulates rewards steadily. For example, let’s say you spend $200 a month on groceries, $80 a month on transportation and $20 a month on school supplies. By using a card that earns 1.5% cash back, you’d earn $54 in rewards over a year on purchases you would make anyway.

Capital One Quicksilver Student Cash Rewards Credit Card

1.5% cash back

“Earn unlimited 1.5% cash back on every purchase, every day.“

2.3 Best Student Cards for Maximizing Rewards

Not all student cards are created equal. Here’s how to spot the gems and make the most of your card choice:

2.3.1 Look for Cards with No Annual Fee

A good course of action for students is to keep away from cards that have annual fees. Avoid credit cards that charge you a fee for the privilege of using them. There are plenty of rewarding zero-fee cards out there. As a student, your income will be more than likely limited. Annual fees can hurt you financial and eat into your rewards earnings. Avoid them when you’re just starting out.

Your Best option:

The Discover it® Student Cash Back Card. It has no annual fee and offers 5% cash back on rotating categories each quarter (up to $1,500 in purchases, then 1%), plus 1% cash back on all other purchases. This card also provides a unique bonus: a $20 statement credit each school year your GPA is 3.0 or higher for up to 5 years.

2.3.2 Consider Cards with Introductory Bonuses

Some student cards offer easier sign-up bonuses as an incentive for new student cardholders. They are more attainable than premium rewards cards sign-up bonuses. This is great for students who have limited spending power. They typically have lower spending thresholds, usually ranging from $500 to $1,000 within the first 3 months of account opening.

Your Best option:

The Bank of America® Customized Cash Rewards Credit Card for Students offers a $200 online cash rewards bonus after making at least $1,000 in purchases in the first 90 days of account opening. This may be a good fit if your regular spending is $350 dollars or higher per month. It’s like getting a 20% discount on your purchases.

(As a side note:)

The Capital One Quicksilver Student Cash Rewards Credit Card offers a $50 bonus after spending $100 within the first 3 months from account opening. It’s not the highest bonus, but it’s incredibly easy to earn.

2.3.3 Choose Cards with High Rewards on Everyday Purchases

It’s a good idea to focus on the cards that give you extra points or cash back on the things you regularly buy. If you’re always buying food on campus, choose a card that offers 3% back on dining. Look for cards with bonus categories that match your spending habits. This will help you to maximize your earnings. If you qualify, this hack does not require the credit card to be a student credit card.

Your Best option:

The Chase Freedom Unlimited® Credit Card offers 3% cash back on dining at restaurants, including takeout and eligible delivery services. It also offers a 1.5% cash back on all purchases. It’s an excellent card for students who want to earn dining and purchase rewards. It even offers $0 annual fee. This card is not directly marketed as a student card, but it’s available to students with a credit history.

2.3.4 Evaluate Redemption Options

Flexibility is a key factor in maximizing credit card rewards. Basically, you want a card that gives you options. The freedom to use your hard-earned points and cash back as you see fit. Some cards only let you redeem for statement credits. That’s not too bad because you get to pay down the balance of the card. It’s even better if you can get actual cash back. Or maybe choose from a variety of gift cards.

Your best bet is to look for cards that let you redeem your rewards in multiple ways. This way, you’re not locked into one redemption method. One month you may need cash back to cover some unexpected expenses. The next month you might want to treat yourself to a gift card for your favorite store. You should have the flexibility and freedom to do so.

With some cards, you can transfer points to travel partners. This is great for maximizing your travel rewards. You might be able to get more value for your points by transferring them to an airline or hotel loyalty program.

Your Best option:

The Bank of America® Travel Rewards Credit Card For Students is worth looking in to out. It’s quite flexible when it comes to using your rewards. You can use your points to offset travel expenses, get cash back, or even snag some gift cards. What’s great is that when you use your points for travel, each point is worth a penny. Therefor 10,000 points = $100 off your travel costs. Pretty good for a student card.

Selecting the right credit card is a personalized choice. Consider your spending habits and the rewards that excite you. Choose a card that aligns with your lifestyle and spending patterns. This way, you’ll maximize your rewards while building credit. Remember, the perfect card is the one that suits your unique needs.

2.4 Maximizing Rewards with Limited Student Budgets

Being a student is not easy. Managing a tight budget is often a reality that most students live with. That doesn’t mean you can’t take advantage of credit card rewards. Yes you can. Here are some strategies to help you make the most of your spending:

2.4.1 Stick to the Essentials

Use your credit card for purchases that are essential to you. Whatever you need on a regular basis. Things like groceries, transportation, and school supplies. For example, let’s say you spend $50 a week on groceries. Choose a credit card that can get 3% cash back at groceries, retail purchases and gas as well. This will help you to maximize your earnings. If you qualify, this hack does not require the credit card to be a student credit card.

American Express Blue Cash Everyday® Card

3% cash back

“Earn 3% cash back at groceries, retail purchases and gas as well up to $6,000 per year in purchases (then 1%).“

So here’s the breakdown:

$50 per week on groceries = $2,600 per year

3% cash back on $2,600 = $78 in cash back rewards

This card will earn you $78 a year just for buying the food you were going to buy anyway. This American Express card has no annual fee. This makes it is very popular among students and young adults. Remember, the key is to use the card for essential expenses. Make sure you don’t overspend just to earn the rewards.

2.4.2 Take Advantage of Category Bonuses

Student credit cards usually offer bonus rewards in more that one category. This allows you to earn more on your required spending. For example, let’s say you spend $100 a month online to pay for things like your cable, your internet connection, your phone plan and streaming services. Choose the, you can get 3% cash back in the online shopping category (which includes cable, internet, phone plans, and streaming).This will help you get rewards for the purchases you would make anyway.

Bank of America® Customized Cash Rewards Credit Card for Students

3% cash back

“Earn 3% cash back in the online shopping category (which includes cable, internet, phone plans, and streaming). It’s 3% and 2% cash back on the first $2,500 in combined purchases each quarter.“

So here’s the breakdown:

$100 per month on online shopping = $1,200 per year

3% cash back on $1,200 = $36 in cash back rewards

So by taking advantage of online category bonus of this card, you can earn $36 in cash back in a year. All the meanwhile paying what you’ve already been paying. Without a change in your spending habits. This makes your regular expenses more affordable. It also helps you build your credit history. Remember, the key is to use the card for purchases you would make anyway, and not to overspend just to earn rewards.

2.4.3 Stack Rewards with Student Discounts

Many retailers offer student discounts. This happens both online and off. These discounts can be very profitable if you know what to do. Your goal here is to try to combine the student discount with your credit card rewards. If you do this, you will maximize your overall savings in a big way. If done correctly, this credit card hack allows you to save twice the money on a single purchase.

For example, let’s say that you’re buying $200 worth of textbooks from a retailer. The retailer is offering a 10% student discount on those textbooks. Choose a student credit card that can get you 5% cash back on rotating categories each quarter. This is up to the quarterly maximum when you activate. You also get 1% cash back on all other purchases.

Discover it® Student Cash Back Card

5% cash back

“Earn 5% cash back on rotating categories each quarter up to the quarterly maximum when you activate. 1% cash back on all other purchases.“

So here’s the breakdown:

Original textbook price: $200

10% student discount: -$20

Price after student discount: $180

5% cash back on $180: $9

Total savings: $20 (student discount) + $9 (cash back) = $29

By stacking your student discount with your credit card rewards, you’ve saved $29 on a $200 purchase, which is about 14.5% in total savings.

Now, the Discover it® Student Cash Back Card also states that it will “match your cash back at the end of your first year“. This extra bonus can potentially double your rewards.

The key is to look for opportunities to combine discounts with your credit card rewards, maximizing your savings on purchases you need to make anyway.

2.4.4 Utilize Loyalty Programs

Loyalty programs are extremely popular in the retail industry. They turn shoppers into frequent shoppers. Depending on the credit card you use, you can basically double the rewards on your purchases. Your goal here is to pair these loyalty programs with the rewards offered by your card. For example, let’s say you spend $200 in restaurants and the restaurant has a 10% cash back customer loyalty discount. Choose a card that can get you 2% cash back at gas stations and restaurants.

Discover it® Student Chrome Card

2% cash back

“Earn Earn 2% Cashback Bonus® at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus, earn unlimited 1% cash back on all other purchases.“

So here’s the breakdown:

Original restaurant bill: $200

Restaurant loyalty discount (10%): -$20

Actual amount paid: $180

Discover it® Student chrome cash back (2% on restaurants): $3.60

Total savings: $20 (loyalty discount) + $3.60 (cash back) = $23.60

Additionally, this credit card requires no annual fee and is designed for students. So you’re saving $23.60 on a $200 meal, which is equivalent to an 11.8% total discount. Simply by combing the restaurants loyalty program with your credit card’s reward program. If you do this for a year, you will spend $2,400 on dining. Your total savings will be $283.20 ($240 from the loyalty discount and $43.20 from cash back).

In this specific example, the saving don’t end there. The Discover it® Student Chrome Card will match all the cash backs you’ve earned at the end of your first year. This added feature doubles your rewards for the first year. The key is to use this strategy for purchases you would make anyway, and not to overspend just to earn rewards or discounts.

2.5 Leveraging Long-Term Financial Health for Better Rewards

The key to being able access and take advantage of the full potential of credit card rewards is to build a strong financial foundation. If you focus on your long-term financial health, you’ll will qualify for better credit card options. You’ll also be in a position to maximize the value of your rewards.

This section will guide you through the steps of first establishing good credit habits and then transitioning to high-reward credit cards. We’ll explore how to improve your credit score, which opens doors to premium card offers, and then how to strategically upgrade your credit cards to take advantage of more lucrative benefits and perks. Whether you’re just starting out or looking to level up your rewards game, these strategies will help you enhance your financial well-being while enjoying more valuable credit card rewards.

Let’s dive into the specifics of each:

2.5.1 Establishing Good Credit Habits

Building strong credit habits is step one. It’s essential for everything that comes after. Good habits improve your credit score. They also teach you valuable financial management skills that will serve you well throughout your life. Remember, credit card companies are looking for responsible borrowers. People who will respect the terms of borrow and pay the debt back promptly and on time. In other word, people who can handle credit wisely. By demonstrating these qualities, you’re setting yourself up for better offers and more lucrative rewards in the future. This is what you need to do establish good credit habits….

2.5.1.1 Pay Your Bills on Time

This cannot be overstated. Pay your bills on time . Show the lenders that your are reliable. It’s not only about avoiding late fees ands the possibility of a higher credit rate. Late payments can hurt your credit score. A poor credit score can deny you many opportunities in the future. As a fail safe, you can set up automatic payments or create a bill payment calendar.

Click here to read an excellent Nerdwallet article on how to “Set Up Automatic Credit Card Payments, Forget the Late Fees“. Click here to access WordTemplatesOnline’s “Free Bill Pay Checklists and Calendars (Edit & Printable)“.

2.5.1.2 Keep Your Credit Utilization Low

Don’t max out your cards. This makes you look like your heavily dependent on credit and that you don’t manage money well. Credit card companies prefer to see that you’re using only a small portion of your available credit. This shows them that you’re a responsible financial manager. The benchmark is at about 30%. Try to keep your credit utilization below 30% of your total available credit. So if you have a card with a $1,000 limit, try to keep your balance under $300.

So this credit card hack stipulates that if you have large purchase to make, pay it off immediately. If that’s not possible, try to spread the cost across multiple cards. This will keep every cards card utilization low. For example, let’s say you if need to make a $900 purchase. You have three cards each with a $1,000 limit. Charge $300 to each card and keep all three at 30% utilization instead of maxing out one card.

Lower utilization rates are even better. Usually people who have the highest credit scores often keep their utilization rates below 10%. This send a positive signal to lenders about your creditworthiness. This can lead to better credit offers and terms in the future.

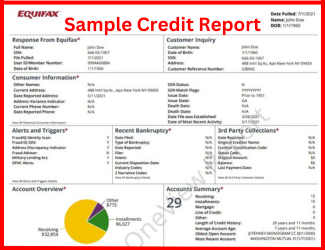

2.5.1.3 Why Is It Important To Check Your Credit Report

So why is it important to check your credit report? What are you looking for? The truth is that it’s not just about detecting possible errors. This credit card hack is a preventative, common sense approach t credit. It’s about understanding your credit profile and detecting any signs of identity theft early on.

So what should you look for? When reviewing your report, look for:

- Accounts you don’t recognize

- Incorrect personal information

- Late payments you know you made on time

- Outdated negative information that should have dropped off

If you spot any inaccuracies, dispute them immediately with both the credit bureau and the company that reported the information. This process can be initiated online, by phone, or by mail.

There are three major credit bureaus in the US. They are Equifax, Experian, and TransUnion. Once a year, you’re entitled to free credit reports from each of the three major credit bureaus. You can get your reports at AnnualCreditReport.com. This is the only official site authorized by federal law to provide these free reports. Now as of 2023, you can actually access your reports weekly for free through this same site.

Just so you know, your credit report does not include your credit score. This is explained in the next section. People sometimes assume that they are one in the same. They are two very different tools that are used to assess a person’s creditworthiness.

So by regularly monitoring your credit report, your in a position to immediately address any issues or errors. This is one of the best ways maintain a healthy credit profile. This, in turn, can lead to better credit card offers with more lucrative rewards programs. Stay vigilant and proactive. You’re not just protecting your financial reputation – you’re positioning yourself to take full advantage of the best credit card rewards available in the market.

2.5.1.4 What Is The Difference Between A Credit Report And A Credit Score?

So, what is the difference between a credit report and a credit score? Great question! A credit report is a more in-depth understanding of your credit history and can help you take targeted steps to improve it. A credit score is a quick assessment or numerical summary of that history.

Credit Report:

- A comprehensive document detailing your credit history

- Includes information about your credit accounts, payment history, and public records

- Used by lenders to evaluate your creditworthiness in detail

Credit Score:

- A numerical representation of your creditworthiness, typically ranging from 300 to 850

- Calculated using information from your credit report

- Provides a quick snapshot of your credit health for lenders

Key Differences:

- Format: Reports are detailed documents; scores are single numbers

- Calculation: Reports compile raw data; scores use algorithms to interpret that data

- Use: Lenders use reports for in-depth analysis and scores for quick assessments

- Accessibility: Scores are not included in your free annual credit report

Your credit score can be seen on your credit or loan statements. It can be obtained through a credit or housing counselor or a credit score service. It can also be purchased from one of the three three major credit bureaus listed above.

Click the icon below to see a sample credit report form Equifax.

This chart explains how your credit score is graded by lenders and financial institutions.

| Category | FICO Score Range | Description |

|---|---|---|

| Exceptional | 800-850 | Most likely to receive the best terms and lowest interest rates. |

| Very Good | 740-799 | Considered favorable by most lenders. |

| Good | 670-739 | May face higher interest rates or stricter terms. |

| Fair | 580-669 | Difficulty qualifying for credit or face the highest costs when borrowing. |

| Poor | 300-579 | Difficulty qualifying for credit or face the highest costs when borrowing. |

*FICO stands for the Fair Isaac Corporation, which developed the FICO Score as a method to evaluate credit risk based on information from credit reports. The FICO Score is widely used by lenders to assess an individual’s creditworthiness and determine the terms of loans and credit products. It ranges from 300 to 850, with higher scores indicating lower credit risk and better borrowing terms.

2.5.2 Transitioning to High-Reward Credit Cards

So, you’ve established good credit habits and improved your credit rating. That’s amazing. It’s now time to level up your credit card game and transition to high-reward credit cards. This credit card hack will take you from a student cards to a regular credit cards with higher rewards. It will allow you to take advantage of more lucrative benefits and perks. Here’s how to strategically upgrade your credit cards:

2.5.2.1 Research and Compare Cards

The first thing you need to do before researching and comparing credit cards is to find out where your money is going. Be honest with yourself and take a good look at your spending habits. Are you a frequent traveler or do you prefer staying home? Do you spend more on groceries or do you prefer dining out? Your spending patterns should guide your card choice.

If you want to research credit cards, there is a great tool that we’ve created that uses AI to conduct amazing research . It’s called Best Credit Cards. It will help you find the best credit cards with the best benefits. You can search by rewards, points, cash backs, balance transfers, travel incentives, interest rates, credit ratings, and much more. It’s also very easy to use. You can check it out here:

Now if you want to compare cards, there a two great tools that you can use. Nerdwallet’s Side by Side Credit Card Comparison Tool and Forbes’ Credit Card Comparison tool. You simply select the cards you want to compare and review the key features displayed side-by-side. Things like annual fees, rewards rates, and APR offers. It’s a great way to easily evaluate which card best fits your financial needs and goals.

When comparing, don’t just focus on flashy rewards rates. Consider these key factors:

- Annual Fees: Sometimes, a card with a fee offers enough value to offset the cost.

- Interest Rates: Important if you might carry a balance.

- Welcome Bonuses: These can provide significant upfront value.

- Rewards Rate: Look at earn rates in categories where you spend most.

- Additional Perks: Travel insurance, airport lounge access, or purchase protection can add significant value.

Use the comparison tools to input your average monthly spending in different categories. This will help calculate potential rewards earnings for each card, making it easier to see which one offers the best value for your specific spending habits.

Remember, the best card for someone else might not be the best for you. Take the time to thoroughly compare options based on your unique financial situation and spending patterns. This careful research will help you find a card that maximizes your rewards and fits your lifestyle.

2.5.2.2 Strategically Time Your Applications

Be careful with this credit card hack. You need to time your credit card applications when transitioning from other types of cards to high-reward credit cards. Why? Because of the impact each application has on your credit score. It’s important to understand that each time you apply for a new card, a hard inquiry is placed on your credit report. This can temporarily lower your credit score. So, in order to minimize this impact and increase your chances of approval do the following:

- Space out your applications: The waiting period between applications should be at least 3-6 months. This will give your credit score time to recover from each application hard inquiry.

- Apply for the best cards first: Start with the one that have the best rewards. Start earning points and rewards immediately. Less important cards can be applied for later

- Consider the Chase 5/24 Rule: Some issuers, like Chase, have rules limiting approvals if you’ve opened too many new accounts recently. Be aware of these rules when planning your card strategy.

- Monitor your credit score: Use free credit monitoring services to track your score and time your applications when your score is at its peak.

By being strategic about when and how you apply for new cards, you can transition to high-reward cards more smoothly and with less impact on your credit health.

Utilize Advanced Reward Strategies:

Once you have a high-reward card, explore advanced strategies like point transfers to airline or hotel loyalty programs. This strategy can significantly increase the value of your rewards. For example, transferring points to a frequent flyer program might offer better redemption rates than using them for cash back.

Example:

A graduate with a solid credit history transitions from a student card to the Citi® Double Cash Card, which offers 2% cash back on all purchases (1% when you buy, plus 1% as you pay). They also open a travel rewards card to take advantage of travel-related perks and bonuses, maximizing their rewards based on their lifestyle.

By focusing on long-term financial health and strategically transitioning to cards with higher rewards, you can significantly enhance the benefits you receive from credit cards. This credit card hack not only boosts your rewards but also supports your overall financial well-being.

If you haven’t done so already, click here here to access Part 1 of this blog post series “Advanced Credit Card Hacks (Part 1): How To Maximize Your Cash Back And Cashback Rewards“. Learn how to make the most of your Cash Back and Cashback rewards.

You helped me a lot by posting this article and I love what I’m learning. http://www.ifashionstyles.com

The articles you write help me a lot and I like the topic http://www.goodartdesign.com

Whoa! This blog looks exactly like my old one! It’s on a entirely different subject but it has pretty much the same page layout and design. Great choice of colors!

The articles you write help me a lot and I like the topic http://www.kayswell.com

Can you write more about it? Your articles are always helpful to me. Thank you! http://www.hairstylesvip.com

Join our affiliate community and start earning instantly! https://shorturl.fm/SkuxT

Maximize your earnings with top-tier offers—apply now! https://shorturl.fm/uIalv

Join our affiliate program today and earn generous commissions! https://shorturl.fm/ptDTM

Apply now and unlock exclusive affiliate rewards! https://shorturl.fm/Mi0cg

Grow your income stream—apply to our affiliate program today! https://shorturl.fm/IFQMD

Unlock top-tier commissions—become our affiliate partner now! https://shorturl.fm/HGXrC

Start earning on autopilot—become our affiliate partner! https://shorturl.fm/FwOUa

Become our partner and turn referrals into revenue—join now! https://shorturl.fm/uqO6c

Refer customers, collect commissions—join our affiliate program! https://shorturl.fm/NXXSS

Partner with us and earn recurring commissions—join the affiliate program! https://shorturl.fm/daJRN

Start sharing, start earning—become our affiliate today! https://shorturl.fm/1uxKi

Join our affiliate community and earn more—register now! https://shorturl.fm/14c0o

Earn recurring commissions with each referral—enroll today! https://shorturl.fm/Ox9YB

Join our affiliate community and maximize your profits! https://shorturl.fm/Wezyh

Your influence, your income—join our affiliate network today! https://shorturl.fm/9BrDD

Your network, your earnings—apply to our affiliate program now! https://shorturl.fm/C4L6b

Become our partner and turn referrals into revenue—join now! https://shorturl.fm/PDJ7q

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/HopOf

Partner with us and enjoy high payouts—apply now! https://shorturl.fm/BNjmE

Start earning on every sale—become our affiliate partner today! https://shorturl.fm/zgslP

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/bKtII

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/ROl8N

Promote our brand and get paid—enroll in our affiliate program! https://shorturl.fm/SKzZ1

Partner with us for generous payouts—sign up today! https://shorturl.fm/XzBNq

Refer customers, collect commissions—join our affiliate program! https://shorturl.fm/twGgO

Monetize your influence—become an affiliate today! https://shorturl.fm/63UVi

Join our affiliate program today and earn generous commissions! https://shorturl.fm/IHZlT

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/g4gqC

The articles you write help me a lot and I like the topic http://www.ifashionstyles.com

You helped me a lot with this post. http://www.kayswell.com I love the subject and I hope you continue to write excellent articles like this.

Partner with us and enjoy high payouts—apply now! https://shorturl.fm/m7UPh

Become our partner now and start turning referrals into revenue! https://shorturl.fm/zNe1c

May I have information on the topic of your article? http://www.ifashionstyles.com

Earn passive income with every click—sign up today! https://shorturl.fm/hjEMC

Promote our brand, reap the rewards—apply to our affiliate program today! https://shorturl.fm/O4zF1

Drive sales, collect commissions—join our affiliate team! https://shorturl.fm/xUI1k

Promote our products and earn real money—apply today! https://shorturl.fm/77xNT

Thanks for posting. I really enjoyed reading it, especially because it addressed my problem. http://www.goodartdesign.com It helped me a lot and I hope it will help others too.

https://shorturl.fm/8B5KD

https://shorturl.fm/WMV5c

https://shorturl.fm/n44Iu

https://shorturl.fm/G8Drv

Heya just wanted to give you a brief heads up and let you know a few of the pictures aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different internet browsers and both show the same results.

Thanks for all of your work on this website. My niece really loves going through investigations and it’s easy to understand why. I know all regarding the powerful mode you convey both interesting and useful secrets by means of this web blog and in addition improve participation from some others on the situation then our child has been understanding a lot of things. Take pleasure in the remaining portion of the year. You’re conducting a first class job.

https://shorturl.fm/AsVKX

https://shorturl.fm/eOQZs

https://shorturl.fm/o1LTN

https://shorturl.fm/FO0Hj

https://shorturl.fm/2xcwk

https://shorturl.fm/FJgZA

https://shorturl.fm/sMATT

https://shorturl.fm/G74qJ

https://shorturl.fm/w0xOx

https://shorturl.fm/J6RVB

https://shorturl.fm/V58sJ

https://shorturl.fm/GdB2x

https://shorturl.fm/7PFta

Thank you for being of assistance to me. I really loved this article. http://www.kayswell.com

https://shorturl.fm/sDFNE

https://shorturl.fm/en63y

https://shorturl.fm/eQRQp

https://shorturl.fm/76Dzd

https://shorturl.fm/mzjfT

https://shorturl.fm/WEKIr

May I request that you elaborate on that? http://www.ifashionstyles.com Your posts have been extremely helpful to me. Thank you!

https://shorturl.fm/TVoEW

Thank you for providing me with these article examples. May I ask you a question? http://www.kayswell.com

https://shorturl.fm/JxWZT

https://shorturl.fm/s1BDm

https://shorturl.fm/cS12T

https://shorturl.fm/wmeri

https://shorturl.fm/wZGDu

https://shorturl.fm/QdvIq

https://shorturl.fm/ocsH9

https://shorturl.fm/rr2v0

May I request that you elaborate on that? http://www.kayswell.com Your posts have been extremely helpful to me. Thank you!

https://shorturl.fm/SasGV

https://shorturl.fm/ieT8O

Thanks for your post here. One thing I’d like to say is most professional job areas consider the Bachelors Degree as the entry level requirement for an online course. When Associate Certifications are a great way to begin, completing ones Bachelors uncovers many entrance doors to various employment opportunities, there are numerous on-line Bachelor Diploma Programs available via institutions like The University of Phoenix, Intercontinental University Online and Kaplan. Another concern is that many brick and mortar institutions present Online versions of their certifications but normally for a drastically higher payment than the corporations that specialize in online degree plans.

https://shorturl.fm/Vp05G

https://shorturl.fm/meREs

Thank you for your articles. http://www.kayswell.com They are very helpful to me. Can you help me with something?

https://shorturl.fm/NPvyt

https://shorturl.fm/b3CEA

https://shorturl.fm/KpmWq

I enjoyed reading your piece and it provided me with a lot of value. http://www.kayswell.com

https://shorturl.fm/jHZm0

Thank you for sharing this article with me. It helped me a lot and I love it. http://www.hairstylesvip.com

Thanks a lot for the helpful write-up. It is also my opinion that mesothelioma has an extremely long latency time, which means that signs and symptoms of the disease may not emerge until finally 30 to 50 years after the initial exposure to asbestos fiber. Pleural mesothelioma, and that is the most common type and has an effect on the area round the lungs, will cause shortness of breath, chest muscles pains, and a persistent cough, which may result in coughing up bloodstream.

You helped me a lot with this post. http://www.kayswell.com I love the subject and I hope you continue to write excellent articles like this.

https://shorturl.fm/FQSNn

https://shorturl.fm/EwsZ9

https://shorturl.fm/HrkuR

https://shorturl.fm/f32HO

https://shorturl.fm/bNpkr

You helped me a lot with this post. http://www.ifashionstyles.com I love the subject and I hope you continue to write excellent articles like this.

https://shorturl.fm/eW8Sl

https://shorturl.fm/d6RP0

https://shorturl.fm/LCjxE

https://shorturl.fm/SOFJQ

https://shorturl.fm/Yfqn7

Hi there to every one, since I am really eager of reading this blog’s post to be updated on a regular basis. It includes fastidious data.

Thanks , I’ve just been looking for information approximately this topic for a while and yours is the greatest I’ve found out so far. But, what about the conclusion? Are you certain about the supply?

What a information of un-ambiguity and preserveness of valuable familiarity on the topic of unexpected feelings. http://www.kayswell.com

https://shorturl.fm/KfNlp

Sweet blog! I found it while searching on Yahoo News. Do you have any tips on how to get listed in Yahoo News?I’ve been trying for a while but I never seem to get there! Many thanks http://www.kayswell.com

https://shorturl.fm/6pFGZ

After exploring a few of the blog articles on your site, I seriously like your technique of blogging. I book-marked it to my bookmark webpage list and will be checking back soon. Take a look at my website as well and let me know what you think. http://www.ifashionstyles.com

Hello mates, nice article and fastidious urging commented here, I am actually enjoying by these. http://www.kayswell.com

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! By the way, how could we communicate? http://www.kayswell.com

You actually make it seem so easy with your presentation but I find this matter to be actually something that I think I would never understand. It seems too complex and very broad for me. I’m looking forward for your next post, I will try to get the hang of it! http://www.kayswell.com

These are actually great ideas in about blogging. You have touched some pleasant things here. Any way keep up wrinting. http://www.kayswell.com

etxc9p

I am actually pleased to read this blog posts which contains lots of useful facts, thanks for providing these kinds of information. http://www.kayswell.com

My partner and I stumbled over here coming from a different page and thought I might check things out. I like what I see so i am just following you. Look forward to finding out about your web page yet again. http://www.kayswell.com

What i do not understood is actually how you’re no longer really much more well-preferred than you may be now. You’re very intelligent. You know thus significantly in terms of this subject, made me personally believe it from a lot of numerous angles. http://www.kayswell.com Its like men and women aren’t interested unless it’s something to do with Girl gaga! Your individual stuffs great. At all times deal with it up!

If some one desires expert view concerning blogging afterward i advise him/her to pay a visit this weblog, Keep up the good work. http://www.ifashionstyles.com

https://shorturl.fm/OaMtc

https://shorturl.fm/DslyE

I carry on listening to the news speak about receiving free online grant applications so I have been looking around for the finest site to get one. Could you advise me please, where could i find some?

Good day! Would you mind if I share your blog with my zynga group?There’s a lot of folks that I think would really enjoy your content. Please let me know. Cheers http://www.kayswell.com

It’s enormous that you are getting ideas from this paragraph as well as from our dialogue made at this time. http://www.hairstylesvip.com

https://shorturl.fm/P3LZG

Superb post however , I was wanting to know if you could write a litte more on this subject? I’d be very grateful if you could elaborate a little bit further.

https://shorturl.fm/WkApT

I have noticed that online diploma is getting well-liked because obtaining your degree online has developed into a popular method for many people. Many people have not really had an opportunity to attend a regular college or university nevertheless seek the raised earning potential and career advancement that a Bachelors Degree offers. Still other people might have a college degree in one discipline but would like to pursue anything they now possess an interest in.

Hi, i think that i saw you visited my website thus i came to “return the favor?I’m trying to find things to enhance my site!I suppose its ok to use a few of your ideas!!

https://shorturl.fm/xdZOq

F*ckin?tremendous things here. I am very glad to see your post. Thanks a lot and i am looking forward to contact you. Will you kindly drop me a e-mail?

https://shorturl.fm/3QWx6

I just like the valuable information you provide on your articles.I’ll bookmark your blog and test again here frequently.I’m quite certain I’ll be informed plenty of new stuff proper right here! Good luck for the next!

Wow, fantastic blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is great, let alone the content!

Greetings! Very helpful advice in this particular post! It is the little changes that produce the biggest changes. Thanks a lot for sharing!

https://shorturl.fm/R9WGr

Hi every one, here every person is sharing these kinds of knowledge, therefore it’s good to read this blog, and I used to pay a quick visit this blog daily.

It’s amazing to pay a visit this site and reading the views of all friends regarding this paragraph, while I am also keen of getting know-how. http://www.kayswell.com

Hello there, You’ve done a great job. I will definitely digg it and personally recommend to my friends. I am confident they will be benefited from this website. http://www.kayswell.com

What’s up, after reading this awesome post i am too happy to share my familiarity here with colleagues.

https://shorturl.fm/I6F5f

Thanks for one’s marvelous posting! I truly enjoyed reading it, you are a great author.I will ensure that I bookmark your blog and will often come back in the future. http://www.kayswell.com I want to encourage you to definitely continue your great posts, have a nice day!

https://shorturl.fm/ZQBLj

https://shorturl.fm/IeZBM

Good day! Would you mind if I share your blog with my zynga group?There’s a lot of folks that I think would really enjoy your content. Please let me know. Cheers http://www.kayswell.com

Hi! I know this is kinda off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having difficulty finding one? Thanks a lot!

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several emails with the same comment. Is there any way you can remove people from that service? Many thanks!

https://shorturl.fm/YZYfd

https://shorturl.fm/Gpcxn

https://shorturl.fm/3uvVm

https://shorturl.fm/ECUJh

https://shorturl.fm/ev25C

Thanks for your short article. I would love to say that a health insurance brokerage also works for the benefit of the particular coordinators of your group insurance policies. The health insurance broker is given an index of benefits looked for by an individual or a group coordinator. Such a broker does is search for individuals and also coordinators which will best match those needs. Then he shows his suggestions and if all parties agree, this broker formulates legal contract between the two parties.

It’s enormous that you are getting ideas from this paragraph as well as from our dialogue made at this time. http://www.ifashionstyles.com

3gr7nz

Hurrah! In the end I got a weblog from where I know how to truly take helpful information regarding my study and knowledge.

Hi there, everything is going sound here and ofcourse every one is sharing data, that’s really good, keep up writing.

Right here is the perfect blog for everyone who hopes to find out about this topic. You understand so much its almost hard to argue with you (not that I actually will need to…HaHa). You definitely put a freshspin on a topic that has been written about for decades.Excellent stuff, just great!

https://shorturl.fm/n6FDV

https://shorturl.fm/s5Ais

great points altogether, you simply received a logo new reader. What might you suggest in regards to your publish that you just made a few days in the past? Any positive? http://www.ifashionstyles.com

https://shorturl.fm/SLC5h

Hello, I enjoy reading all of your post. I wanted to write a little comment to support you.

You’re so interesting! I don’t suppose I have read something like this before. So nice to discover another person with a few genuine thoughts on this subject. Seriously.. many thanks for starting this up. This web site is something that’s needed on the web, someone with a little originality! http://www.ifashionstyles.com

Heya i am for the first time here. I found this board and I to find It truly helpful & it helped me out much. I hope to offer one thing back and help others like you aided me.

What’s up i am kavin, its my first time to commenting anywhere, when i read this paragraph i thought i could also make comment due to this sensible post.

constantly i used to read smaller articles or reviews that also clear their motive,and that is also happening with this piece of writing which I am reading here.

https://shorturl.fm/KCJ2l

This paragraph will assist the internet users for building up new web site or even a blog from start to end.

I抎 have to test with you here. Which isn’t one thing I normally do! I get pleasure from reading a submit that can make people think. Additionally, thanks for allowing me to comment!

https://shorturl.fm/8G7of

Hello there! I could have sworn I’ve been to this blog before but after checking through some of the post I realized it’s new to me.Anyways, I’m definitely glad I found it and I’ll be bookmarking and checking back frequently!

https://shorturl.fm/qVjRg

https://shorturl.fm/Tm5B8

What’s up, after reading this awesome post i am too happy to share my familiarity here with colleagues.

You actually make it seem so easy with your presentation but I find this matter to be actually something that I think I would never understand. It seems too complex and very broad for me. I’m looking forward for your next post, I will try to get the hang of it! http://www.ifashionstyles.com

Sweet blog! I found it while searching on Yahoo News. Do you have any tips on how to get listed in Yahoo News?I’ve been trying for a while but I never seem to get there! Many thanks http://www.hairstylesvip.com

https://shorturl.fm/3zIZn

https://shorturl.fm/J9IuG

https://shorturl.fm/y5uZO

We’re a group of volunteers and starting a new scheme in our community. Your website offered us with helpful information to work on. You’ve done a formidable task and our whole community will be thankful to you.

If some one needs to be updated with latest technologies therefore he must be go to see this web site and be up to date every day.

whoah this blog is great i like studying your articles. Stay up the good work! You realize, lots of persons are searching around for this information, you could aid them greatly.

Superb post however , I was wanting to know if you could write a litte more on this subject? I’d be very grateful if you could elaborate a little bit further. http://www.kayswell.com

I’m not that much of a internet reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your website to come back in the future.

https://shorturl.fm/u8eba

I believe that avoiding processed foods may be the first step in order to lose weight. They can taste excellent, but refined foods possess very little vitamins and minerals, making you feed on more just to have enough vigor to get with the day. If you are constantly consuming these foods, transferring to whole grains and other complex carbohydrates will let you have more vigor while feeding on less. Thanks alot : ) for your blog post.

https://shorturl.fm/UPa2U

https://shorturl.fm/mlDO2

Hello my family member! I want to say that this post is amazing, great written and come with almost all significant infos. I would like to look more posts like this .

I am actually pleased to read this blog posts which contains lots of useful facts, thanks for providing these kinds of information.

This piece of writing will help the internet visitors for creating new web site or even a blog from start to end.

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is valuable and everything. Nevertheless think about if you added some great pictures or video clips to give your posts more, http://www.hairstylesvip.com“pop”! Your content is excellent but with pics and videos, this site could certainly be one of the best in its niche. Terrific blog!

Hi, i think that i saw you visited my weblog so i came to “return the favor”.I am trying to find things to enhance my site!I suppose its ok to use some of your ideas!! http://www.hairstylesvip.com

Oh my goodness! Amazing article dude! Many thanks, However I am encountering problems with your RSS. I don’t understand the reason why I can’t join it. Is there anybody else having similar RSS issues? Anyone who knows the answer can you kindly respond? http://www.kayswell.com

https://shorturl.fm/cHeQj

Aw, this was a very nice post. Taking the time and actual effort to create a great article… but what can I say… I hesitate a whole lot and never seem to get nearly anything done.

It’s amazing to pay a visit this site and reading the views of all friends regarding this paragraph, while I am also keen of getting know-how.

Hi, Neat post. There’s an issue together with your site in internet explorer, could test this? IE still is the market leader and a large section of other folks will miss your great writing due to this problem.

After exploring a few of the blog articles on your site, I seriously like your technique of blogging. I book-marked it to my bookmark webpage list and will be checking back soon. Take a look at my website as well and let me know what you think.

Ahaa, its fastidious discussion on the topic of this article at this place at this website, I have read all that, so now me also commenting at this place.

https://shorturl.fm/oWQxw

https://shorturl.fm/iASIc

Hi, Neat post. There is a problem with your site in web explorer, might test this? IE still is the market chief and a large component of other people will leave out your wonderful writing because of this problem.

Do you mind if I quote a few of your articles as long as I provide credit and sources back to your website? My website is in the exact same area of interest as yours and my visitors would definitely benefit from some of the information you provide here.

Hey I know this is off topic but I was wondering if you knew of any widgetsI could add to my blog that automatically tweet my newest twitter updates.

https://shorturl.fm/0iiAL

https://shorturl.fm/MxeSY

https://shorturl.fm/RXnZq

Hey there fantastic blog! Does running a blog similar

https://shorturl.fm/VQHPj

https://shorturl.fm/xOe5W

https://shorturl.fm/K3MG8

https://shorturl.fm/YKDMm

It’s actually very complex in this busy life to listen news on TV, so I just use world wide web for that reason, and get the newest news.

It’s enormous that you are getting ideas from this paragraph as well as from our dialogue made at this time.

I’m really enjoying the design and layout of your website.It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a developer to create your theme?

Good write-up. I certainly appreciate this website. Keep it up! http://www.hairstylesvip.com

Way cool! Some extremely valid points! I appreciate you penning this write-up and also the rest of the website is really good.

It抯 actually a nice and helpful piece of info. I am glad that you simply shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

https://shorturl.fm/N7LrM