Exploring Credit Cards for Young Adults: A Comprehensive Guide

Finding the best credit cards for young adults can be a great way to help a young person choose the right credit card that best suits their needs and desires. This blogpost focuses on just that; some of the best credit cards for young adults to ensure a solid financial start. They need a card that offers them cash back or other rewards on their everyday purchases. One that saves them money on the things they want to buy. Since their income is not yet at a higher level, a beginner’s credit card with no annual fee. They especially need a credit card that will help them begin to establish and build their credit.

If you’re a young adult with bad credit, check out our detailed guide on the best credit cards for young adults with bad credit in 2025 for options like the Yendo Credit Card and OpenSky Secured Visa.”

So, finding the best credit cards for young adults of the best credit cards for teens is a positive endeavor. It’s like helping them find the key that unlocks their world of financial possibilities and responsibilities. The downside it that when you’re just starting out, the world of credit cards can be a quite confusing. In truth, a young person may not yet have a clear understanding of how credit cards work, what types of card are available, the benefits and drawbacks of using them, interest rates, fees, late fees, available programs, and how using credit cards can affect one’s credit score. With so many options available, finding best first credit card can feel overwhelming.

But fret not, recent graduates, young professionals and teens as well! As a result, this blogpost will equip you with the knowledge and tools to navigate the credit card landscape and choose a card that perfectly suits your needs.

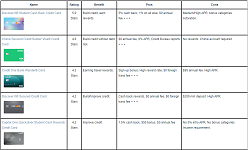

Click the image to show a summary table of the credit cards mentioned below

Click here to hide the table

| Name | Rating | Benefit | Pros | Cons |

|---|---|---|---|---|

Discover It® Student Cash Back Credit Card

|

5.0 Stars | Build credit, earn rewards. | 5% cash back, 1% on all else, $0 annual fee.+ + + | Medium/High APR, bonus categories Activation. |

Chime Secured Credit Builder Visa® Credit Card

|

4.6 Stars | Build credit without debt risk. | $0 annual fee, 0% APR, Credit Bureau reports + + + | No rewards. Chime account required. |

Credit One Bank Wander® Card

|

4.3 Stars | Earning travel rewards. | Sign-up bonus, High reward rate, $0 foreign trans fee + + + | $95 annual fee. High APR. |

Discover It® Secured Credit Card

|

4.2 Stars | Build/Improve credit. | Cash back rewards, $0 annual fee, $0 foreign trans fee + + + | $200 min deposit. High APR. |

Capital One Quicksilver Student Cash Rewards Credit Card

|

4.2 Stars | Improve credit. | 1.5% cash back, $50 bonus, $0 annual fee | No 0% intro APR. No bonus categories. Income requirement. |

1. The Best Credit Cards For Young Adults:

In the quest for the best credit cards for young adults, it’s equally crucial to consider a variety of factors that cater to the unique lifestyle, financial status, and goals of the younger generation. So, let’s explore some standout options that resonate with the aspirations and needs of young adults today.

1.1 The Discover It® Student Cash Back Credit Card

5.0 Star Review according to Forbes Advisor

Why It Stands Out:

The Discover It® Student Cash Back Credit Card is for college students. It’s a strong contender for the best first credit card for young adults because it is designed as a valuable tool to help them build their credit, earn rewards and gain financial knowledge.

The Pros:

- Cash Back Rewards: Students can earn 5% cash back on everyday purchases at different places each quarter (like grocery stores, restaurants, gas stations, and more), up to the quarterly maximum when activating the bonus categories and an additional 1% cash back on all other purchases.

- Annual Fee: $0

- APR: 0% introductory APR (Annual Percentage Rate) on purchases for the first 6 months.

- Foreign Transaction Fee: $0

- Cashback Match™: Discover automatically matches all cash back earned

- Financial Tools: Additionally, Discover provides tools like the FICO credit score tracker to help students understand their credit health.

- Free FICO® Score: Students have access to their FICO® Score.

- Qualification Requirements: No existing credit score required when applying.

The Cons:

- Medium To High APR: After 6 months, APR (Annual Percentage Rate) on purchases climbs to 18.24% – 27.24% Variable

- Bonus Categories: The bonus categories require quarterly activation.

1.2 Chime Secured Credit Builder Visa® Credit Card

4.6 Star Review according to NerdWallet

Why It Stands Out:

The Chime Credit Builder card is designed to help young adults establish and build their credit without the possibility of going into further debt.

The Pros:

- Annual Fee: $0

- APR: 0% APR (Annual Percentage Rate) on purchases.

- Foreign Transaction Fee: $0

- Security Deposit: No minimum security is required.

- Credit Bureau Reports: The cardholder’s activity is reported to all three major credit bureaus (which lays the foundations for establishing and improving one’s credit score).

- Qualification Requirements: Poor to fair credit.

The Cons:

- Rewards: This card offers no rewards.

- Credit Limit Imposed: The card’s credit limit cannot be greater than the security deposit.

- Requirements: Requires a Chime Spending bank account to be linked the the Chime Secured Credit Builder Visa® Credit Card.

1.3 Credit One Bank Wander® Card

4.3 Star Review according to Forbes Advisor

Why It Stands Out:

The Credit One Bank Wander® Card is another one of the recommended credit cards for young adultsfor young adults who want to build or improve their credit all while earning rewards on their travel purchases.

The Pros:

- Signup Bonus: This card offers a signup bonus of 10,000 points if in the first 90 days of the account opening you spend more than $1,000 on eligible purchases.

- Generous Rewards: Moreover, cardholders can earn 10X the points on qualifying hotels and car rentals that are booked via the Credit One Bank travel partner site, additional 5X points on eligible dining, gas and flights and 1x the points on daily purchases.

- Foreign Transaction Fee: $0

- Free Credit Score Access: Cardholders are able to monitor their credit score online for free.

- Qualification Requirements: Fair to good credit.

The Cons:

- Annual Fee: This card comes with an annual fee of $95.

- High APR: This cards comes with a high APR (Annual Percentage Rate) of 29.74% variable on purchases

1.4 The Discover It® Secured Credit Card

4.2 Star Review according to Forbes Advisor

Why It Stands Out:

The Discover It® Secured Credit Card is designed for people who want to build their credit or improve their credit.

The Pros:

- Cash Back Rewards: Cardholders earn 2% cash back at gas stations and restaurants (up to $1,000 in combined purchases each quarter) and unlimited 1% cash back on all other purchases.

- Annual Fee: $0

- Foreign Transaction Fee: $0

- Cashback Match™: Discover automatically matches all cash back earned at the end of the first year.

- Free FICO® Score: Cardholders have access to their FICO® Score.

- Account Review For Unsecured Credit: After 7 months, Discover reviews accounts to determine if users qualify for an unsecured line of credit and can return their deposit.

- Qualification Requirements: Limited or even bad credit

The Cons:

- Security Deposit: To open an account, users must provide a $200 security deposit (minimum) which is refundable.

- High APR: Offers an introductory 10.99% APR (Annual Percentage Rate) on Balance Transfers for 6 months, and then an APR of 28.24% Variable.

- Requirements: Requires a bank account to fund it.

1.5 Capital One Quicksilver Student Cash Rewards Credit Card

4.2 Star Review according to Forbes Advisor

Why It Stands Out:

The Capital One Quicksilver Student Cash Rewards Credit Card is specifically designed for college or university students who have fair to limited credit and wish to improve their credit. It can also be considered one of the best credit cards for teens.

The Pros:

- Cash Back Rewards: Students can earn an unlimited 1.5% cash back on every purchase, and a a one-time $50 cash bonus once they spend $100 or more on purchases within 3 months of opening their account. Additionally they can also receive a 10% cash back on purchases made through Uber & Uber Eats.

- Annual Fee: $0

- Foreign Transaction Fee: $0

- Qualification Requirements: Limited or fair credit

The Cons:

- APR: No introductory 0% APR (Annual Percentage Rate) is offered on purchases.

- Bonus Categories: No bonus categories are offered.

- Income Requirement: Your monthly income needs to be greater than your rent or mortgage by at least $425.

2. What To Look For in a Credit Card

Selecting the best credit card for young adults is a really big decision. This is especially true for those young adults who are just getting started with managing their own finances. In truth, it’s easy to get lost in the terminology options and details.

Here’s straightforward advise on what to look for in a credit card. So let’s go through each important feature one by one to help you choose wisely.

2.1 Low APR (or Interest Rate)

Choose a card that offers you a low APR (or Interest rate). In fact, some cards even offer a 0% introductory APR for the first few months as an incentive.

What it means: The interest rate that a credit card company charges you is called the APR or Annual Percentage Rate. This interest rate is charged on the balance that you owe that is carried past the payment deadline. Therefore, if the APR is low, you pay less interest on the amount you owe on your credit card. Moreover, this interest only applies if you carry a balance and don’t pay your full balance each month.

How to choose the right one: Firstly, compare different credit cards from different companies.

Find a credit card with a low APR, or possibly 0% APR at least for the first few months.

But be aware of the regular APR after the promotion ends. Secondly, read the fine print because the APR can change under different circumstances. Such as if you make late payments.

2.2 Rewards Programs

Choose a Rewards Programs that suit your spending.

What it means: Without a doubt, most credit card rewards programs give you a chance to earn points, cash back, or travel miles every time you make a purchase. Therefore, to really benefit from these programs, choose a card that offers extra rewards for the kinds of things you buy the most, like groceries or gas.

How to choose the right one: At first, look at your recent spending to see where your money goes the most. This will help you figure out which categories you spend on frequently. Then, find credit cards that offer bonuses for buying things in those categories. Moreover, you can use websites that compare different credit cards to help you see which ones align with your spending habits.

2.3 Annual Fees

If you choose a card with an annual fee, make sure rewards and benefits are greater than the annual fee.

What it means: Some credit cards charge an annual fee. This is a fee that you pay once a year in exchange for higher rewards rates or additional benefits. This fee can be worthwhile, but only if the rewards and benefits exceed the cost of the fee.

How to choose the right one: Firstly, calculate the break-even point for any card with an annual fee. This means estimating how much you need to spend on the card to make the rewards value received exceed the fee. Secondly, determine that if you’re unlikely to spend enough to justify the fee, a no-annual-fee card may be more economical.

2.4 Credit Limits

Choose a card that offers a higher credit limit.

What it means: Obviously, your credit limit is the maximum amount you can borrow at one time on your card. Therefore, a higher credit limit can be beneficial for making large purchases and can help improve your credit score by lowering your credit utilization ratio, provided you keep your balances low.

How to choose the right one: To maintain a good utilization ratio, experts generally recommend using less than 30% of your total available credit. You can also request a higher credit limit on your existing accounts if you have a good payment history, though this sometimes results in a hard inquiry on your credit report, which might temporarily lower your score.

2.5 Educational Resources

Choosing the best credit cards for young adults often comes with the benefit of educational resources that can guide them in financial management.

What it means: Financial stability and wellbeing come from better managing our finances. In other words, understand how credit works and how to manage it successfully. Financial knowledge is the key. Moreover, understanding thinks like your credit card score, interest rates, minimum payments and due dates can help you make better financial decisions.

How to choose the right one: Many credit card companies offer resources and tools to help you learn about managing credit. Additionally, there are numerous online platforms and non-profits that provide free educational materials on financial literacy. As a result, engaging with these resources can build your understanding and confidence in using credit wisely.

2.6 High Approval Odds

What it means: Approval odds refer to the likelihood that your application for a specific credit card will be accepted. So, for beginners or those with limited credit history, finding a card with high approval odds is crucial as it can help you start building your credit profile without facing frequent rejections, which could impact your credit score.

How to choose the right one:

- Look for Cards Aimed at Beginners: Credit cards (like those above) designed for students, secured credit cards, and those specifically marketed towards individuals with no or low credit history generally offer higher approval odds.

- Check for Pre-Approval Options: Many credit card issuers provide online pre-approval tools that allow you to see if you’re likely to qualify without affecting your credit score. Because this is a soft inquiry, it gives you a good idea of your chances without any risk.

- Apply for Retail Store Cards: Often, retail store credit cards have more lenient approval criteria. While these cards typically come with higher interest rates, they can be easier to obtain and can help build your credit if used responsibly.

- Use Credit Builder Programs: Some financial institutions offer programs designed to help individuals build or rebuild their credit. Hence, these programs might include a small loan or credit card product with guided financial education.

If you’re looking for a card to rebuild your credit, see how the Yendo Credit Card works in our post Yendo Reviews 2025: Is the Yendo Credit Card Legit for Bad Credit?

- Consult with Financial Institutions Where You Have Accounts: If you already have for example a relationship with a bank or credit union, ask about credit card options they may have for someone with your financial profile. In truth, existing banking relationships can sometimes improve your chances of approval.

2.7 Listed with the Major Credit Bureaus

Specifically, try to choose a card that reports to all three major credit bureaus. They are Experian, Equifax, and TransUnion. These types of credit cards have a greater impact when trying to build credit.

What it means: Credit bureaus undoubtedly collect and maintain individual credit information and use it to create credit reports and scores. Therefore, reporting your account activity to all three major credit bureaus—Experian, Equifax, and TransUnion—ensures that any credit you build is recognized and reflected in your credit report at each agency.

How to choose the right one: Look for credit cards that explicitly state they report to all three major credit bureaus. In truth, this is crucial for building your credit score effectively, as lenders and other financial institutions may check your credit history from different bureaus. So, reporting to all three helps maintain a consistent and accurate credit profile across the board.

By choosing a credit card that reports to Experian, Equifax, and TransUnion, you maximize the potential to build a strong credit score, provided you manage your credit responsibly, such as by making payments on time and maintaining low balances relative to your credit limit. This is particularly important for beginners who are looking to establish a solid credit foundation.

3. Credit Card Terms Every Beginner Should Know

At first, credit card terminology and lingo can be confusing. This is especially true if your new to the credit card world and are totally unfamiliar to these terms. Therefore, if you’re just starting out, it’s very important that you understand what things mean. So, in this section we’ll take the time to explore key terms related to credit cards, financing and borrowing.

3.1 Annual Fee

This fee is what you pay every year to use your credit card. These cards usually offer rewards and services that out weigh the annual fee. Some cards are more limited in terms of rewards and services but don’t charge an annual fee.

3.2 Annual Percentage Rate (APR)

APR is the interest rate charged on any money you don’t pay back each month. Moreover, it shows how much extra you’ll pay if you don’t clear your balance.

3.3 Card Balance

This is how much money you owe on your card. It includes everything you’ve bought, plus any fees or interest.

3.4 Balance Transfer

Moving the debt that you owe from one card to another, usually to get a lower interest rate.

3.5 Billing Cycle

The time between your credit card bills. It’s usually 30 to 31 days. It may be longer due to legal holidays.

3.6 Credit Limit

The maximum amount you can spend on your card before the credit card is considered to be “maxed out”. It’s set based on your creditworthiness.

3.7 Due Date

The day by which you need to pay your credit card bill to avoid late fees.

3.8 Minimum Payment

The smallest amount you can pay on your bill to avoid a penalty. You pay less per month, but it’ll take longer to pay off your card and it will cost you considerably more in terms of interest.

3.9 Overdraft

When you spend more than your credit limit, you are in overdraft. Not all cards have this. This option usually comes with extra fees.

3.10 Statement

Your monthly bill. A complete monthly overview that lists everything you’ve spent and owe on your credit cards. Some statements also include how many points you’re earned. your expenses.

3.11 Credit Score

It’s basically a report of your borrowing and payback habits. According to you history, it tells credit card companies and financial institutions how likely you are to pay back borrowed money on time.

3.12 Foreign Transaction Fee

A fee that is charge to your card for making purchases in a currency other than your own.

3.13 Cashback

A reward where you get money back on what you spend. It’s like saving a bit on each purchase.

3.14 Security Deposit (Secured Credit Cards)

The amount of money you deposit into the credit card that you will be using. It’s secure because you cannot spend more that this amount. You are using your own money but also and more importantly establishing credit and trust with the credit card companies.

3.15 Rewards

Rewards are perks like points and miles you earn from using your card. Points and miles can be applied to for example, getting cheaper (or free) airline tickets, hotel rooms, merchandise, gifts and many more other things a well.

3.16 Credit Utilization Ratio

It’s a way of measuring how much of your credit limit you are using. Additionally, credit bureaus can see a high credit utilization ratio as a sign of overspending or financial difficulty. So, it’s best to keep this metric low (under 30% of your total available credit) to look good to lenders.

To sum up, knowing these simple terms will help you make better choices and use your credit card wisely.

4. How Credit Cards Affect Your Credit Score

4.1 Understanding Credit Scores

Understanding specifically how the best first credit card for young adults affects one’s credit score is very important for maintaining a good financial standing.

Therefore it’s important to mention that credit card companies, banks and financial lenders use your credit score to determine if they can trust you with the money they will lend you. Moreover, to determine to what degree you’re likely to pay it back or not. So think of your credit score is a numerical value that represents and is used to assess your creditworthiness.

Your credit score is influenced by several factors. This includes your payment history. If you pay your bills on time. How much credit you use compared to your credit limits. This is your credit utilization rate. Another important factor is the length of your credit history. A long positive credit track history is a good thing to have. And the types of credit you have, and any new credit. Too much available credit can sometimes work against you.

4.2 Impact of Credit Cards on Your Credit Score

The best credit cards for young adults are designed to positively influence your credit score when used responsibly. This is how:

Payment History: Making your credit card payments on time is crucial. Late payments can significantly hurt your credit score. Credit cards like to get paid on time.

Credit Utilization: Even though you may need it, using up all the available credit on your credit card can negatively impact your credit score because “Maxing it out” looks bad. In truth, tt send a message that you may be are struggling financially. So try to keep your utilization below 30% of your total credit limit.

Credit History Length: Without a doubt, older credit accounts contribute to a longer credit history. As a result, these accounts show more stability and will positively affect your score. However, opening new credit cards frequently can lower the average age of your accounts, potentially reducing your score.

Credit Mix and New Credit: Having a mix of credit types can help your credit score. Things line revolving credit cards, installment loans and credit lines. However, every time you apply for a new credit card, a hard inquiry is made, which might temporarily lower your score.

4.3 Tips for Maintaining a Good Credit Score

Pay Your Bills on Time: Of course, make sure you always pay your bills on time. This cannot be overstated. To put it another way, even one small late payment can hurt your credit and stay in credit file for a long, long time. Consider setting up automatic payments. This will help you avoid any missed deadlines

Don’t Max Out Your Credit Limit: Try not to max anything out. Keep your balances low and manage your credit limits wisely. Keep your utilization amount below 30% of your total credit.

Don’t Apply for Too Many Credit Cards at The Same Time: Too many credit inquiries done in a short period can hurt and even lower your score. Also, only apply for new credit when necessary. Having too many credit cards can hurt your chances of being approved for bigger loan or mortgage that you really want.

Monitor Your Credit Regularly: Regularly monitor your credit report to ensure accuracy and spot potential fraud. If you find errors, make sure to dispute them promptly.

4.4 Credit Score Chart

Here’s a quick rundown of what credit scores mean. This credit score chart will help you understand the different ranges of credit scores and how they rate. It’s based on the on the FICO® Score Scale, which is one of the most commonly used and accepted credit scoring models. To check your credit score for FREE visit: AnnualCreditReport.com.

| Credit Score Range | Quality |

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very Good |

| 800 – 850 | Excellent |

5. Budgeting Tips For The Best Credit Cards For Young Adults

Now that you have one of the best credit cards for young adults, it’s time to learn a few budgeting tips. In truth, for young inexperienced adults, credit cards can be a double-edged sword. When used wisely, they can be a great budgeting tool. They can also be a stepping stone to building great credit. Here are some strategies to help you manage your finances effectively with a credit card:

5.1 Effective Budgeting is Key When Managing the Best Credit Cards For Young Adults

Set a Budget and Stick to It: Without a doubt, you should know what your spending habits are. Ijn fact, to do this you need to track you expenses and your income. So, create a budget where you determine how money you need for things like savings, food, rent and entertainment. Then, only use your credit card for purchases that you know that you can completely pay off by the due date.

Pay Your Balance in Full Each Month: Additionally, make sure you pay off your entire credit card statement balance each month by the due date. As a result you will avoid interest charges because a zero balance has no interest charged to it.

.Beware of Impulse Purchases: When shopping, always avoid impulse purchases because they frequently lead to overspending and debt. In fact, make it a rule to never buy anything on impulse. That is, if you really want something, research it because may be available elsewhere at a cheaper price. Purchase it when you can work it into your budget.

Track Your Spending: Many credit card companies offer budgeting tools on their website or in the form of apps. Some even have spending trackers. Use these features to control your spending.

Avoid Cash Advances: Never take a cash advance. A credit card cash advance come with very high interest rates and fees. Considerably high than those of a regular purchase. If you consider them for emergencies, be prepared to repay them quickly.

By incorporating these budgeting strategies with your credit card use, you can develop healthy financial habits and avoid the pitfalls of credit card debt.

6. How to Protect Yourself from Credit Card Fraud

6.1 Key Credit Card Security Features: Credit Card Fraud Detection

Due to the fact that credit card fraud is a huge problem in today’s digitally connect world, the best credit cards for young adults now come equipped with advanced security features to safeguard against fraud. Specifically,features that help keep your financial information safe and are geared for credit card fraud detection.

Chip Technology: To clarify, nearly all credit cards today come with a chip that’s embedded into the body of tyhe card. Moreover, this chip creates a unique code for each and every transaction you make. As a result, this makes it much more difficult for thieves to copy your card’s information and commit fraud.

Zero Liability Protection: Many credit card companies now guarantee that you won’t be held responsible for unauthorized charges made with your card. You must however report these unauthorized charges as soon as you detect them.

Virtual Card Numbers: These are temporary card numbers that can be used for online shopping. They link to your account but keep your real card number hidden, adding an extra layer of security. Click on this link to find out more about “Understanding Credit Card Tokenization: A New Era of Secure Transactions“.

Credit Card Security Code: A credit card security code is a numbered code on the back (sometimes the front) of your card. It’s also know as CVV number (Card Verification Value). It’s required for most online purchases, proving you have the actual card with you.

6.2 Tips to Keep Your Card Safe

Here’s what you can do to keep your card and money secure. Start putting these safety features into practice.

Protect Your Card Information: Once outside of a transaction, never share your credit card number, PIN, or CVV number with anyone. Also always remember to keep these things confidential. When not in use, keep your credit card out of sight.

Review Your Statements: Of course, you should always check your card statements regularly. In fact, make it a point to look for any charges you don’t recognize or anything suspicious at all. As a result, if you find something and it looks wrong, contact your card company immediately.

Secure Your Online Transactions: Due to the growing sophistication of hackers and fraudsters, make sure to use strong passwords on websites where your credit card information is stored. Obviously, the more complicated the password, the better. Equally important, never save a password on a public computer.

Set Transaction Alerts: Once you’ve downloaded the credit card company’s app, using it to set up alerts that will send you a message every time a transaction is made. This is without a doubt a great way to catch fraud right away.

6.3 Extra Precautions You Can Take

Use a Secure Network: Despite its mass availabilty, always try to avoid shopping or banking over public Wi-Fi. Make sure you’re on a secure internet connection before entering your card information online.

Consider Credit Monitoring: Also, consider enrollong in a credit monitoring service because this service will alert you of any changes to your credit report. When sudden changes occur, they can be a sign of unauthorized or fraudulent actions. This is indeed a great way to keep an eye on things.

In summary, by understanding these security features and practicing vigilant behaviors, you can help protect your credit card from fraud and keep your financial life secure.

c2blac

mngmav

3m2boh

I am eagerly awaiting the latest news from your site. There is a lot of great information to be found. Keep writing something useful, keep up the good work. https://inspirationals.s3.amazonaws.com/index.html

relaxation thc edibles reduce stress and promote calm

When will you write something similarly interesting again? I really enjoyed it. I will come back here again sometime to see what else you have to offer. Very inspiring.

https://fashionsstyles.s3-eu-west-3.amazonaws.com/index.html

e are fortunate to have found this topic here. Your presentation is interesting and can broaden our horizons. It is worth visiting again sometime. https://thehobby.dkjrgvssmmayy.amplifyapp.com

Leaving a mark here, I hope to return again soon. https://master.d1y7ckvd5885is.amplifyapp.com